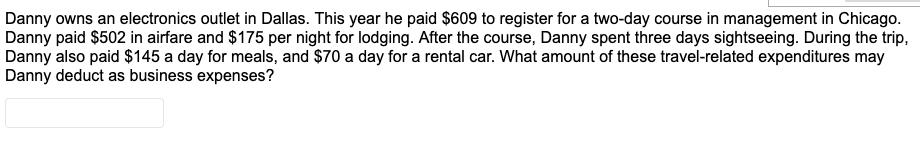

Question: Danny owns an electronics outlet in Dallas. This year he paid $609 to register for a two-day course in management in Chicago. Danny paid

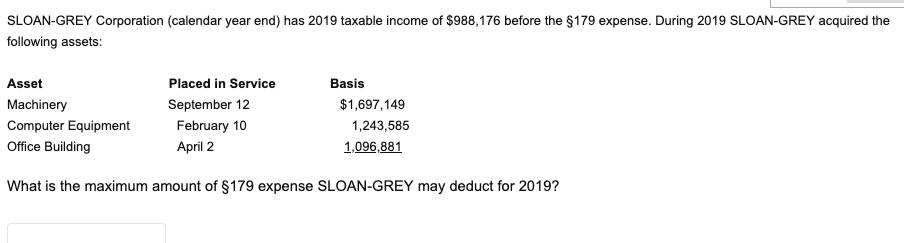

Danny owns an electronics outlet in Dallas. This year he paid $609 to register for a two-day course in management in Chicago. Danny paid $502 in airfare and $175 per night for lodging. After the course, Danny spent three days sightseeing. During the trip, Danny also paid $145 a day for meals, and $70 a day for a rental car. What amount of these travel-related expenditures may Danny deduct as business expenses? SLOAN-GREY Corporation (calendar year end) has 2019 taxable income of $988,176 before the $179 expense. During 2019 SLOAN-GREY acquired the following assets: Asset Placed in Service Basis Machinery September 12 $1,697,149 Computer Equipment February 10 1,243,585 Office Building April 2 1,096,881 What is the maximum amount of $179 expense SLOAN-GREY may deduct for 2019?

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Answer Part 1 Danny can deduct business expenses as follows Deductible Travel Cost Description Amoun... View full answer

Get step-by-step solutions from verified subject matter experts