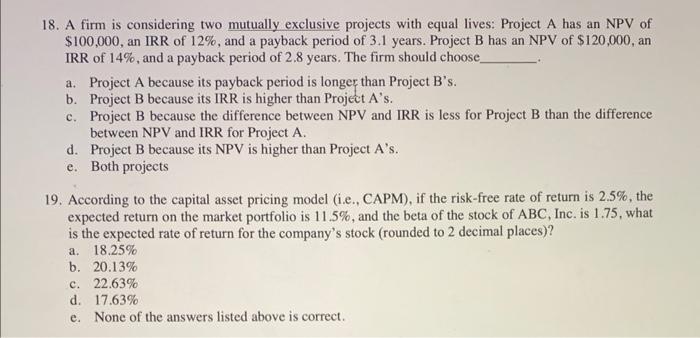

Question: 18. A firm is considering two mutually exclusive projects with equal lives: Project A has an NPV of $100,000, an IRR of 12%, and a

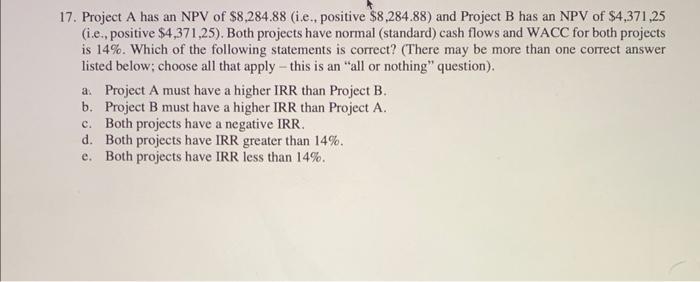

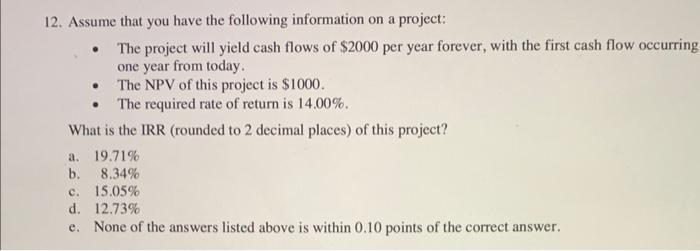

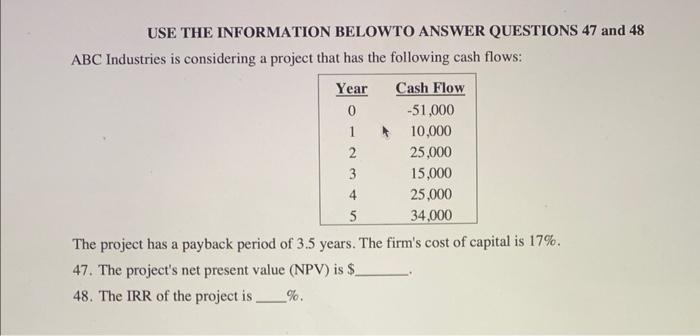

18. A firm is considering two mutually exclusive projects with equal lives: Project A has an NPV of $100,000, an IRR of 12%, and a payback period of 3.1 years. Project B has an NPV of $120,000, an IRR of 14%, and a payback period of 2.8 years. The firm should choose a. Project A because its payback period is longer than Project B's. b. Project B because its IRR is higher than Project A's. c. Project B because the difference between NPV and IRR is less for Project B than the difference between NPV and IRR for Project A. d. Project B because its NPV is higher than Project A's. e. Both projects 19. According to the capital asset pricing model (i.e., CAPM), if the risk-free rate of return is 2.5%, the expected return on the market portfolio is 11.5%, and the beta of the stock of ABC, Inc. is 1.75, what is the expected rate of return for the company's stock (rounded to 2 decimal places)? a. 18.25% b. 20.13% c. 22.63% d. 17.63% e. None of the answers listed above is correct. 17. Project A has an NPV of $8,284.88 (i.e., positive $8,284.88 ) and Project B has an NPV of $4,371,25 (i.e., positive $4,371,25 ). Both projects have normal (standard) cash flows and WACC for both projects is 14%. Which of the following statements is correct? (There may be more than one correct answer listed below; choose all that apply - this is an "all or nothing" question). a. Project A must have a higher IRR than Project B. b. Project B must have a higher IRR than Project A. c. Both projects have a negative IRR. d. Both projects have IRR greater than 14%. e. Both projects have IRR less than 14%. 12. Assume that you have the following information on a project: - The project will yield cash flows of $2000 per year forever, with the first cash flow occurring one year from today. - The NPV of this project is $1000. - The required rate of return is 14.00%. What is the IRR (rounded to 2 decimal places) of this project? a. 19.71% b. 8.34% c. 15.05% d. 12.73% e. None of the answers listed above is within 0.10 points of the correct answer. USE THE INFORMATION BELOWTO ANSWER QUESTIONS 47 and 48 ABC Industries is considering a project that has the following cash flows: The project has a payback period of 3.5 years. The firm's cost of capital is 17%. 47. The project's net present value (NPV) is $ 48. The IRR of the project is %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts