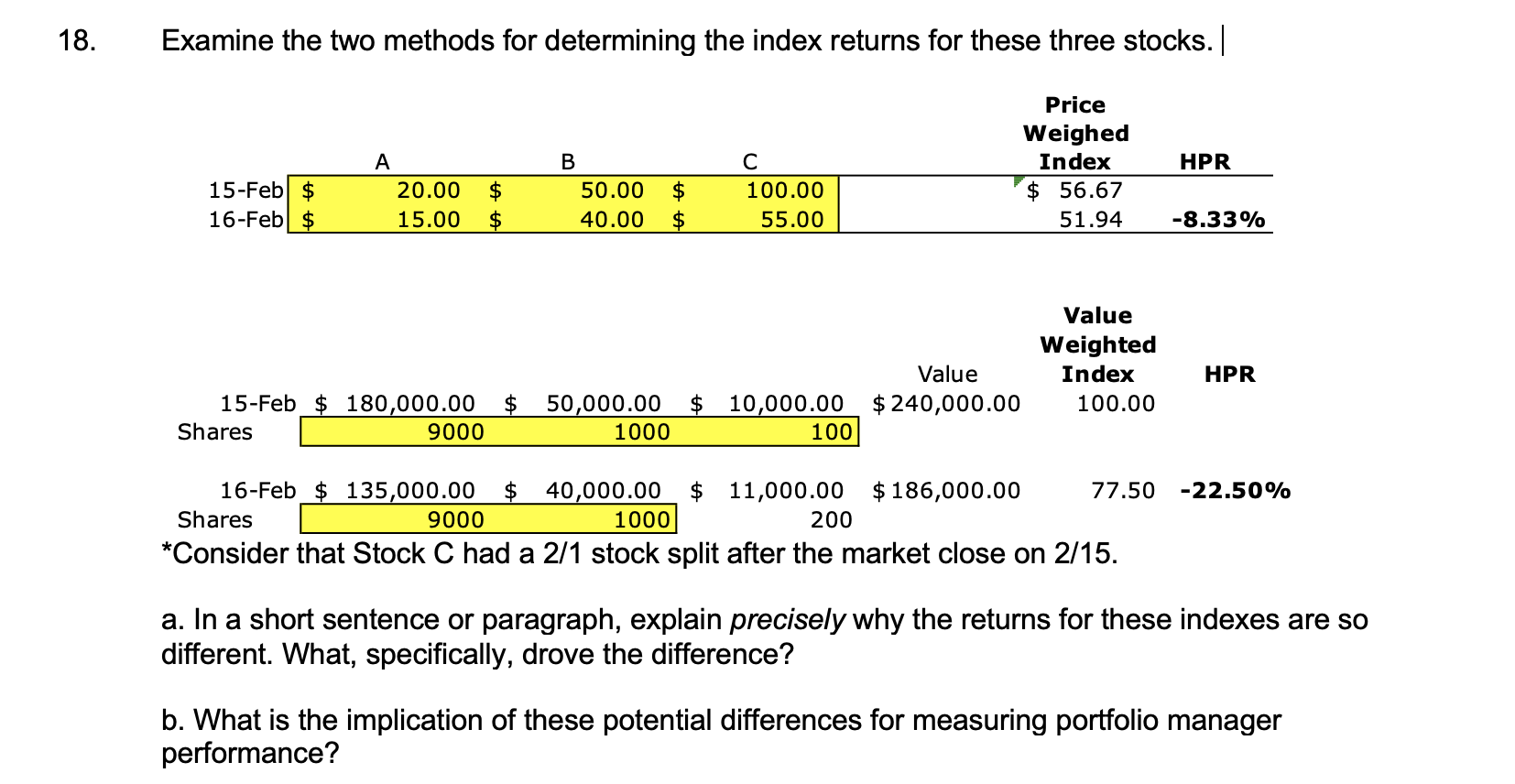

Question: 18. Examine the two methods for determining the index returns for these three stocks. | HPR A 20.00 15.00 Price Weighed Index 56.67 51.94 15-Feb

18. Examine the two methods for determining the index returns for these three stocks. | HPR A 20.00 15.00 Price Weighed Index 56.67 51.94 15-Feb 16-Feb $ B 50.00 40.00 100.00 55.00 -8.33% Value Weighted Index 100.00 HPR 15-Feb _$ 180,000.00 $ 50,000.00 $ 10,000.00 Shares 9000 1000 100 Value $ 240,000.00 -22.50% 16-Feb _$ 135,000.00 $ 40,000.00 $ 11,000.00 $ 186,000.00 77.50 Shares 9000 1000 200 *Consider that Stock C had a 2/1 stock split after the market close on 2/15. a. In a short sentence or paragraph, explain precisely why the returns for these indexes are so different. What, specifically, drove the difference? b. What is the implication of these potential differences for measuring portfolio manager performance? 18. Examine the two methods for determining the index returns for these three stocks. | HPR A 20.00 15.00 Price Weighed Index 56.67 51.94 15-Feb 16-Feb $ B 50.00 40.00 100.00 55.00 -8.33% Value Weighted Index 100.00 HPR 15-Feb _$ 180,000.00 $ 50,000.00 $ 10,000.00 Shares 9000 1000 100 Value $ 240,000.00 -22.50% 16-Feb _$ 135,000.00 $ 40,000.00 $ 11,000.00 $ 186,000.00 77.50 Shares 9000 1000 200 *Consider that Stock C had a 2/1 stock split after the market close on 2/15. a. In a short sentence or paragraph, explain precisely why the returns for these indexes are so different. What, specifically, drove the difference? b. What is the implication of these potential differences for measuring portfolio manager performance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts