Question: 1a 1b) The table below contains data on Fincorp Inc. The balance sheet items correspond to values at year-end 2018 and 2019, while the income

1a

1b)

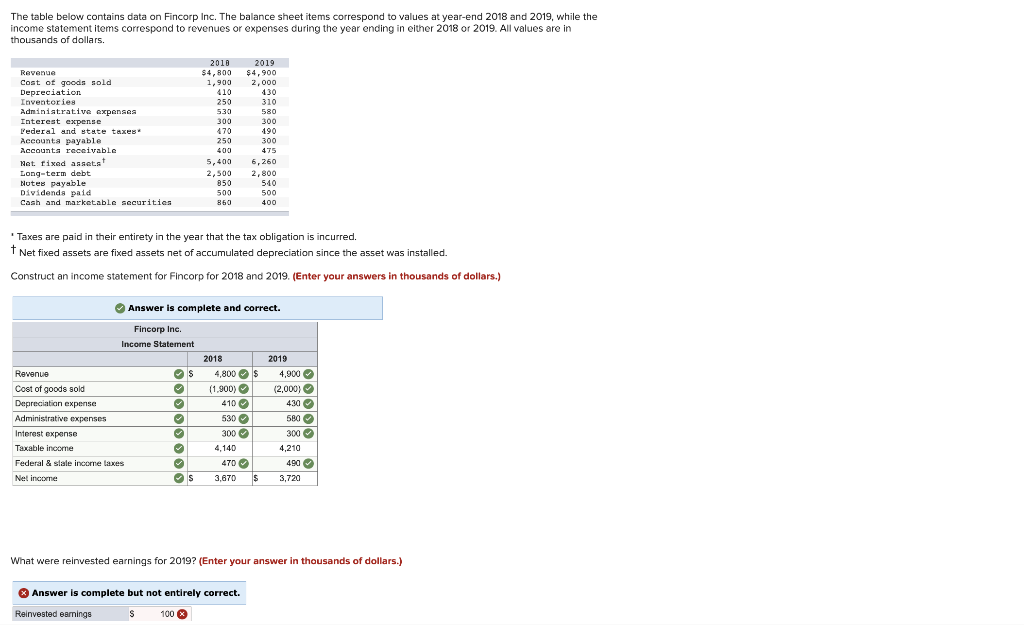

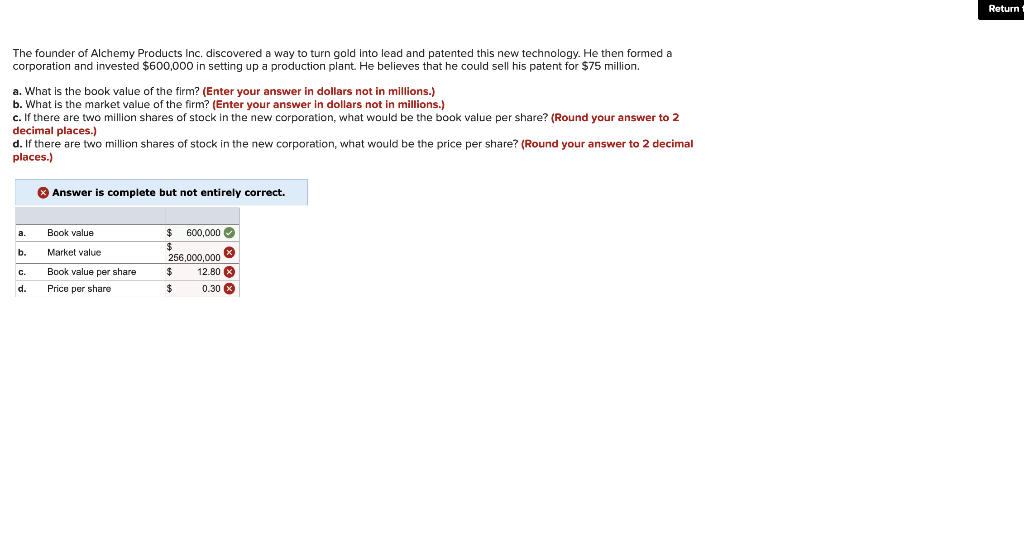

The table below contains data on Fincorp Inc. The balance sheet items correspond to values at year-end 2018 and 2019, while the income statement items correspond to revenues or expenses during the year ending in either 2018 or 2019. All values are in thousands of dollars. Revenge Cost of goods sold Depreciation Inventories Administrative expenses Interest expense Federal and state taxes Accounts payable Accounts receivable Net fixed assets Long-term debt Nutes payable Dividenda paid Cash and marketable securities 2010 $4,800 1,900 410 250 530 300 470 250 400 5,400 2,500 850 500 850 2019 $4,900 2,000 430 310 580 300 190 300 475 6,260 2,800 540 500 400 * Taxes are paid in their entirety in the year that the tax obligation is incurred. + Net fixed assets are fixed assets net of accumulated depreciation since the asset was installed. Construct an income statement for Fincorp for 2018 and 2019. (Enter your answers in thousands of dollars.) Answer is complete and correct. Fincorp Inc. Income Statement Revenue S Cost of goods sold Depreciation expense Administrative expenses Indomar Interest expense Taxable income Federal & slale income taxes 2018 4,800S (1.900) 410 530 300 4,140 2019 4,900 (2,000) 430 580 300 4,210 490 3,720 470 Net income OS 3,670 $ What were reinvested earnings for 2019? (Enter your answer in thousands of dollars.) ) Answer is complete but not entirely correct. Reinvested earnings 100 S Return The founder of Alchemy Products Inc. discovered a way to turn gold into lead and patented this new technology. He then formed a corporation and invested $600,000 in setting up a production plant. He believes that he could sell his patent for $75 million. a. What is the book value of the firm? (Enter your answer in dollars not in millions.) b. What is the market value of the firm? (Enter your answer in dollars not in millions.) c. If there are two million shares of stock in the new corporation, what would be the book value per share? (Round your answer to 2 decimal places.) d. If there are two million shares of stock in the new corporation, what would be the price per share? (Round your answer to 2 decimal places.) Answer is complete but not entirely correct. a. Book value b. Market value $ 600,000 $ 256,000,000 12.80 X 0.30 c. Book value per share Price per share d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts