Question: how to solve part 1-4 Problem 1 Intro You've collected the following information about a corporate bond: A B 1 Face value 1,000 2 Years

how to solve part 1-4

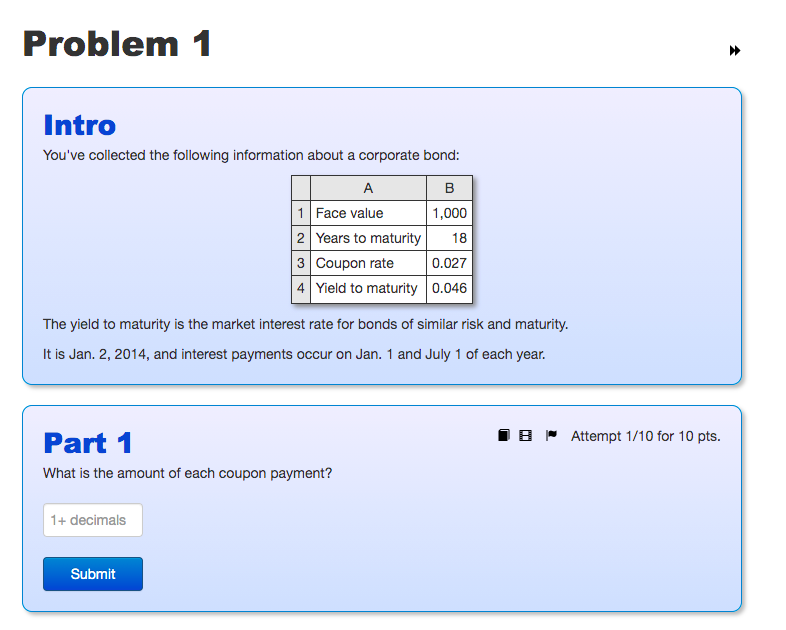

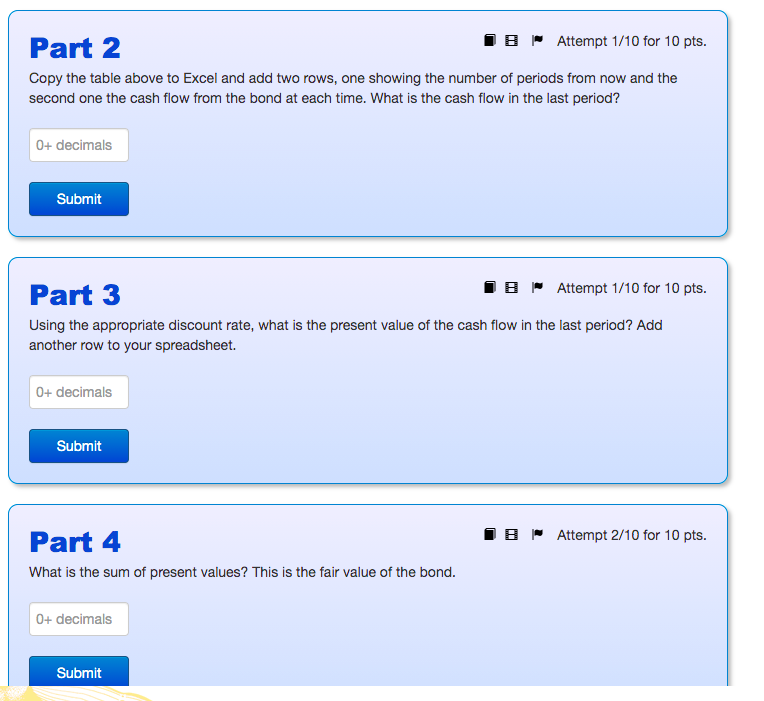

Problem 1 Intro You've collected the following information about a corporate bond: A B 1 Face value 1,000 2 Years to maturity 18 3 Coupon rate 0.027 4 Yield to maturity 0.046 The yield to maturity is the market interest rate for bonds of similar risk and maturity. It is Jan. 2, 2014, and interest payments occur on Jan. 1 and July 1 of each year. B Attempt 1/10 for 10 pts. Part 1 What is the amount of each coupon payment? 1+ decimals Submit Part 2 IB Attempt 1/10 for 10 pts. Copy the table above to Excel and add two rows, one showing the number of periods from now and the second one the cash flow from the bond at each time. What is the cash flow in the last period? O+ decimals Submit Part 3 IB Attempt 1/10 for 10 pts. Using the appropriate discount rate, what is the present value of the cash flow in the last period? Add another row to your spreadsheet. 0+ decimals Submit IB Attempt 2/10 for 10 pts. Part 4 What is the sum of present values? This is the fair value of the bond. 0+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts