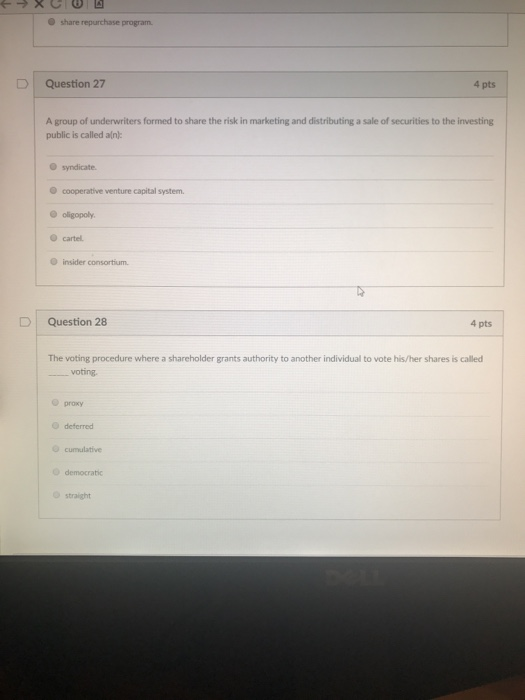

Question: O share repurchase program | Question 27 4 pts A group of underwriters formed to share the risk in marketing and distributing a sale of

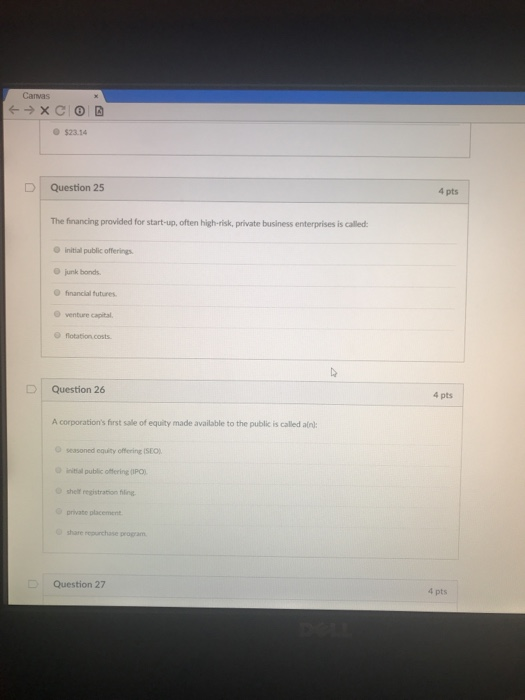

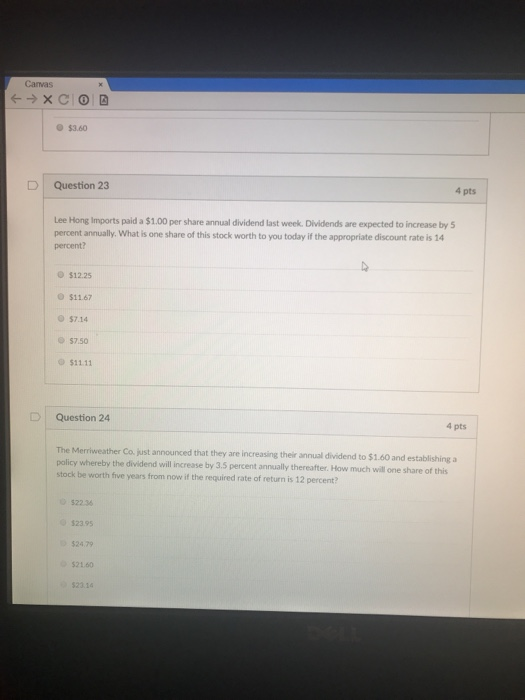

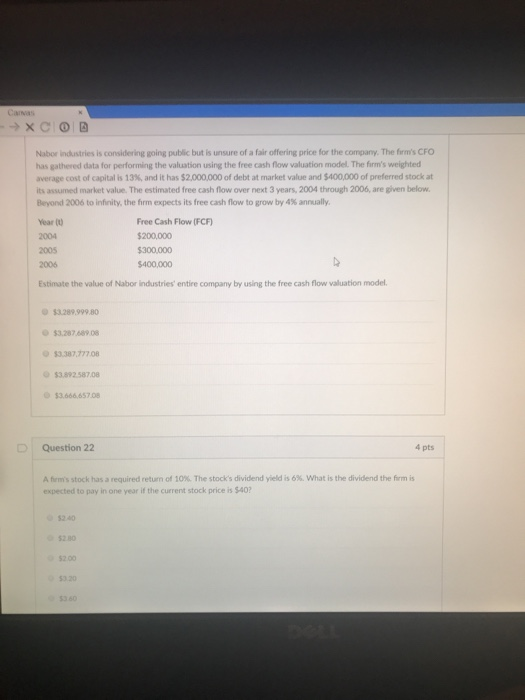

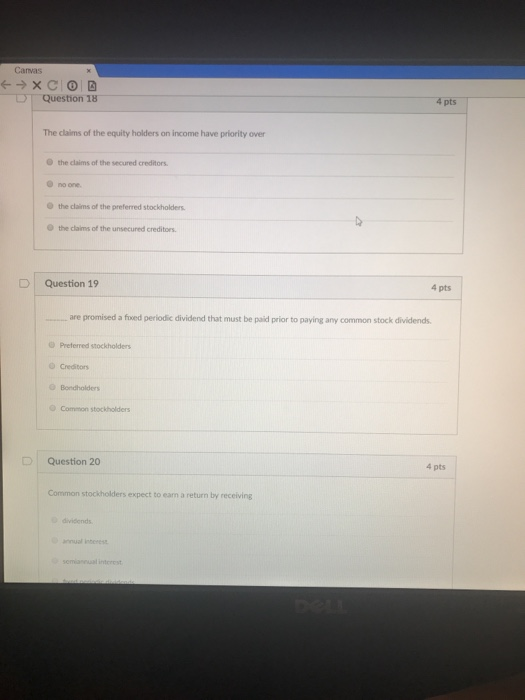

O share repurchase program | Question 27 4 pts A group of underwriters formed to share the risk in marketing and distributing a sale of securities to the investing public is called aln O syndicate. O cooperative venture capital system. cartel O insider consortium D Question 28 4 pts The voting procedure where a shareholder grants authority to another individual to vote his/her shares is called voting, proxy O deferred Odemocratic straight Canvas $23.14 D Question 25 4 pts The financing provided for start-up, often high-risk, private business enterprises is called O initial public offerings O junk bonds financial futures venture capital flotation.costs D Question 26 4 pts A corporation's first sale of equity made available to the public is called alr seasoned equity offering ISEO initial public oftering (PO) shelf registraton hing private placement share repurchase progam Question 27 4 pts Canvas $3.60 D | Question 23 4 pts Lee Hong Imports paid a $1.00 per share annual dividend last week. Dividends are expected to increase by 5 percent annually. What is one share of this stock worth to you today if the appropriate discount rate is 14 percent? $12.25 $11.67 o s7.14 $7.50 $11.11 D Question 24 4 pts announced that they are increasing their annual dividend to $1.60 and establishing a policy whereby the dividend will increase by 3.5 percent annually stock be worth five years from now if the required rate of return is 12 percent? thereafter. How much will one share of this 22.36 $23.95 $24.79 $21.60 $23.14 Nabor industries is considering going public but is unsure of a fair offering price for the company. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model. The firm's weighted average cost of capital is 13%, and it has S 2.000.000 of debt at market value and S40000 of preferred stock at its assumed market value. The estimated free cash flow over next 3 years, 2004 through 2006, are given below. Beyond 2006 to infinity, the firm expects its free cash flow, to grow by 4% annually. Year t 2004 2005 2006 Free Cash Flow (FCF $200,000 $300,000 400,000 Estimate the value of Nabor industries' entire company by using the free cash flow valuation model. $3289.999.80 s32874 08 $3.387 777.08 $3.892 587.08 $3.666.657 08 Question 22 4 pts A firm's stock has a required return of 10% The stock's dividend yield is 6%. What is the dividend the fris expected to pay in one year if the current stock price is $40 $20 $2.80 2.00 $3.60 Carvas Question 18 4 pts The claims of the equity holders on income have priority over the claims of the secured creditors O no one. the claims of the preferred stockholders. O the claims of the unsecured creditors Question 19 4 pts are promised a foxed periodic dividend that must be paid prior to paying any common stock dividends Preferred stockholders O Creditors Bondholders Question 20 4 pts Common stockholders expect to earn a return by receiving dividends nnual inberes semaneual interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts