Question: 20. A firm is considering two mutually exclusive projects with equal lives, Project A has an NPV of $100,000, an IRR of 12%, and a

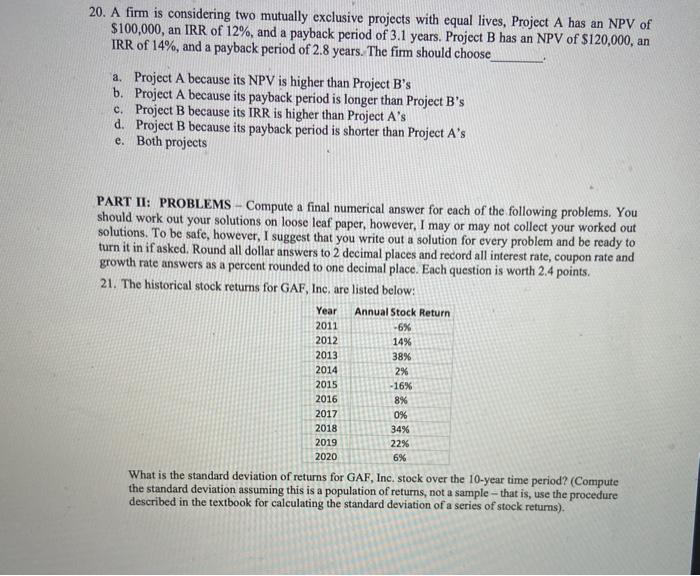

20. A firm is considering two mutually exclusive projects with equal lives, Project A has an NPV of $100,000, an IRR of 12%, and a payback period of 3.1 years. Project B has an NPV of $120,000, an IRR of 14%, and a payback period of 2.8 years. The firm should choose a. Project A because its NPV is higher than Project B's b. Project A because its payback period is longer than Project B's c. Project B because its IRR is higher than Project A's d. Project B because its payback period is shorter than Project A's e. Both projects PART II: PROBLEMS - Compute a final numerical answer for each of the following problems. You should work out your solutions on loose leaf paper, however, I may or may not collect your worked out solutions. To be safe, however, I suggest that you write out a solution for every problem and be ready to turn it in if asked. Round all dollar answers to 2 decimal places and record all interest rate, coupon rate and growth rate answers as a percent rounded to one decimal place. Each question is worth 2.4 points. 21. The historical stock returns for GAF, Inc. are listed below: Year Annual Stock Return 2011 -6% 2012 14% 2013 38% 2014 2% 2015 -16% 2016 8% 2017 0% 2018 34% 2019 22% 2020 6% What is the standard deviation of returns for GAF, Inc. stock over the 10-year time period? (Compute the standard deviation assuming this is a population of returns, not a sample - that is, use the procedure described in the textbook for calculating the standard deviation of a series of stock returns)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts