Question: 10 points Save Araw QUESTION 63 Please select at least two lquidity measures you have ready calculated for the organization. In the box below, please

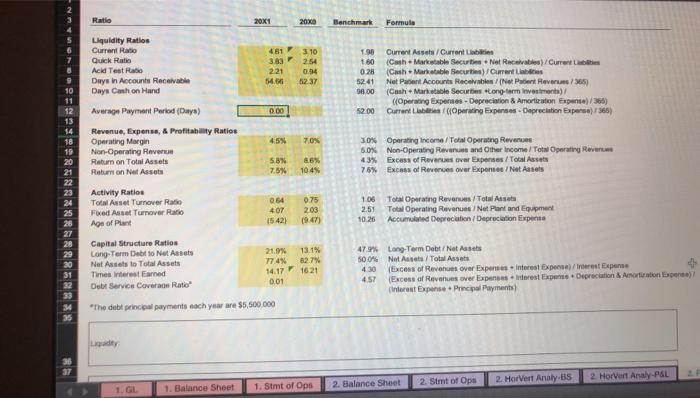

10 points Save Araw QUESTION 63 Please select at least two lquidity measures you have ready calculated for the organization. In the box below, please apply the framework we reviewed in class and discuss your findings with respect to the following: Year over your trending Performance against benchmark Drivers of change in the metric and management considerations for improvement For the toolbar, pre ALT F10 (PC) O ALTFN.P10 Madh BIO Paragraph Arial 14px E A 14 9. C a - 1 1 --- H: *9 2 1 5 B. B 3 x x 3 BED 0 Ratio 20X1 2000 Benchmark Formula Liquidity Ratios Current Ratio Quick Ratio Acid Test Ratio Days in Accounts Receivable Days Cash on Hand 481310 3.83 2.54 221 0.94 54.66 5237 1.96 160 0.28 52.41 38.00 Current Assets Current Cash Marketable Securtis. Net Receive) / Current Cash Marble Securi) Ouren Net Pant Accounts Receivable/Niet Pant Revers/365) Cash Marketable Securities Long-term investments) (Operating Expenses - Depreciation & Amortization Expe365) Current Lab (Operating Expenses - Depreciation Expense) 365) 10 11 12 13 14 0.00 52.00 Average Payment Period (Daya) Revenue, Expense & Profitability Ratios Operating Margin Non-Operating Rever Return on Total Assets Return on Net Assets 70% 30% Operating Income To Operating Revers 5.0% Non-Operating Revand Other Income Total Operating Rever 43% Excess of Revens over Expenses/Total Assets 76% Excess of Reveres over Foxpenses/Not Assets 58% 7.5% 10.45 19 20 21 22 23 24 25 Activity Ratio Total Asset Turnover Rat Fred Asset Turnover Radio Age of Plant 064 407 1542) 075 203 19.07) 106 To Operating Revenues/Total Asses 2.51 Total Operating Revenues / Not Plant and met 10.26 Accumulated Depreciation Depreciation Expense 28 30 31 22 Capital Structure Ratios Long-Term Debt to Net Assets Net Assets to Total Assets Times interested Debt Service Coverage Ratio 21.9% 13.1% 174 82.7 14.17 1621 0.01 479% Long Term Debt Net Assets 50046 Net Aset / Total Assets 4.30 Excess of Revenues over Expenses interest Expenses/terest Expense 4.57 (Excess of Revenues over Expenses interest Expense Depreciation & Arion bp) Interest Expense. Principal Payments The debt principal payments each year are $5,500,000 Lody 37 2. Simt of Ops 2. HorVert Analy.BS 2 Horvart Analy-P&L 2. Balance Sheet 1. GL 1. Balance Sheet 1. Stmt of Ops 10 points Save Araw QUESTION 63 Please select at least two lquidity measures you have ready calculated for the organization. In the box below, please apply the framework we reviewed in class and discuss your findings with respect to the following: Year over your trending Performance against benchmark Drivers of change in the metric and management considerations for improvement For the toolbar, pre ALT F10 (PC) O ALTFN.P10 Madh BIO Paragraph Arial 14px E A 14 9. C a - 1 1 --- H: *9 2 1 5 B. B 3 x x 3 BED 0 Ratio 20X1 2000 Benchmark Formula Liquidity Ratios Current Ratio Quick Ratio Acid Test Ratio Days in Accounts Receivable Days Cash on Hand 481310 3.83 2.54 221 0.94 54.66 5237 1.96 160 0.28 52.41 38.00 Current Assets Current Cash Marketable Securtis. Net Receive) / Current Cash Marble Securi) Ouren Net Pant Accounts Receivable/Niet Pant Revers/365) Cash Marketable Securities Long-term investments) (Operating Expenses - Depreciation & Amortization Expe365) Current Lab (Operating Expenses - Depreciation Expense) 365) 10 11 12 13 14 0.00 52.00 Average Payment Period (Daya) Revenue, Expense & Profitability Ratios Operating Margin Non-Operating Rever Return on Total Assets Return on Net Assets 70% 30% Operating Income To Operating Revers 5.0% Non-Operating Revand Other Income Total Operating Rever 43% Excess of Revens over Expenses/Total Assets 76% Excess of Reveres over Foxpenses/Not Assets 58% 7.5% 10.45 19 20 21 22 23 24 25 Activity Ratio Total Asset Turnover Rat Fred Asset Turnover Radio Age of Plant 064 407 1542) 075 203 19.07) 106 To Operating Revenues/Total Asses 2.51 Total Operating Revenues / Not Plant and met 10.26 Accumulated Depreciation Depreciation Expense 28 30 31 22 Capital Structure Ratios Long-Term Debt to Net Assets Net Assets to Total Assets Times interested Debt Service Coverage Ratio 21.9% 13.1% 174 82.7 14.17 1621 0.01 479% Long Term Debt Net Assets 50046 Net Aset / Total Assets 4.30 Excess of Revenues over Expenses interest Expenses/terest Expense 4.57 (Excess of Revenues over Expenses interest Expense Depreciation & Arion bp) Interest Expense. Principal Payments The debt principal payments each year are $5,500,000 Lody 37 2. Simt of Ops 2. HorVert Analy.BS 2 Horvart Analy-P&L 2. Balance Sheet 1. GL 1. Balance Sheet 1. Stmt of Ops

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts