Question: A parent has contributed to a 5 2 9 Plan to fund her child's college education. The child gets into her preferred college and is

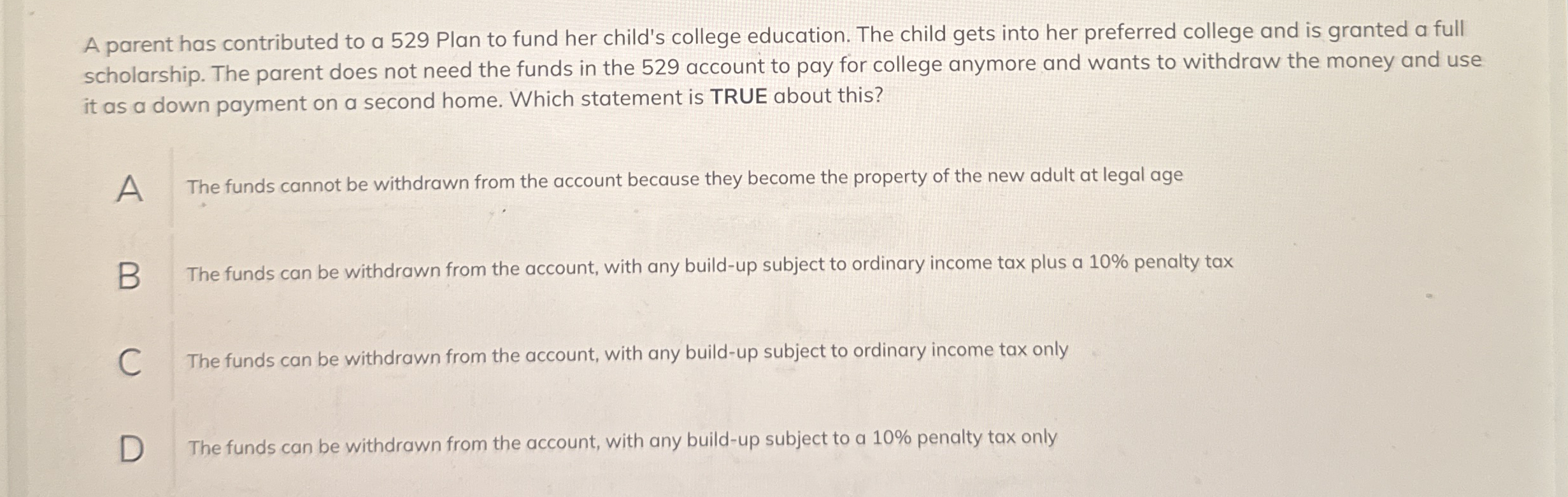

A parent has contributed to a Plan to fund her child's college education. The child gets into her preferred college and is granted a full scholarship. The parent does not need the funds in the account to pay for college anymore and wants to withdraw the money and use it as a down payment on a second home. Which statement is TRUE about this?

A The funds cannot be withdrawn from the account because they become the property of the new adult at legal age

B The funds can be withdrawn from the account, with any buildup subject to ordinary income tax plus a penalty tax

The funds can be withdrawn from the account, with any buildup subject to ordinary income tax only

The funds can be withdrawn from the account, with any buildup subject to a penalty tax only

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock