Question: 182 chapter 3 > Tying It All Together Case 3-1 Before you begin this assignment review the Twing it All Together feature in the chapter

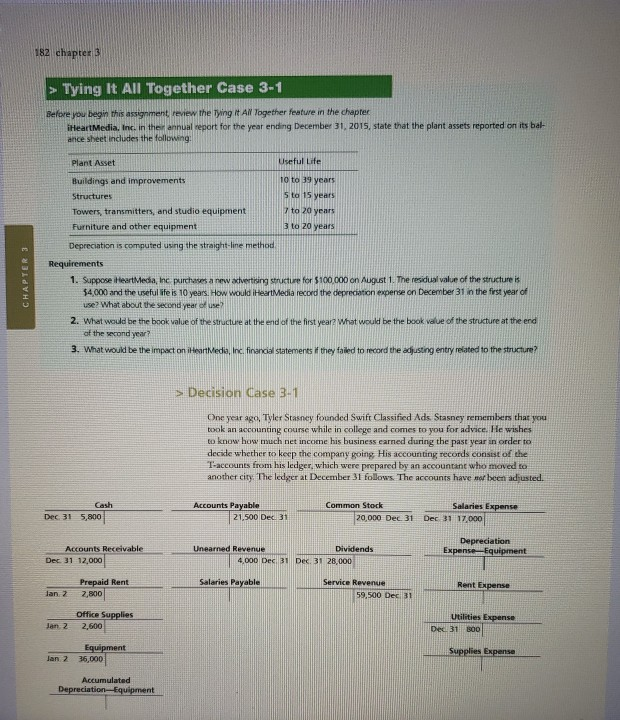

182 chapter 3 > Tying It All Together Case 3-1 Before you begin this assignment review the Twing it All Together feature in the chapter iHeartMedia, Inc. in the annual report for the year ending December 31, 2015, state that the plant assets reported on its bal ance sheet includes the following CHAPTER 3 Plant Asset Useful Life Buildings and improvements 10 to 39 years Structures 5 ta 15 years Towers, transmitters, and studio equipment 7 to 20 years Furniture and other equipment 3 to 20 years Depreciation is computed using the straight-line method Requirements 1. Suppose HeartMedia, Inc purchases a new activertising structure for 5100 000 on August 1. The residual value of the structure is $4,000 and the useful life is 10 years. How would iHeartMedia record the depreciation expense on December 31 in the first year of use? What about the second year of use? 2. What would be the book value of the structure at the end of the first year? What would be the book value of the structure at the end of the second year 3. What would be the impact on iHeartMedia, Inc. financial statements if they failed to record the adjusting entry related to the structure? > Decision Case 3-1 One year ago. Tyler Stasney founded Swift Classified Ads Stasney remembers that you took an accounting course while in college and comes to you for advice. He wishes to know how much net income his business earned during the past year in order to decide whether to keep the company going His accounting records consist of the T-accounts from his ledger, which were prepared by an accountant who moved to another city. The ledger at December 31 follows. The accounts have mor been adjusted. Cash Dec 31 5,800 Accounts Payable 21,500 Dec 31 Common Stock 20,000 Dec 31 Salaries Expense Dec 31 17.000 Accounts Receivable Dec 31 12.000 Unearned Revenue Dividends 4.000 Dec 31 Dec 31 28,000 Depreciation Expense Equipment Salaries Payable Prepaid Rent 2,800 Service Revenue 59,500 Dec 31 Rent Expense Jan 2 Office Supplies 2,600 Jan 2 Utilities Expense Dec 31100 Equipment 36,000 Supplies Expense Jan 2 Accumulated Depreciation Equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts