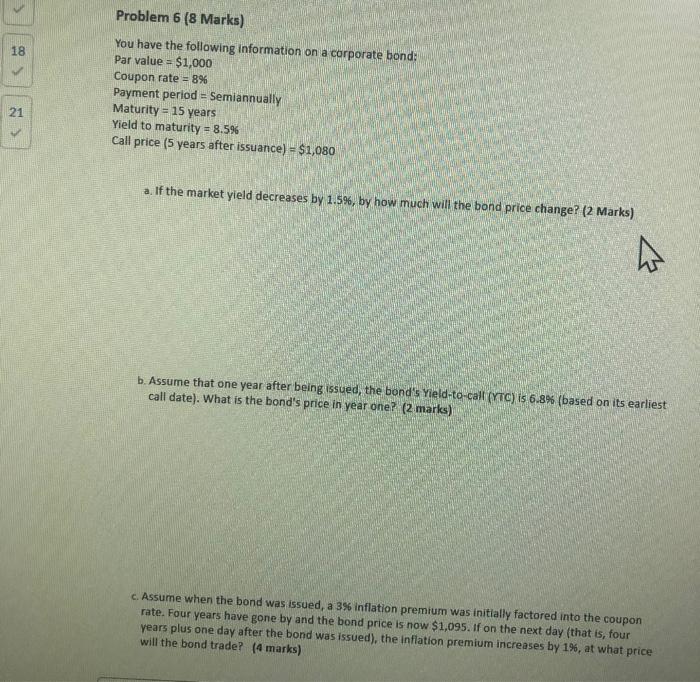

Question: 18 Problem 6 (8 Marks) You have the following information on a corporate bond: Par value = $1,000 Coupon rate = 8% Payment period =

18 Problem 6 (8 Marks) You have the following information on a corporate bond: Par value = $1,000 Coupon rate = 8% Payment period = Semiannually Maturity = 15 years Yield to maturity = 8.5% Call price (5 years after issuance) = $1,080 21 a. If the market yield decreases by 1.5%, by how much will the bond price change? (2 Marks) 4. b. Assume that one year after being issued, the bond's Yield-to-call TC) is 6.8% (based on its earliest call date). What is the bond's price in year one? (2 marks) c. Assume when the bond was issued, a 3% inflation premium was initially factored into the coupon rate. Four years have gone by and the bond price is now $1,095. If on the next day (that is, four years plus one day after the bond was issued), the inflation premium increases by 1%, at what price will the bond trade? (4 marks) 18 Problem 6 (8 Marks) You have the following information on a corporate bond: Par value = $1,000 Coupon rate = 8% Payment period = Semiannually Maturity = 15 years Yield to maturity = 8.5% Call price (5 years after issuance) = $1,080 21 a. If the market yield decreases by 1.5%, by how much will the bond price change? (2 Marks) 4. b. Assume that one year after being issued, the bond's Yield-to-call TC) is 6.8% (based on its earliest call date). What is the bond's price in year one? (2 marks) c. Assume when the bond was issued, a 3% inflation premium was initially factored into the coupon rate. Four years have gone by and the bond price is now $1,095. If on the next day (that is, four years plus one day after the bond was issued), the inflation premium increases by 1%, at what price will the bond trade? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts