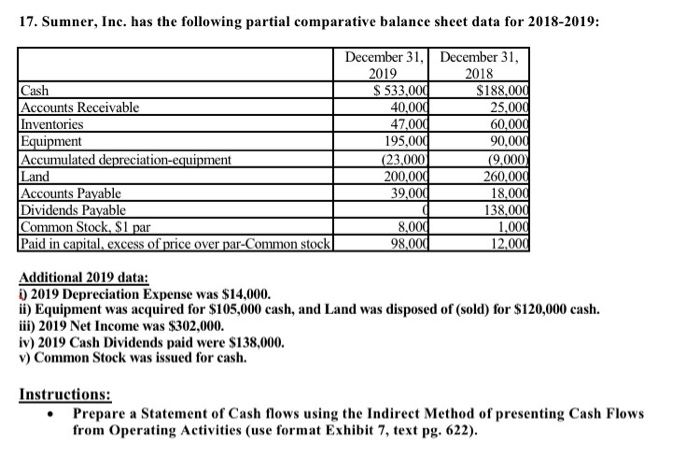

Question: 17. Sumner, Inc. has the following partial comparative balance sheet data for 2018-2019: December 31, December 31, 2019 2018 Cash $ 533,000! $188.000 Accounts Receivable

17. Sumner, Inc. has the following partial comparative balance sheet data for 2018-2019: December 31, December 31, 2019 2018 Cash $ 533,000! $188.000 Accounts Receivable 40,000 25,000 Inventories 47.000 60,000 Equipment 195,000 90,000 Accumulated depreciation-equipment (23,000 (9,000 Land 200,000 260,000 Accounts Payable 39,000 18,000 Dividends Payable 138.000 Common Stock, $1 par 8,000 1,000 Paid in capital, excess of price over par-Common stock 98,000 12.000 Additional 2019 data: D) 2019 Depreciation Expense was $14,000. ii) Equipment was acquired for $105,000 cash, and Land was disposed of (sold) for $120,000 cash. iii) 2019 Net Income was $302,000. iv) 2019 Cash Dividends paid were $138,000. v) Common Stock was issued for cash. Instructions: Prepare a Statement of Cash flows using the Indirect Method of presenting Cash Flows from Operating Activities (use format Exhibit 7, text pg. 622)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts