Question: 19 & 20 please label the answer l TFW LTE 2:49 PM 61% 16) Beginning with an investment in one company's securities, as we add

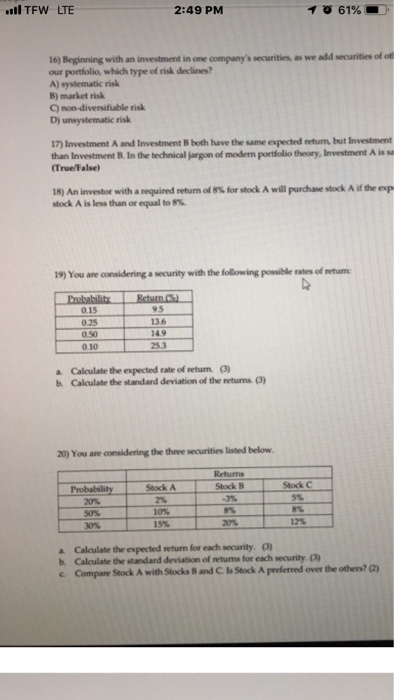

l TFW LTE 2:49 PM 61% 16) Beginning with an investment in one company's securities, as we add securities of ot our portiolio, which type of risk declines? A) systematic risk B) market risk C) non-diversifiable risk D) unsystematic risk 17) Investment A and Investment B both have the same expected return, but Investment than Investment B. In the technical jargon of modern portfolio theory, Investment A is sa (True/False) 18) An investor with a required return of 8% for stock A will pucha est ok Aiftheep stock A is less than or equal to 8 19) You ane considering a security with the following possible rates of retum 0.15 0.25 0.50 0.10 95 13.6 14.9 253 a Calculate the expected rate of return. ) b. Calculate the standard deviation of the returms. (3) 20) You are considering the three securities listed below Returns TrobabilityStox Stock A Stock B Stock C 59% 0% 10% 15% 201% 12% a Calculate the expected return for each security. 0) b Calculate the standard deviation of retums for each security. e Compare Stock A with Stocks B and C Is Stock A preferred over the others? )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts