Question: 18. You are comparing two annuities that pay cash annually for twelve years. The annuities are identical except for the payment dates. Annuity A

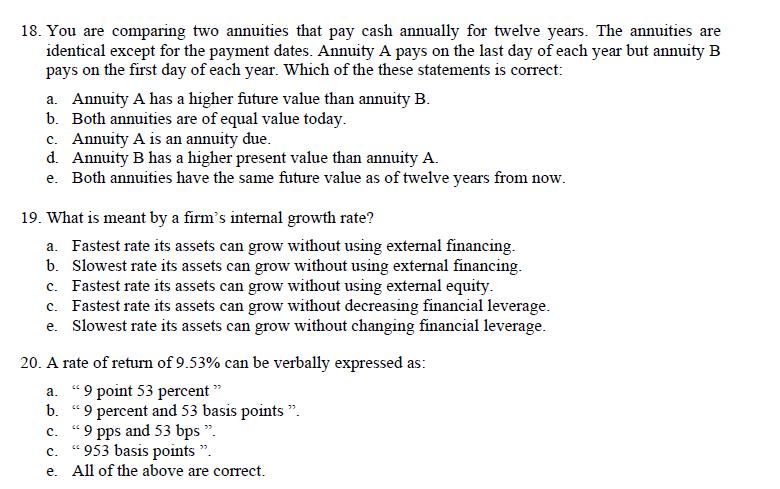

18. You are comparing two annuities that pay cash annually for twelve years. The annuities are identical except for the payment dates. Annuity A pays on the last day of each year but annuity B pays on the first day of each year. Which of the these statements is correct: a. Annuity A has a higher future value than annuity B. b. Both annuities are of equal value today. c. Annuity A is an annuity due. d. Annuity B has a higher present value than annuity A. e. Both annuities have the same future value as of twelve years from now. 19. What is meant by a firm's internal growth rate? a. Fastest rate its assets can grow without using external financing. b. Slowest rate its assets can grow without using external financing. c. Fastest rate its assets can grow without using external equity. c. Fastest rate its assets can grow without decreasing financial leverage. e. Slowest rate its assets can grow without changing financial leverage. 20. A rate of return of 9.53% can be verbally expressed as: a. "9 point 53 percent " b. 9 percent and 53 basis points ". c. "9 pps and 53 bps ". c. 953 basis points ". e. All of the above are correct.

Step by Step Solution

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Lets address each question step by step Question 18 Comparing two annuities Annuity A pays on th... View full answer

Get step-by-step solutions from verified subject matter experts