Question: Mutual Fund Performance Many mutual funds compare their performance with that of a benchmark, an index of the return on all securities of the kind

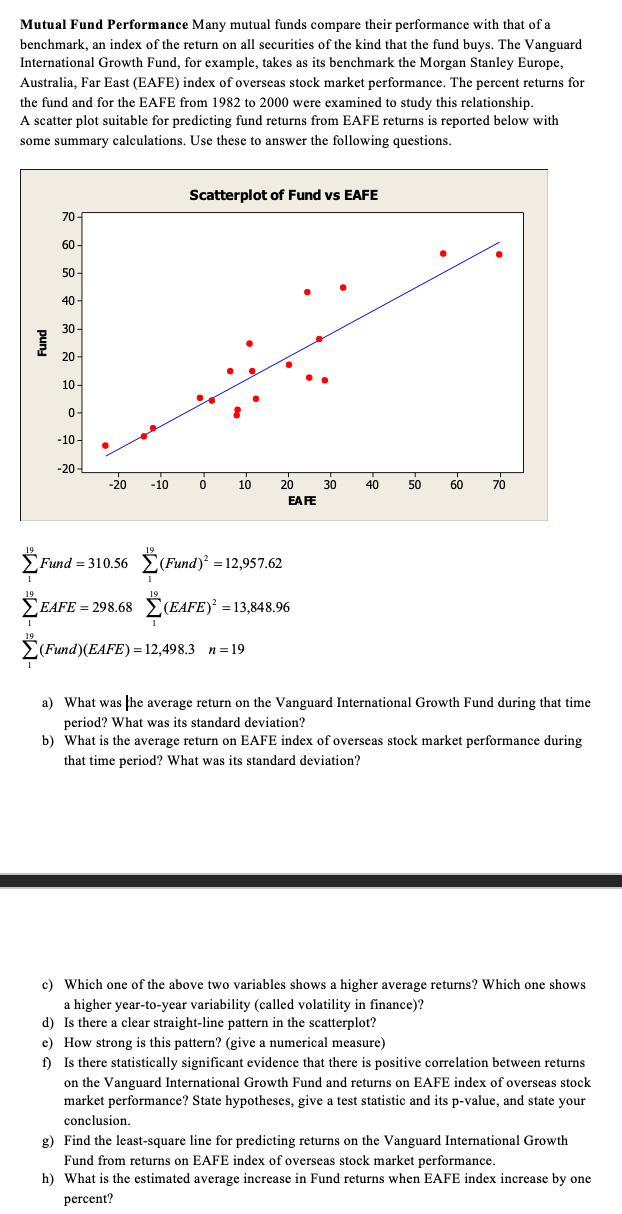

Mutual Fund Performance Many mutual funds compare their performance with that of a benchmark, an index of the return on all securities of the kind that the fund buys. The Vanguard International Growth Fund, for example, takes as its benchmark the Morgan Stanley Europe, Australia, Far East (EAFE) index of overseas stock market performance. The percent returns for the fund and for the EAFE from 1982 to 2000 were examined to study this relationship. A scatter plot suitable for predicting fund returns from EAFE returns is reported below with some summary calculations. Use these to answer the following questions. Scatterplot of Fund vs EAFE 70 60 50 40 30 Fund 20 10 0 - -10- -20 -20 -10 0 10 40 50 60 70 20 30 EA FE Fund = 310.56 (Fund)? = 12,957.62 EEAFE = 298.68 (EAFE)? = 13,848.96 (Fund)(EAFE) = 12,498.3 n=19 a) What was the average return on the Vanguard International Growth Fund during that time period? What was its standard deviation? b) What is the average return on EAFE index of overseas stock market performance during that time period? What was its standard deviation? c) Which one of the above two variables shows a higher average returns? Which one shows a higher year-to-year variability (called volatility in finance)? d) Is there a clear straight-line pattern in the scatterplot? e) How strong is this pattern? (give a numerical measure) f) Is there statistically significant evidence that there is positive correlation between returns on the Vanguard International Growth Fund and returns on EAFE index of overseas stock market performance? State hypotheses, give a test statistic and its p-value, and state your conclusion. g) Find the least-square line for predicting returns on the Vanguard International Growth Fund from returns on EAFE index of overseas stock market performance. h) What is the estimated average increase in Fund returns when EAFE index increase by one percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts