Question: Tying It All Together Case 18-1 Before you begin this assignment, review the Tying It All Together feature in the chapter. PepsiCo, Inc. is a

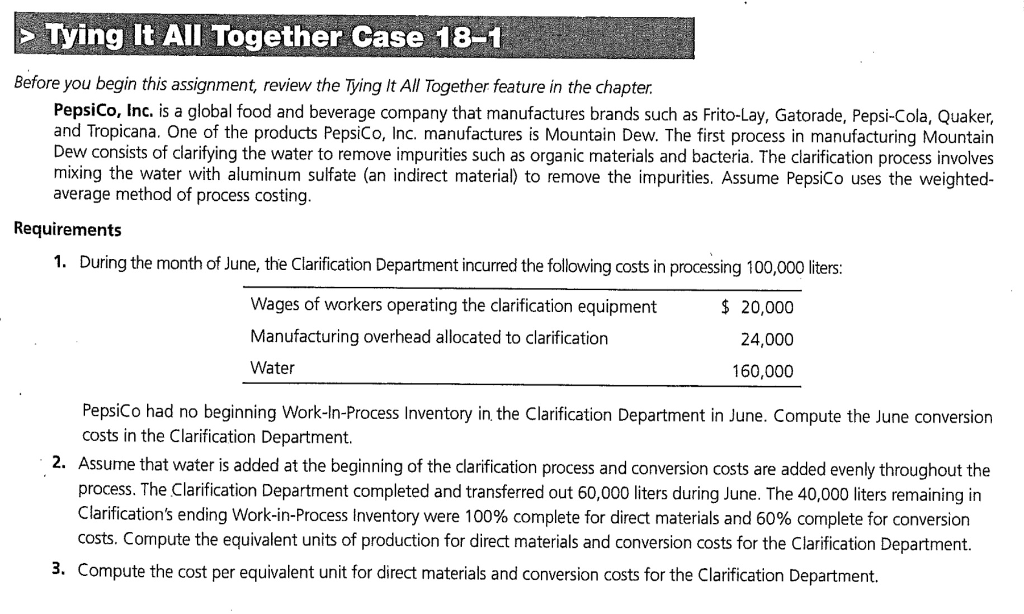

Tying It All Together Case 18-1 Before you begin this assignment, review the Tying It All Together feature in the chapter. PepsiCo, Inc. is a global food and beverage company that manufactures brands such as Frito-Lay, Gatorade, Pepsi-Cola, Quaker, and Tropicana. One of the products PepsiCo, Inc. manufactures is Mountain Dew. The first process in manufacturing Mountain Dew consists of clarifying the water to remove impurities such as organic materials and bacteria. The clarification process involves mixing the water with aluminum sulfate (an indirect material) to remove the impurities. Assume PepsiCo uses the weighted- average method of process costing. Requirements 1. During the month of June, the Clarification Department incurred the following costs in processing 100,000 liters: Wages of workers operating the clarification equipment20,000 Manufacturing overhead allocated to clarification Water 24,000 160,000 PepsiCo had no beginning Work-In-Process Inventory in the Clarification Department in June. Compute the June conversion costs in the Clarification Department. Assume that water is added at the beginning of the clarification process and conversion costs are added evenly throughout the process. The Clarification Department completed and transferred out 60,000 liters during June. The 40,000 liters remaining in Clarification's ending Work-in-Process Inventory were 100% complete for direct materials and 60% complete for conversion costs. Compute the equivalent units of production for direct materials and conversion costs for the Clarification Department Compute the cost per equivalent unit for direct materials and conversion costs for the Clarification Department. 2. 3. Tying It All Together Case 18-1 Before you begin this assignment, review the Tying It All Together feature in the chapter. PepsiCo, Inc. is a global food and beverage company that manufactures brands such as Frito-Lay, Gatorade, Pepsi-Cola, Quaker, and Tropicana. One of the products PepsiCo, Inc. manufactures is Mountain Dew. The first process in manufacturing Mountain Dew consists of clarifying the water to remove impurities such as organic materials and bacteria. The clarification process involves mixing the water with aluminum sulfate (an indirect material) to remove the impurities. Assume PepsiCo uses the weighted- average method of process costing. Requirements 1. During the month of June, the Clarification Department incurred the following costs in processing 100,000 liters: Wages of workers operating the clarification equipment20,000 Manufacturing overhead allocated to clarification Water 24,000 160,000 PepsiCo had no beginning Work-In-Process Inventory in the Clarification Department in June. Compute the June conversion costs in the Clarification Department. Assume that water is added at the beginning of the clarification process and conversion costs are added evenly throughout the process. The Clarification Department completed and transferred out 60,000 liters during June. The 40,000 liters remaining in Clarification's ending Work-in-Process Inventory were 100% complete for direct materials and 60% complete for conversion costs. Compute the equivalent units of production for direct materials and conversion costs for the Clarification Department Compute the cost per equivalent unit for direct materials and conversion costs for the Clarification Department. 2. 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts