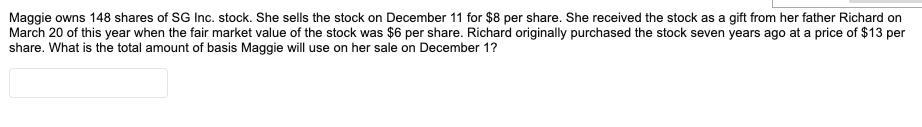

Question: Maggie owns 148 shares of SG Inc. stock. She sells the stock on December 11 for $8 per share. She received the stock as

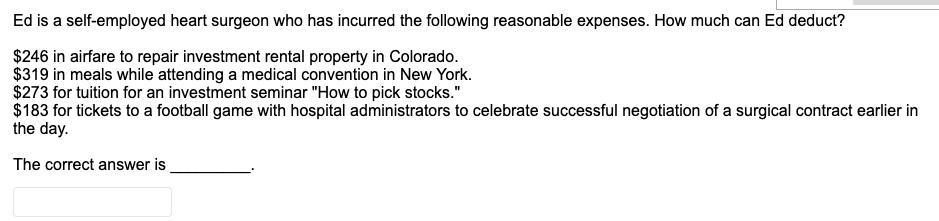

Maggie owns 148 shares of SG Inc. stock. She sells the stock on December 11 for $8 per share. She received the stock as a gift from her father Richard on March 20 of this year when the fair market value of the stock was $6 per share. Richard originally purchased the stock seven years ago at a price of $13 per share. What is the total amount of basis Maggie will use on her sale on December 1? Ed is a self-employed heart surgeon who has incurred the following reasonable expenses. How much can Ed deduct? $246 in airfare to repair investment rental property in Colorado. $319 in meals while attending a medical convention in New York. $273 for tuition for an investment seminar "How to pick stocks." $183 for tickets to a football game with hospital administrators to celebrate successful negotiation of a surgical contract earlier in the day. The correct answer is

Step by Step Solution

3.56 Rating (160 Votes )

There are 3 Steps involved in it

Maggies gift price of shares6 Selling price of Mag... View full answer

Get step-by-step solutions from verified subject matter experts