Question: 17.4. Reconsider the Dewright Co. case study as presented in Sections 17.1 and 17.2. After further reflection about the optimal solution obtained by using weighted

17.4. Reconsider the Dewright Co. case study as presented in Sections 17.1 and 17.2. After further reflection about the optimal solution obtained by using weighted goal programming, management now is asking some what-if questions.

a. Gary Lang wonders what would happen if the penalty weights in the rightmost column of Table 17.1 were to be changed to 7, 4, 1, and 3, respectively. Would you expect the optimal solution to change? Why?

b. Tasha Johnson is wondering what would happen if the total profit goal were to be increased to wanting at least $140 million (without any change in the original penalty weights). Solve the revised model with this change.

c. Solve the revised model if both Garys and Tashas changes are made.

17.1 A CASE STUDY: THE DEWRIGHT CO. GOAL-PROGRAMMING PROBLEM

Whats the matter, honey? A rough day at the office? Well, it really wasnt all that bad, Kathleen responds to her husband Scott. Mainly just frustrating. Ever since I got this job as head of Dewrights Management Science Department, I have emphasized making sure that everything we do is responding to managements needs. Understand what managements objectives are for the decisions they need to make based on our studies. Then address those objectives rather than what we think the goals should be. I preach that all the time. So what happened? Well, weve just been handed an extremely important new project, a really juicy management science study. So I made the rounds today interviewing the key people in top management to clarify just what they wanted to get out of our study. What is the basic objective for the decisions they need to make? Usually this goes pretty smoothly, with a lot of consensus about what the overriding objective should be. But not today. First I was told that we should focus on such and such as the main goal of the study. Then the next person I interviewed said no, the key goal was something completely different. Then the next guy had an entirely new slant on it. Ive never seen so much disagreement. Each one was only protecting his or her own interests instead of looking at the big picture of what is best for the company as a whole. So now were stymied. Ive already selected the members of the team to work on this study. But we cant really get started until we receive much clearer direction from management. And, of course, management needs the study completed quickly. One jokester said they would like our report the day before yesterday. I laughed politely, but I felt like kicking him. Dont they realize that our output from the study can only be as good as their input!?! And that we can only act as quickly as they give us the direction we need! Wow, no wonder youre frustrated, Scott responds. It sounds like management really dropped the ball on this one. Yes, they did. It was clear that they hadnt talked to each other about this issue, even though they knew I would be interviewing all of them about this today. Its managements responsibility to thrash this out and come to a common understanding of what they want out of a management science study, and then give us clear direction. They really didnt do their job this time! So whats the next step? Ive already called our CEO late this afternoon. Direction needs to come from the top. Actually, Gary was pretty sympathetic. He even volunteered that he thought his people had let me down this time. So did he give you the direction you need? Scott asks Kathleen. No, I really wasnt asking for that at this point. He wasnt involved with requesting this management science study, so I was hitting him cold. But he understood right away what had gone wrong. Even before I could suggest it, he said that the managers involved with this project should be brought together in a meeting to thrash out what the main goals should be. He even said he would chair the meeting himself. He also wants me and key members of my team there. He says it is very important that we have a clear understanding of managements thinking on this issue. And I certainly agreed. Great! So it sounds to me like all you have to do is attend the meeting and listen carefully. Let them do their homework and then come to a meeting of the minds. Press them if necessary to get the clarity you need. Then youll be off and running. Background

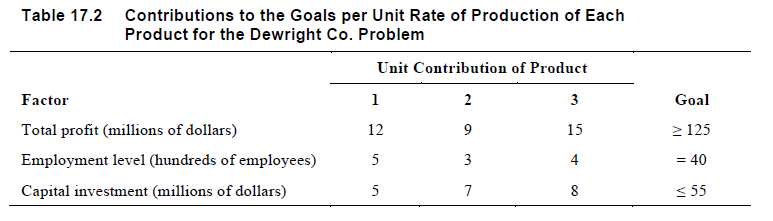

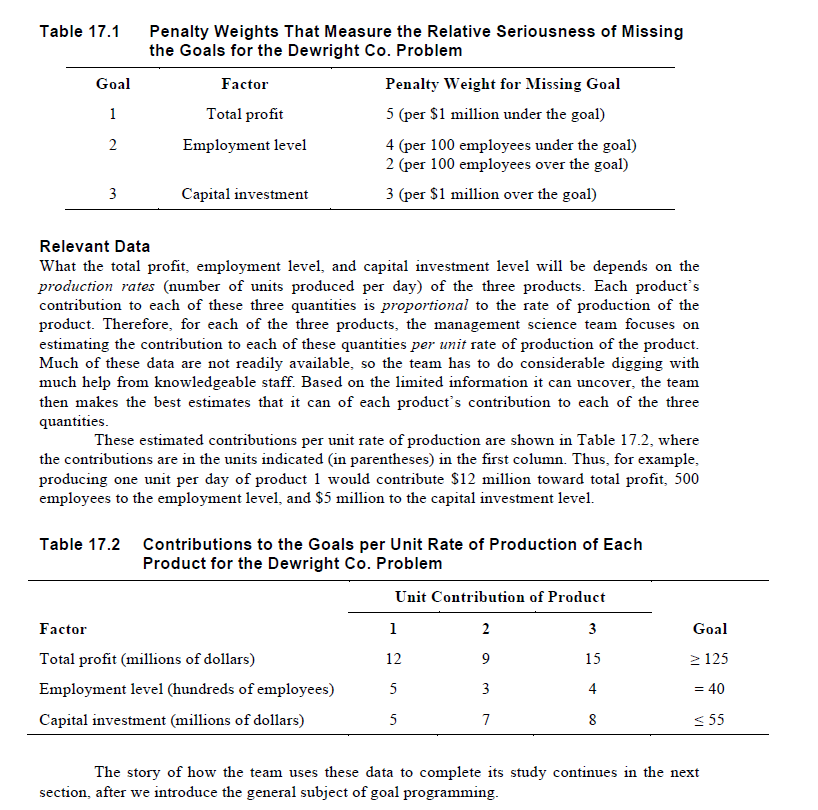

The Dewright Company is one of the largest producers of power tools in the United States. The company has had its ups and downs but has managed to maintain its position as one of the market leaders for over 20 years. This is largely due to superior products produced by a skilled and loyal work force, many of whom have been with the company for most of its existence. One of managements priorities has been to maintain a relatively stable employment level to retain the high morale and loyalty of this work force. The company has just gone through one of its leaner years. Sales were down slightly from the preceding year and earnings dipped as well (much to the discontent of the companys stockholders). One consequence is that the company now has less capital available than usual with which to invest in new product development. Management also is concerned that some downsizing may be needed if sales dont improve soon. Fortunately, help is on the way. The company is preparing to replace its current product line with the next generation of productsspecifically, three exciting new power tools with the latest state-of-the-art features, so they are expected to sell well for at least a year or two. Because of the limited amount of capital available, management needs to make some difficult choices about how much to invest in each of these products. Another concern is the effect of these decisions on the companys ability to maintain a relatively stable employment level. A competitor is known to be developing similar new products, so decisions must be made quickly. These kinds of considerations recently led the companys president, Tasha Johnson, to call Kathleen Donaldson, head of the Management Science Department, to request an urgent management science study to analyze what the product mix should be. Tasha asked Kathleen to come see her for a briefing on managements objectives in making the product-mix decisions. Tasha also suggested that Kathleen talk with Vijay Shah (vice president for manufacturing) and Hien Nguyen (the chief financial officer). Kathleen has just completed these interviews, with the unsatisfactory results reported to her husband. Gary Lang, the companys CEO, now has arranged for the meeting to bring these parties together with Kathleen and key members of her team. The Management Science Team Meets with Top Management

After some pleasantries, the meeting gets under way.

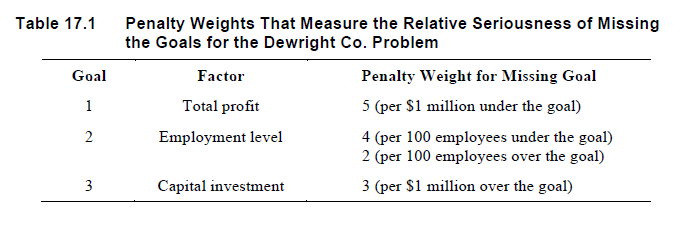

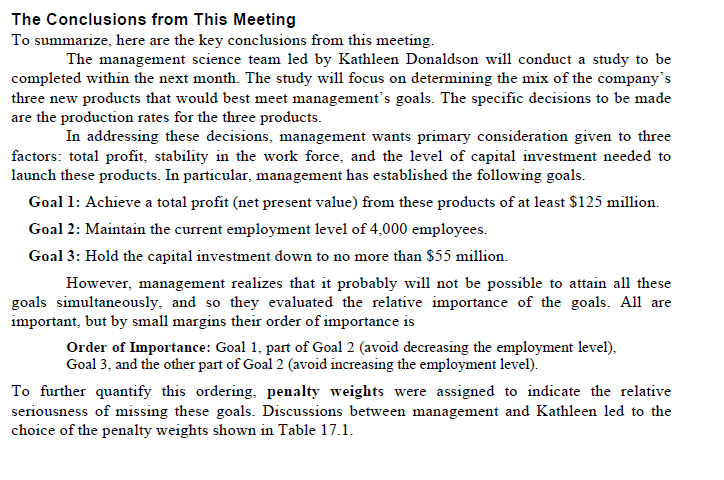

Gary Lang (CEO): Ive called this meeting to clarify what we want to accomplish when we introduce these three new products. What are our main goals? I have some thoughts on that. But first I want to hear your thinking. Then we can work this out together. Once this is settled, planning can get under way to accomplish what we want accomplished. As you know, Tasha has asked Kathleen to personally head a management science team from her department to analyze how we can best meet our goals. Before the team can do that, they need some clear direction from us on just what our goals and priorities are. Kathleen, is that a fair summary of what you want to get out of this meeting? Kathleen Donaldson (head of Management Science Department): Yes, it is, Gary. Thank you. Gary: OK. Lets make the rounds then and get your thinking. Tasha, lets start with you. Tasha Johnson (president): Well, as usual, I think we need to focus on the bottom line. If we do that, everything else will fall into place. After the year we just went through, weve got to get our earnings up. Thats certainly the message our board of directors has been giving us. Youll recall the plan I presented at the last board meeting. To get our earnings headed up where we want them, we need to generate a total profit of at least $125 million from these three products until theyre replaced by the next generation of products. And I think thats doable. Ive already told Kathleen that I would like her team to find the mix of the three products that would maximize our profit. And to make sure that it is at least $125 million, as I promised the board of directors. I think that should be our main focus. Gary: Thank you, Tasha. Its certainly true that the board has been pressing us to substantially improve earnings. And they were encouraged by your plan to generate profits of at least $125 million from these products. Vijay, what is your take on this issue of where our focus should be? Vijay Shah (vice president for manufacturing): Well, Im certainly not going to argue against making profits. But there are different ways of accomplishing that. By and large, weve been a very profitable company for over 20 years. And despite our occasional off years like last year, I think we will continue to be a very successful company as long as we dont forget what got us here. Our number one asset is our work force. Theyre the best in the business and we all know it. Besides our strong leadership at the top, theyre our main reason for success. If we simply go scrambling after big profits in the short run to satisfy the board of directors for a little while, I think thats going to mean some downsizing. That would ruin morale! And cause all kinds of disruption. I know a lot of companies have been doing it, often to their regret, but it would be a huge mistake in our case. Lets not kill the goose thats been laying our golden eggs. We have great morale and an exceptionally efficient work force largely because weve kept them together all these years. Were going to have larger profits in the long run if we maintain a stable employment level and continue developing new products to keep them fully utilized. I told Kathleen that I thought her team should develop a plan for the current new products that would maintain our present employment level, and then profits would take care of themselves. Tasha: But in this global economy, the companies that are surviving are those that downsize quickly when they need to in order to stay competitive. Vijay: That would be shortsighted, especially in our situation. Gary: Vijay, I do agree that we have a terrific work force and we should try to maintain it if possible. It is my hope that these three new products will enable us to do just that. We currently have 4,000 employees. We might even be able to increase that if everything falls into place. When you talk about the disadvantages of changing the employment level, how would you feel about an increase rather than a decrease? Vijay: An increase wouldnt be so bad. But it still would cause some problems, especially since the increase probably would be temporary as these products wind down. First, we would incur the expense and disruption of training these inexperienced workers. Then we would turn around and need to lay them off because we have so little attrition here. Any layoffs are not good for morale. I think were better off sticking pretty close to the 4,000 employees. Gary: OK. Thanks, Vijay. Now Im anxious to hear from Hien, especially after our financial downturn this past year. Hien Nguyen (chief financial officer): Yes. You know well that were not in a good financial situation. We seldom have been as strapped for capital as we are right now. Gary: Unfortunately, were going to need a lot of capital to launch these new products properly. And it is very important to the future of this company to have a good launch. Im going to need to depend on you to work your usual magic to come up with at least the minimum amounts necessary to invest in the production facilities, marketing campaigns, and so forth, that we need for these products. How much do you think we can do? Hien: Ive been looking into that pretty carefully. I think we can scrape together something close to $55 million. However, I wouldnt advise trying to go beyond that. If we get that overextended, I fear that our corporate bonds will be downgraded into the junk bond category. And then we would be paying through the nose in high interest rates for all our debt. So when Kathleen saw me recently, I advised her to stick with plans that would hold the capital investment down to no more than $55 million. Gary: I hear you. OK, here is my conclusion so far. I think all three of you have raised very valid concerns. You each have enunciated a goal: Achieve a total profit from these products of at least $125 million, maintain the current employment level of 4,000 employees, and hold the capital investment down to no more than $55 million. These all are legitimate goals. I seriously doubt that we can fully achieve all of them. However, rather than selecting just one of them, I think we need to try to come as close to meeting all three goals simultaneously as we can. Kathleen: I have a question. Gary: Shoot. Kathleen: Do you see any way of combining all three goals into a single overriding objective one objective that would encompass all three? Gary: Such as? Kathleen: Well, perhaps maximizing long-run profit. The problems associated with either changing the employment level or overextending our capital outlays affect our profit in the long run. Can we measure these effects on long-run profits and combine them with the direct profit from the new products? Gary: Hmmm. An interesting idea. But no, I dont think so. Youre really comparing apples and oranges. There are too many intangibles involved in the impact of missing either the second or third goal. I dont see how you can develop any reasonable estimate of the long-run profit that would result from all this. Kathleen: Yes, that was my reaction too. But yours is the one that counts. So it sounds like we should consider all three goals as separate goals, but then analyze them simultaneously. Gary: Yes, I think so. Do you have a good way of doing this? Kathleen: Well, I can think of two possibilities. But we need further guidance from all of you to determine the approach we should use. Gary: Go ahead. Kathleen: One possibility is to use a linear programming approach. Youll recall that weve conducted several linear programming studies for you recently. Gary: Yes. Kathleen: This would involve maximizing the total profit from the new products, subject to constraints that the second and third goals are met. But this would mean requiring that the second and third goals are completely satisfied. Would that requirement seem reasonable to you? Tasha: No, no, no! I think the first goal is the most important. We should make sure we meet it even if that means missing the second and third goals somewhat. Vijay: But we also should permit missing the first goal somewhat to avoid missing the other goals by a large amount. Gary: Well, there you have it. I agree that we shouldnt require any of the goals to be completely satisfied if they cant all be satisfied simultaneously. Kathleen: OK, fine. So formulating a linear programming model would not be appropriate to meet your needs. But now it sounds to me like the second approach would be perfect for you. Gary: Whats that? Kathleen: Its a management science technique called goal programming. It is designed to find the best way of striving toward several goals. Gary: Yes, that sounds like just the ticket. So now you have what you need from us to start your study? Kathleen: Not quite. I need to ask your indulgence for a few minutes to elicit a little more inputinformation we need to be able to use goal programming. Gary: This is important. Well take as long as you need. Kathleen: Thank you. What we need is your collective assessment of the relative importance of these three goals. Gary: I would like to take a crack at that. Ive been thinking hard about this during our discussion here. I must say that Tasha, Vijay, and Hien all have made strong cases. I think all three goals are important. However, I dont think we have any choice but to put top priority on achieving our profit goal. That is the engine that drives everything else. And our board of directors has made it very clear that this needs to be our top priority. But I also resonate with what Vijay had to say about our work force being our number one asset. However, I would divide his goal of maintaining a stable employment level into two partsavoiding a decrease in the employment level and avoiding an increase in the employment level. I think the negative impact of laying off some of our loyal long-time employees would be much more serious than that of hiring new people and perhaps laying them off in a year or two. Therefore, I would place a pretty strong second priority on avoiding layoffs, but not on avoiding new hiring. Then sorry, Hien, but I think we can only give third priority to the goal of holding our capital investment under $55 million. We mustnt ignore your very legitimate concerns. However, we are in a hole that we need to dig out of, even if that means stretching our finances more than we normally would be willing to do. Then finally, I would put fourth priority on the second part of Vijays goal avoiding an increase in our employment level since it might need to be temporary. What do the rest of you think? Does this seem reasonable? Tasha: Definitely. Vijay: I can live with it. Hien: Youre the one that needs to set priorities. But we do need to be cautious about getting overextended financially. Gary: I hear you. OK, Kathleen, what additional input do you need from us? Kathleen: I need your advice on the following issue. Goal programming is a flexible technique that provides two different approaches to analyzing managerial problems. Which approach is appropriate for any particular problem depends on managements assessment of how big the differences are in the importance of the goals. Are all the goals quite important with only modest differences in their importance? Or are there really big differences in their importance? In the first case, the approach is to literally consider all the goals simultaneously while recognizing the modest differences in their importance. We call this approach weighted goal programming because it places weights on the goals to reflect their relative importance. In the second case, because of the really big differences in the importance of the goals, the approach is to begin by focusing solely on the most important goal and going as far as possible toward achieving that goal. Then it turns to the second most important goal, and then to the third one, and so forth. This approach is called preemptive goal programming because its focus on each goal in turn is preempting any consideration yet of less important goals. My group would be comfortable with using either approach. However, the decision on which one to use really needs to depend on your input. How big do you think the differences are in the importance of the goals? Which approach seems more appropriate for this situation? Gary: I could see us going in either direction. It seems to me that there are clear differences in the importance of the goals. However, they all are quite important. I wouldnt say that there are very big differences in their importance. So my inclination would be to go with that first approach you mentioned. Kathleen: Yes, the weighted goal programming approach. Since you say you could see us going in either direction, this apparently is not a clear-cut situation. Therefore, I think what well do is begin with the weighted goal programming approach, but then double-check our conclusions by applying the preemptive goal programming approach as well. Well include all our results in our report and then the four of you can put your heads together to make the decision on what the product mix should be for the three new products. Gary: I like it. Full steam ahead. Are you all set now? Does this give you everything you need? Kathleen: Nearly. This has been extremely helpful. However, we still need your input on one more thing in order to implement the weighted preemptive programming approach. Let me explain a little more about how this approach works. It assigns penalties to not achieving goals. The more you miss a goal, the larger the penalty. The top priority goals get the largest penalties for missing them and the lowest priority goals get the smallest penalties. Then goal programming finds the set of decisionsin this case the production rates for the three productsthat minimizes the total number of penalty points incurred by missing goals. Gary: Sounds like a good approach. Kathleen: Yes. But what this means is that we need to assign penalty weights that measure the relative seriousness of missing the respective goals. Now we could try to assign the penalty weights based on the discussion here and the priorities you have set. But that really isnt our place. These penalty weights need to reflect your assessment, not ours, of the relative seriousness of missing these goals. Gary: I agree. How do we go about that? Kathleen: Well, the first step is that we assign any old number as the penalty weight for missing one of the goals, just to establish a standard of comparison. Then you would scale this penalty weight up or down for each of the other goals, depending on whether you think the seriousness of missing that goal is larger or smaller than for missing the first goal. OK, since our top priority is the goal of achieving a total profit from these new products of at least $125 million, lets assign a penalty weight of 5 for each $1 million you undershoot this goal. In other words, if the estimated total profit resulting from the selected profit mix is $124 million, 5 penalty points would be assessed. If the estimated total profit is $115 million, undershooting the goal by $10 million, then 50 penalty points would be assessed. Ten times five is 50. Gary: I get it. Kathleen: OK. With this penalty weight of 5 as a standard of comparison, now were ready for the hard questions. Going down your priorities, what should the penalty weight be for each 100 employees we undershoot the goal of maintaining the current employment level at 4,000 employees? For each $1 million we miss the goal of holding the capital investment down to no more than $55 million? For each 100 employees we overshoot the goal of sticking with 4,000 employees? Gary: Hmmm. Good questions. Hmmm. Well, I think I would go 5, 4, 3, 2. Five for the first goal, and then 4, 3, 2 for your three questions. Kathleen: Great. Understood. That gives us exactly what we need. We can launch into our study immediately now. Gary: Very good. You understand that well need your report quite soon. Kathleen: Yes, I think we can finish in a month. Ill tell you what our biggest job is going to be. Gathering data. Were going to need to get good data on the effect of each products production rate toward meeting each of the three goals. How much profit will each product generate? How much employment level? How much capital investment is needed? Well have to get a lot of help from various staff people. Gary: Ill see to it that everybody makes this their top priority. Kathleen: Then we can do it. I dont think any of us will see much of our families for the next month, but Ill make sure that we get it done in time. Gary: Good for you, Kathleen. Thank you so much. And let us know whenever you need more input or help from any of us. Kathleen: I will. Thank you. The meeting concludes, except for a somewhat heated private conversation between Tasha and Vijay.

CASE STUDY 17.2:

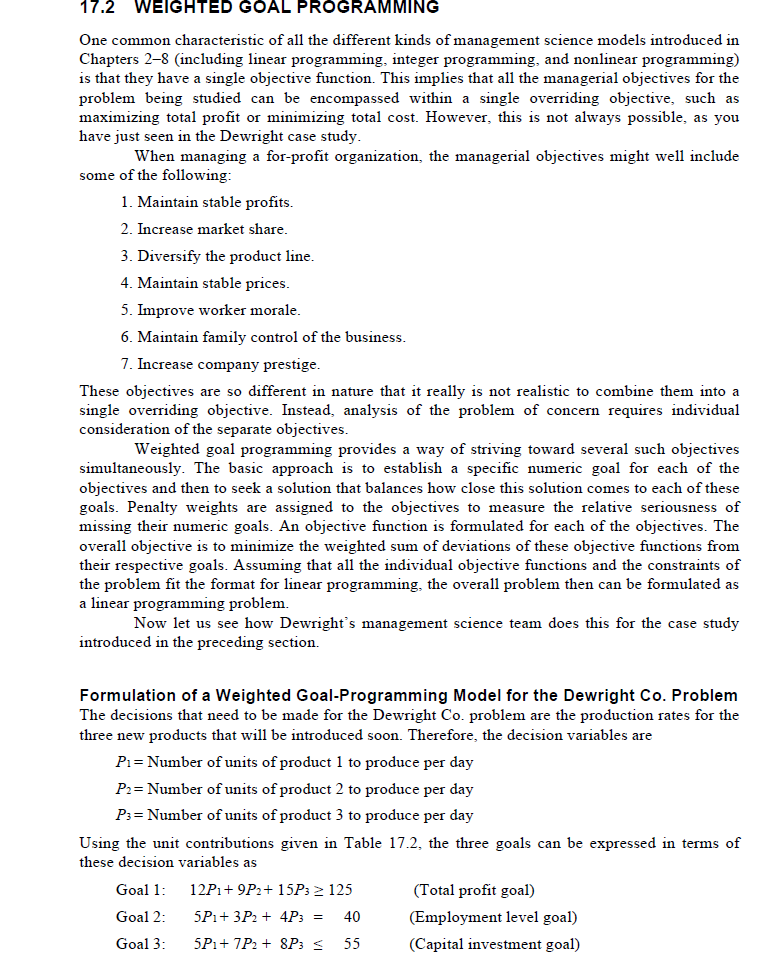

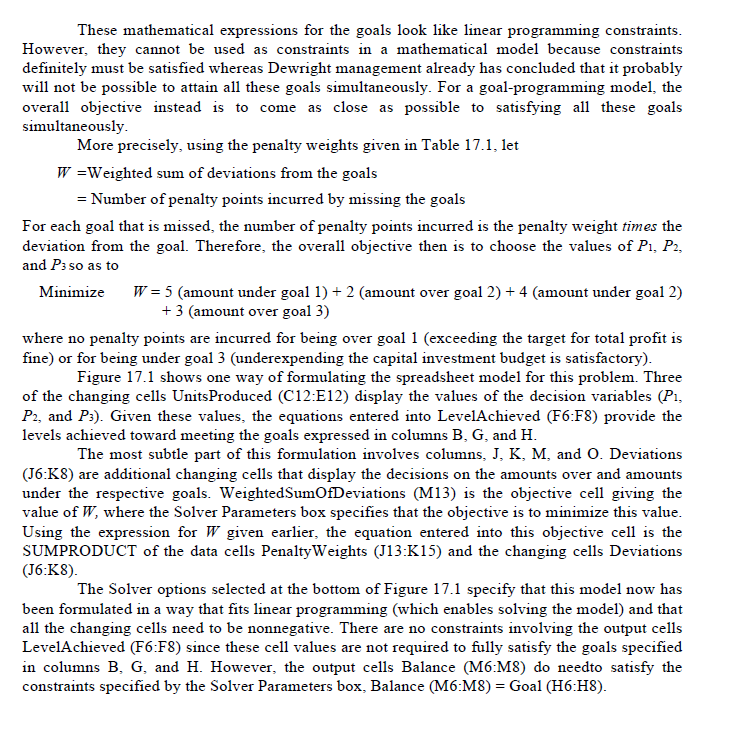

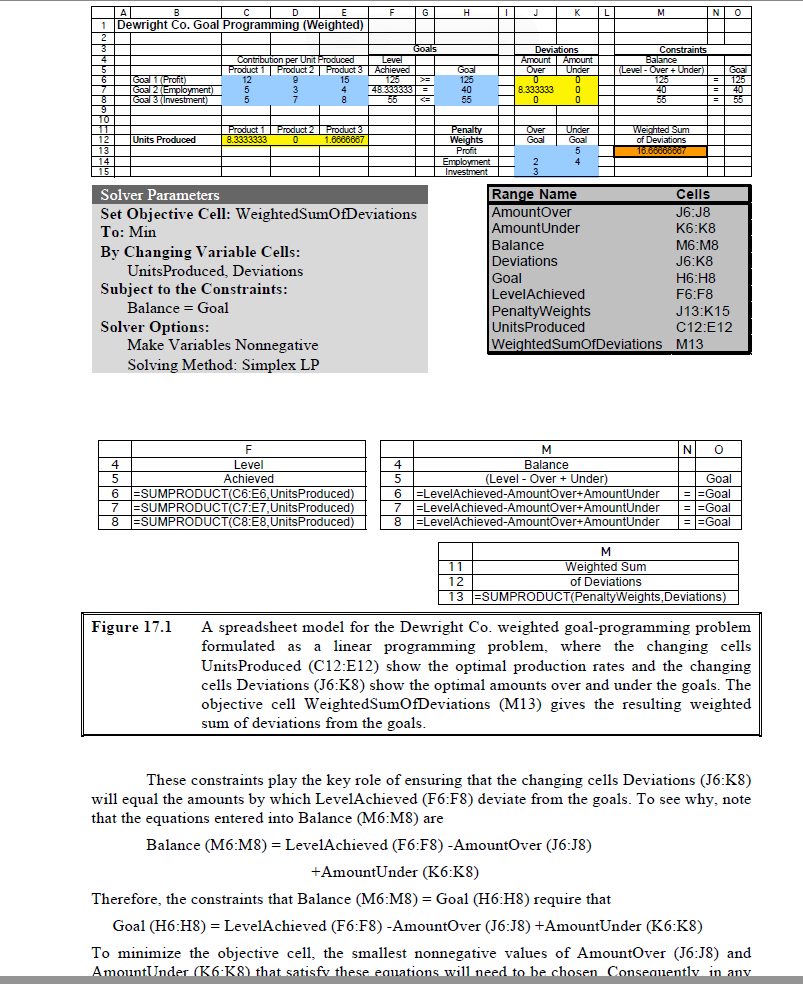

Table 17.1 Penalty Weights That Measure the Relative Seriousness of Missing the Goals for the Dewright Co. Problem Goal Factor Total profit Employment level Penalty Weight for Missing Goal 5 (per $1 million under the goal) 4 (per 100 employees under the goal) 2 (per 100 employees over the goal) 3 (per $1 million over the goal) Capital investment Table 17.1 Penalty Weights That Measure the Relative Seriousness of Missing the Goals for the Dewright Co. Problem Goal Factor Total profit Employment level Penalty Weight for Missing Goal 5 (per $1 million under the goal) 4 (per 100 employees under the goal) 2 (per 100 employees over the goal) 3 (per $1 million over the goal) Capital investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts