Question: 2. The expected return on a portfolio: I. can never exceed the expected return of the best performing security in the portfolio. II. must be

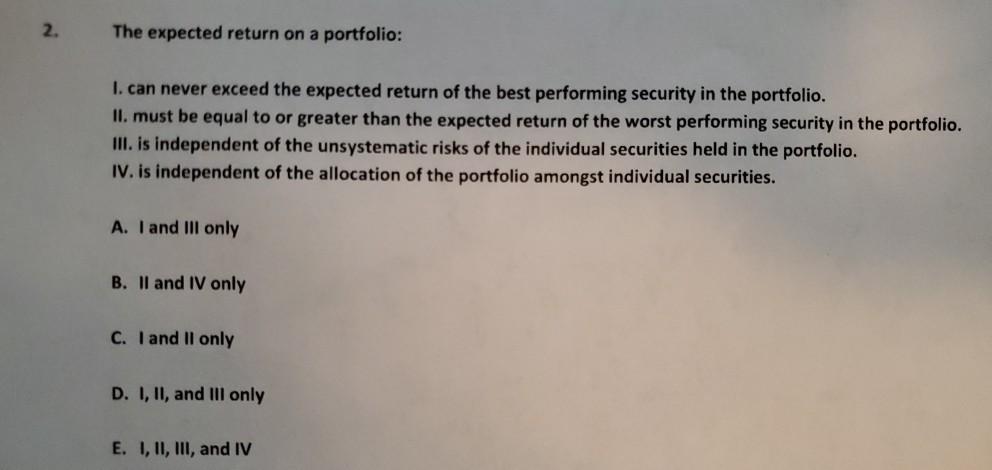

2. The expected return on a portfolio: I. can never exceed the expected return of the best performing security in the portfolio. II. must be equal to or greater than the expected return of the worst performing security in the portfolio. III. is independent of the unsystematic risks of the individual securities held in the portfolio. IV. is independent of the allocation of the portfolio amongst individual securities. A. I and III only B. II and IV only C. I and II only D. I, II, and Ill only E. I, II, III, and IV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts