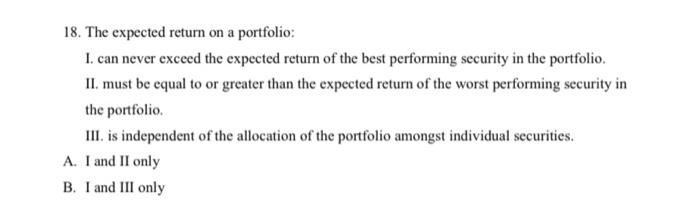

Question: 18. The expected return on a portfolio: 1. can never exceed the expected return of the best performing security in the portfolio. II. must be

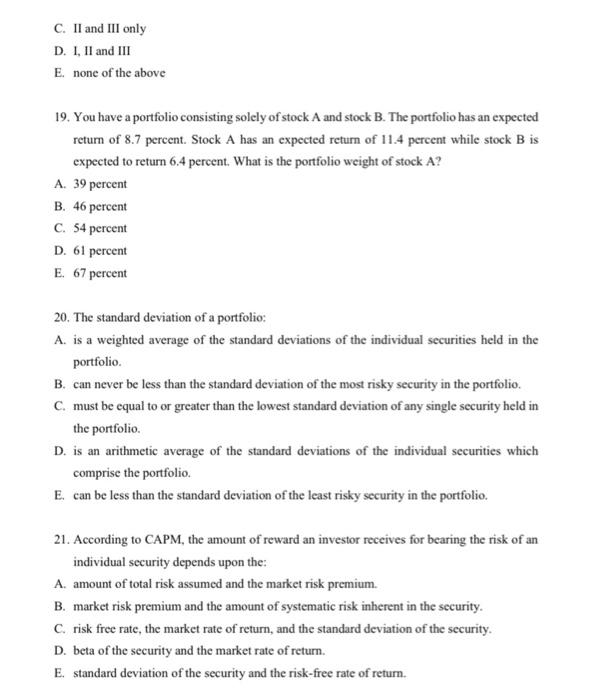

18. The expected return on a portfolio: 1. can never exceed the expected return of the best performing security in the portfolio. II. must be equal to or greater than the expected return of the worst performing security in the portfolio. III. is independent of the allocation of the portfolio amongst individual securities. A. I and II only B. I and III only C. II and III only D. I, II and III E. none of the above 19. You have a portfolio consisting solely of stock A and stock B. The portfolio has an expected return of 8.7 percent. Stock A has an expected return of 11.4 percent while stock B is expected to return 6.4 percent. What is the portfolio weight of stock A? A. 39 percent B. 46 percent C. 54 percent D. 61 percent E. 67 percent 20. The standard deviation of a portfolio: A. is a weighted average of the standard deviations of the individual securities held in the portfolio B. can never be less than the standard deviation of the most risky security in the portfolio. C. must be equal to or greater than the lowest standard deviation of any single security held in the portfolio D. is an arithmetic average of the standard deviations of the individual securities which comprise the portfolio E. can be less than the standard deviation of the least risky security in the portfolio. 21. According to CAPM, the amount of reward an investor receives for bearing the risk of an individual security depends upon the: A. amount of total risk assumed and the market risk premium. B. market risk premium and the amount of systematic risk inherent in the security. C. risk free rate, the market rate of return, and the standard deviation of the security. D. beta of the security and the market rate of return. E. standard deviation of the security and the risk-free rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts