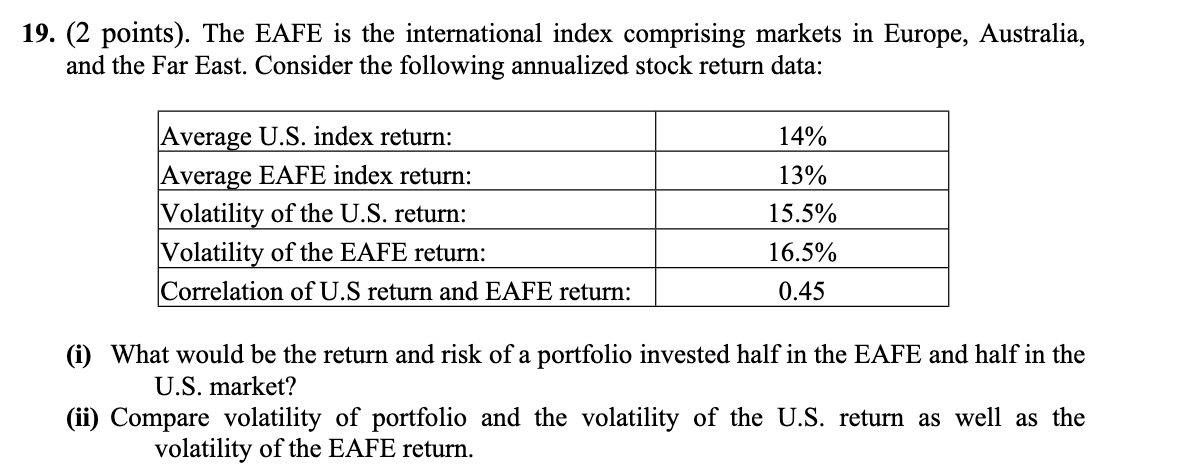

Question: 19. (2 points). The EAFE is the international index comprising markets in Europe, Australia, and the Far East. Consider the following annualized stock return data:

19. (2 points). The EAFE is the international index comprising markets in Europe, Australia, and the Far East. Consider the following annualized stock return data: Average U.S. index return: Average EAFE index return: Volatility of the U.S. return: Volatility of the EAFE return: Correlation of U.S return and EAFE return: 14% 13% 15.5% 16.5% 0.45 (i) What would be the return and risk of a portfolio invested half in the EAFE and half in the U.S. market? (ii) Compare volatility of portfolio and the volatility of the U.S. return as well as the volatility of the EAFE return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts