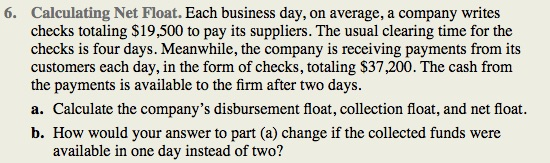

Question: 17.6. Net Float a. First scenario 1. The disbursement float. The disbursement float is the average monthly checks written times the average number of days

17.6. Net Float

a. First scenario

1. The disbursement float. The disbursement float is the average monthly checks written times the average number of days for the checks to clear. (Show work):

Disbursement float =

2. The collection float. The collection float is the average monthly checks received times the average number of days for the checks to clear. (Show work):

Collection float =

3. The net float is the disbursement float plus the collection float. (Show work):

Net float =

b. Second scenario (Show work):

1. Disbursement float = remains the same.

2. Collection float =

3. Net float =

Calculating Net Float. Each business day, on average, a company writes checks totaling $19,500 to pay its suppliers. The usual clearing time for the checks is four days. Meanwhile, the company is receiving payments from its customers each day, in the form of checks, totaling $37,200. The cash from the payments is available to the firm after two days a. Calculate the company's disbursement float, collection float, and net float. b. How would your answer to part (a) change if the collected funds were 6. available in one day instead of two

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts