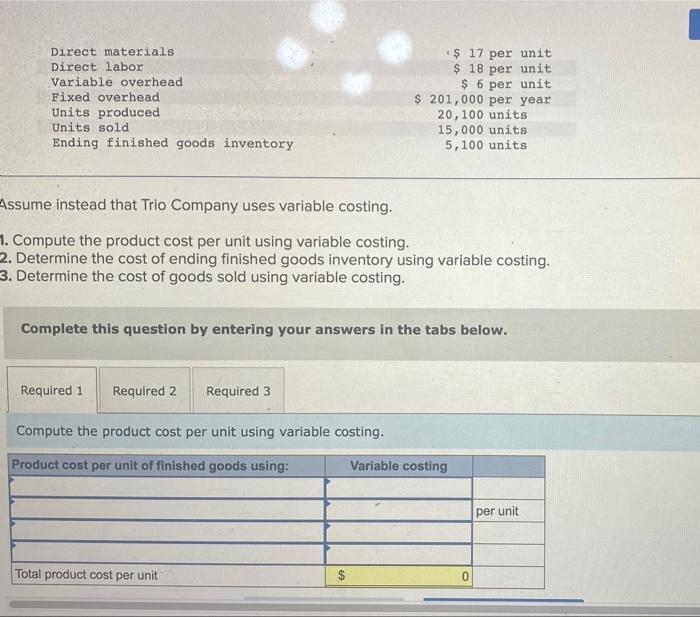

Question: $ 17 per unit $ 18 per unit $ 6 per unit $ 201,000 per year 20,100 units 15,000 units 5,100 units Direct materials

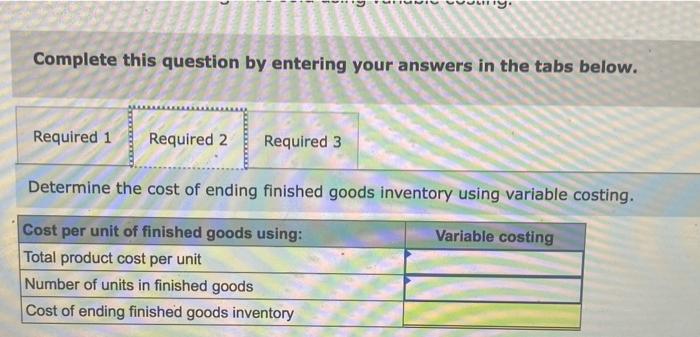

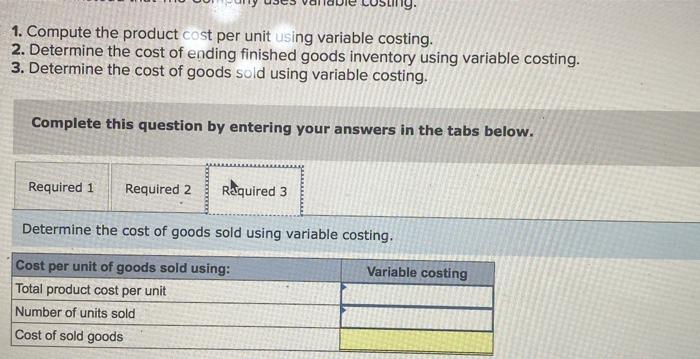

$ 17 per unit $ 18 per unit $ 6 per unit $ 201,000 per year 20,100 units 15,000 units 5,100 units Direct materials Direct labor Variable overhead Fixed overhead Units produced Units sold Ending finished goods inventory Assume instead that Trio Company uses variable costing. 1. Compute the product cost per unit using variable costing. 2. Determine the cost of ending finished goods inventory using variable costing. 3. Determine the cost of goods sold using variable costing. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the product cost per unit using variable costing. Product cost per unit of finished goods using: Variable costing per unit Total product cost per unit Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Determine the cost of ending finished goods inventory using variable costing. Cost per unit of finished goods using: Variable costing Total product cost per unit Number of units in finished goods Cost of ending finished goods inventory 1. Compute the product cost per unit using variable costing. 2. Determine the cost of ending finished goods inventory using variable costing. 3. Determine the cost of goods sold using variable costing. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Raquired 3 Determine the cost of goods sold using variable costing. Cost per unit of goods sold using: Variable costing Total product cost per unit Number of units sold Cost of sold goods

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

1 production cost per unit using Variable costing Direct Material 17 per unit Direc... View full answer

Get step-by-step solutions from verified subject matter experts