Question: 19 is rough EXAMPLE 1: DIFFERENT CASH FLOWS AND NO RESIDUAL VALUP YEAR CASH EIAI 18) Buxton Corporation is evaluating a capital investment project which

19 is rough

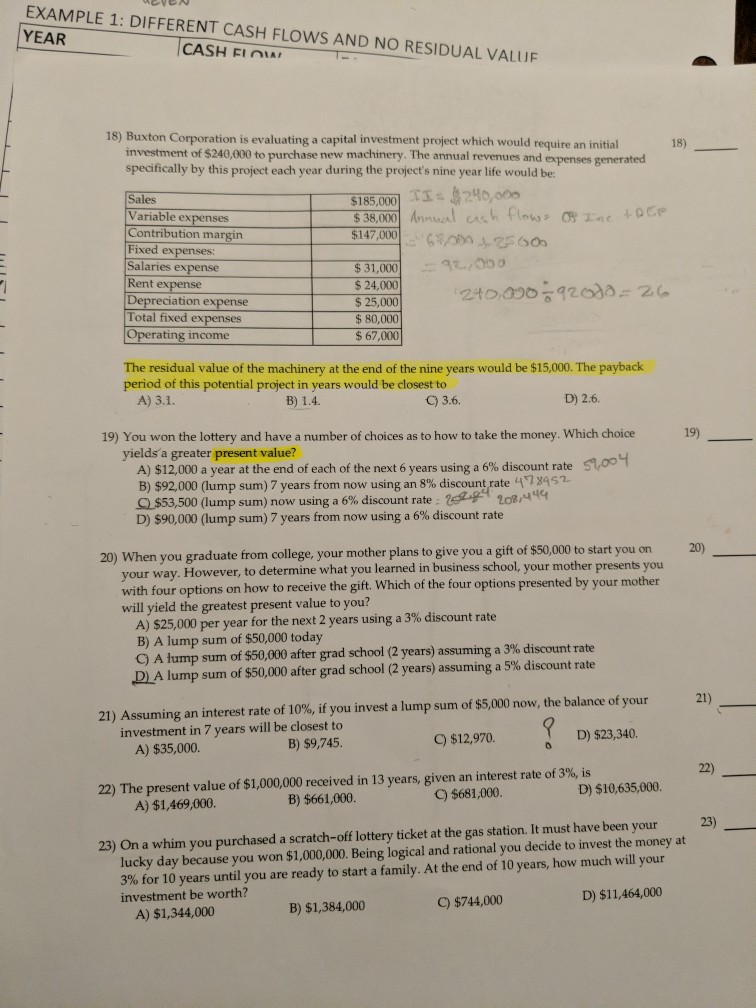

EXAMPLE 1: DIFFERENT CASH FLOWS AND NO RESIDUAL VALUP YEAR CASH EIAI 18) Buxton Corporation is evaluating a capital investment project which would require an initial 18) investment of $240,000 to purchase new machinery. The annual revenues and expenses generated specifically by this project each year during the project's nine year life would be: Sales Variable ex Contribution margin Fixed ex Salaries expense Rent 38,000 Asal cas h Plousc CAS $147,000sF6 $31,000 $ 24,000 $ 25,000 $ 80,000 $ 67,000 ation ex Total fixed expenses ating income The residual value of the machinery at the end of the nine years would be $15,000. The payback period of this potential project in years would be closest to lue o1 D) 2.6. C) 3.6. 19) You won the lottery and have a number of choices as to how to take the money. Which choice 19) yields a greater present value? $100 too A) $12,000 a year at the end of each of the next 6 years using a 6% discount rate B) $92,000 (lump sum) 7 years from now using an 8% discountrate 41n37 o$53,500 (lump sum) now using a 6% discount rate D) $90,000 (lump sum) 7 years from now using a 6% discount rate 20) 20) When you graduate from college, your mother plans to give you a gift of $50,000 to start you dn your way. However, to determine what you learned in business school, your with four options on how to receive the gift. Which of the four options presented by your mother will yield the greatest present value to you? A) $25,000 per year for the next 2 years using a 3% discount rate B) A lump sum of $50,000 today A hump sum of $50,000 after grad school (2 years) assuming a 3% discount rate D A lump sum of $50,000 after grad school (2 years) assuming a 5% discount rate 21) 21) Assuming an interest rate of 10%, if you invest a lump sum of $5,000 now, the balance of your investment in 7 years will be closest to B) $9,745. D) $23,340. C) $12,970. A) $35,000. 22) 22) The present value of $1,000,000 received in 13 years, given an interest rate of 3%, is D) $10,635,000. B) $661,000. C) $681,000. A) $1,469,000. 23) On a whim you purchased a scratch-off lottery ticket at the gas station. It must have been your 23) 3% for 10 years until you are ready to start a family. At the end of 10 years, how much will your investment be worth? lucky day because you won $1,000,000. Being logical and rational you decide to invest the money at D) $11,464,000 B) $1,384,000 C) $744,000 A) $1,344,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts