Question: 19 2.5 When comparing operating income between absorption costing and variable costing, and ending finished goods inventory exceeds beginning finished goods inventory. it may be

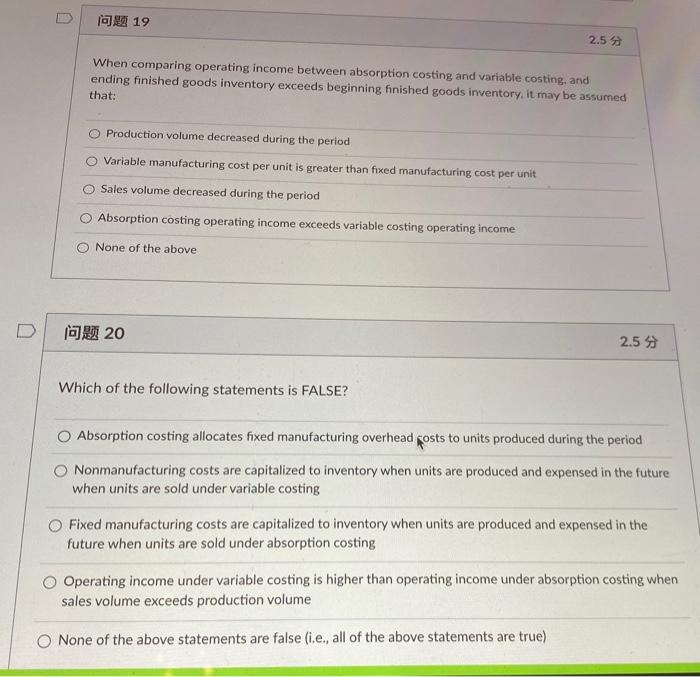

19 2.5 When comparing operating income between absorption costing and variable costing, and ending finished goods inventory exceeds beginning finished goods inventory. it may be assumed that: O Production volume decreased during the period Variable manufacturing cost per unit is greater than fixed manufacturing cost per unit O Sales volume decreased during the period Absorption costing operating income exceeds variable costing operating income None of the above 20 2.5 Which of the following statements is FALSE? Absorption costing allocates fixed manufacturing overhead posts to units produced during the period Nonmanufacturing costs are capitalized to inventory when units are produced and expensed in the future when units are sold under variable costing Fixed manufacturing costs are capitalized to inventory when units are produced and expensed in the future when units are sold under absorption costing Operating income under variable costing is higher than operating income under absorption costing when sales volume exceeds production volume None of the above statements are false (i.e, all of the above statements are true)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts