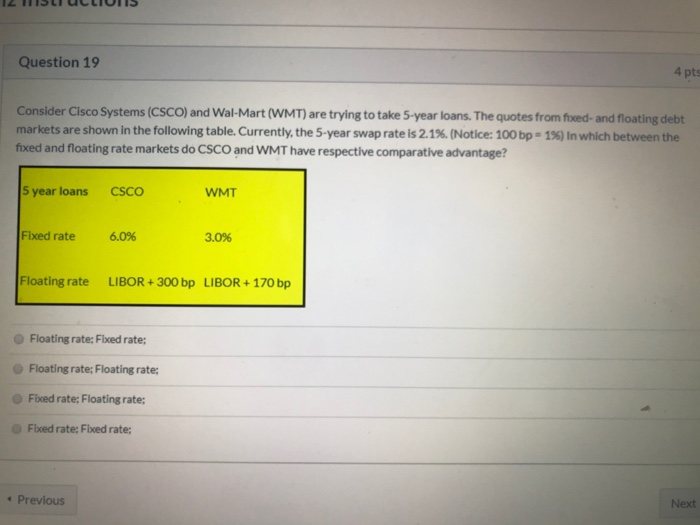

Question: 19 Question 19 4 pts Consider Cisco Systems (CSCO) and Wal-Mart (WMT) are trying to take 5-year loans. The quotes from foed- and floating debt

Question 19 4 pts Consider Cisco Systems (CSCO) and Wal-Mart (WMT) are trying to take 5-year loans. The quotes from foed- and floating debt markets are shown in the following table. Currently, the 5-year swap rate is 2.1%. (Notice: 100 bp = 1%) in which between the fixed and floating rate markets do CSCO and WMT have respective comparative advantage? 5 year loans CSCO WMT Fixed rate 6.0% 3.0% Floating rate LIBOR + 300 bp LIBOR +170 bp Floating rate: Fixed rate; Floating rate; Floating rate: Fixed rate; Floating rate: Fixed rate: Fixed rate; Previous Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts