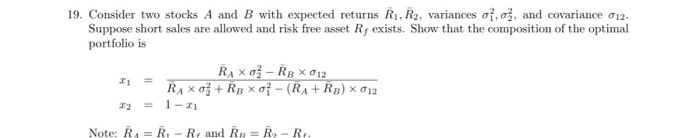

Question: 19. Consider two stocks A and B with expected returns R1, R2, variances o, og, and covariance 012- Suppose short sales are allowed and risk

19. Consider two stocks A and B with expected returns R1, R2, variances o, og, and covariance 012- Suppose short sales are allowed and risk free asset Ry exists. Show that the composition of the optimal portfolio is 11 12 RAX 03 - RB X 012 R A XO} + RB Xo-(RA+RB) x 012 1- = Note: R = R -R and RR=R-R

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts