Question: (17 points) You are trying to help your client, Mario, construct a portfolio. Mario has a quadratic utility function. There are three assets in the

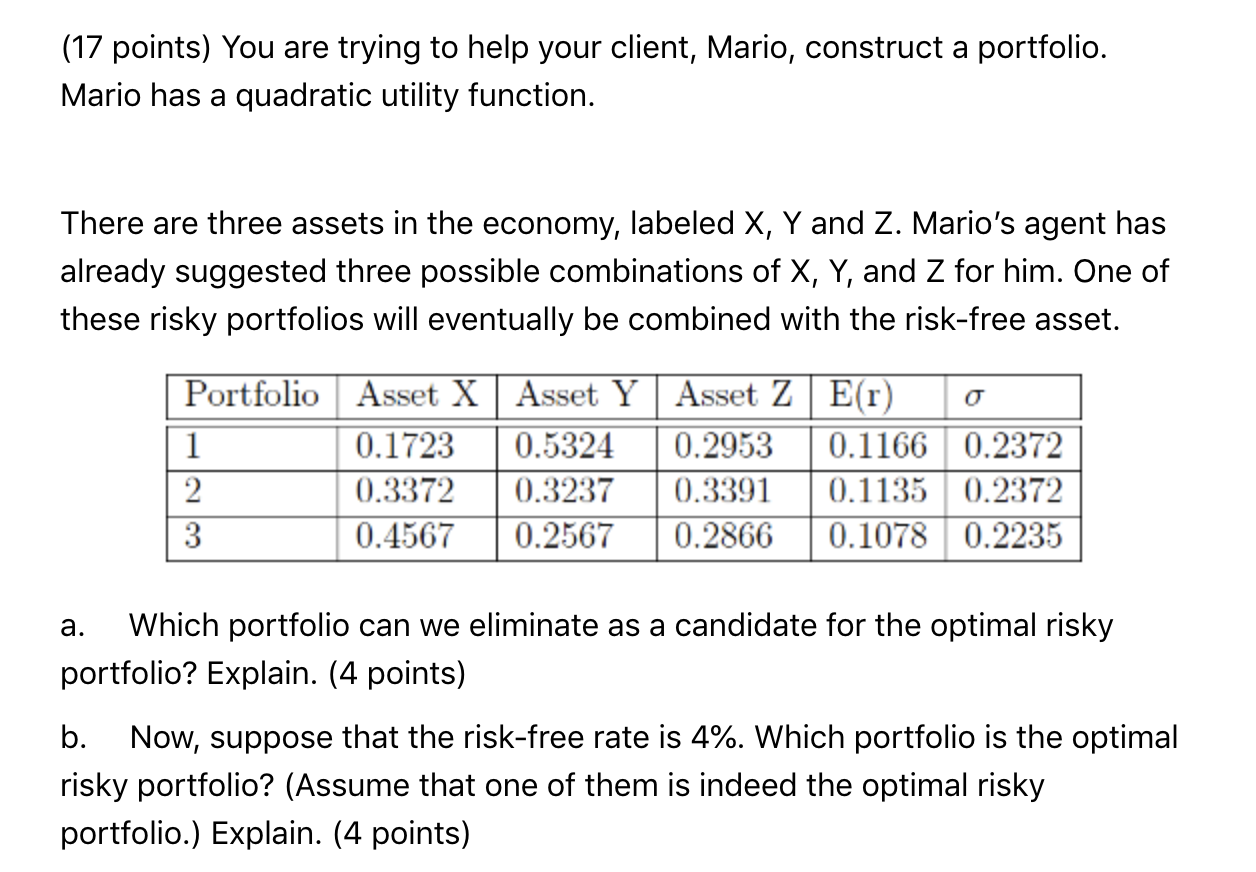

(17 points) You are trying to help your client, Mario, construct a portfolio. Mario has a quadratic utility function. There are three assets in the economy, labeled X, Y and Z. Mario's agent has already suggested three possible combinations of X, Y, and Z for him. One of these risky portfolios will eventually be combined with the risk-free asset. Portfolio Asset X Asset Y Asset Z E(r) 1 0.1723 0.5324 0.2953 0.1166 0.2372 2 0.3372 0.3237 0.3391 0.1135 0.2372 3 0.4567 0.2567 0.2866 0.1078 0.2235 a. Which portfolio can we eliminate as a candidate for the optimal risky portfolio? Explain. (4 points) b. Now, suppose that the risk-free rate is 4%. Which portfolio is the optimal risky portfolio? (Assume that one of them is indeed the optimal risky portfolio.) Explain. (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts