Question: -19. Commodities are an excellent way to increase the return and lower the risk on a portfolio because they have such a low correlation to

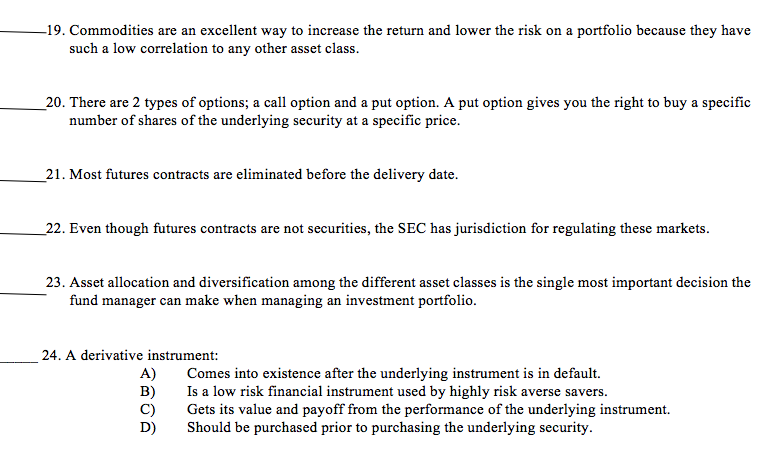

-19. Commodities are an excellent way to increase the return and lower the risk on a portfolio because they have such a low correlation to any other asset class. 20. There are 2 types of options; a call option and a put option. A put option gives you the right to buy a specific number of shares of the underlying security at a specific price. 21. Most futures contracts are eliminated before the delivery date. 22. Even though futures contracts are not securities, the SEC has jurisdiction for regulating these markets. 23. Asset allocation and diversification among the different asset classes is the single most important decision the fund manager can make when managing an investment portfolio. 24. A derivative instrument: A) B) C) D) Comes into existence after the underlying instrument is in default. Is a low risk financial instrument used by highly risk averse savers. Gets its value and payoff from the performance of the underlying instrument. Should be purchased prior to purchasing the underlying security

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts