Question: 19 D | Question 19 Ingram Electric is considering a project with an initial cash outflow of $800,000. This project is expected to have cash

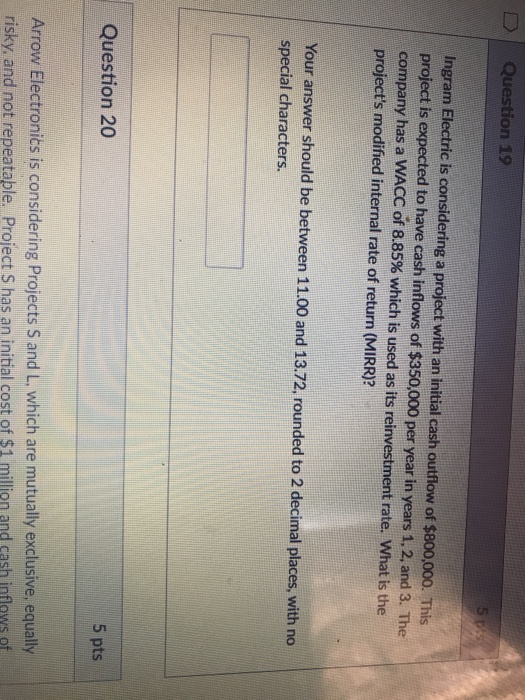

D | Question 19 Ingram Electric is considering a project with an initial cash outflow of $800,000. This project is expected to have cash inflows of $350,000 per year in years 1, 2, and 3. The company has a WACC of 8.85% which is used as its reinvestment rate. What is the project's modified internal rate of return (MIRR)? Your answer should be between 11.00 and 13.72, rounded to 2 decimal places, with no special characters. 5 pts Question 20 Arrow Electronits is considering Projects S and L, which are mutually exclusive, equally risky, and not repeatable. Project S has an initial cost of $1 million and cash inflows of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts