Question: 1A 1B The table below contains data on Fincorp Inc. The balance sheet items correspond to values at year-end 2018 and 2019, while the income

1A

1B

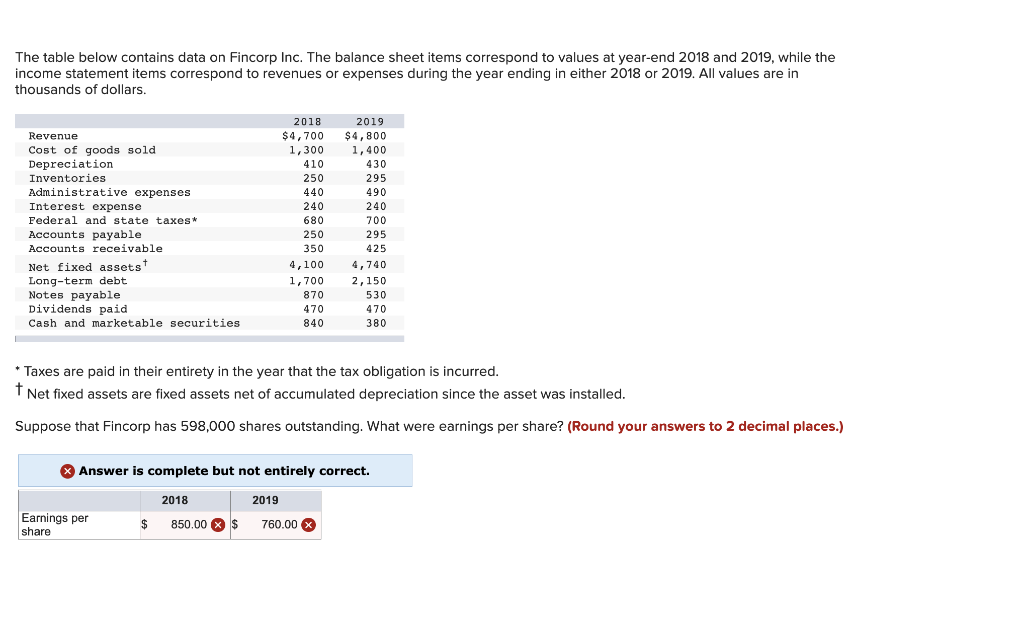

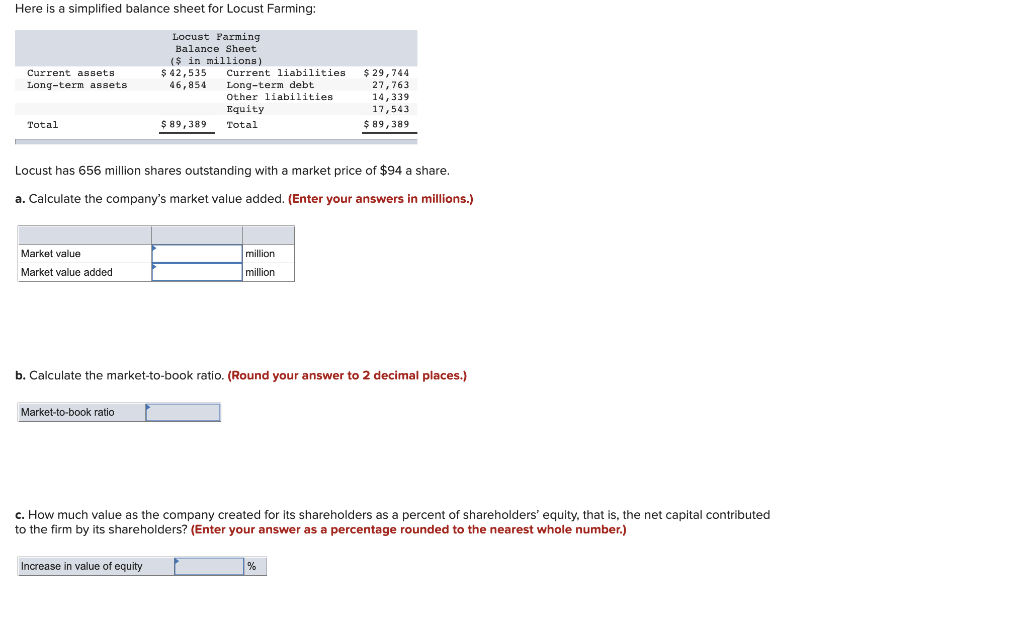

The table below contains data on Fincorp Inc. The balance sheet items correspond to values at year-end 2018 and 2019, while the income statement items correspond to revenues or expenses during the year ending in either 2018 or 2019. All values are in thousands of dollars. Revenue Cost of goods sold Depreciation Inventories Administrative expenses Interest expense Federal and state taxes Accounts payable Accounts receivable Net fixed assetst Long-term debt Notes payable Dividends paid Cash and marketable securities 2018 $4,700 1,300 410 250 440 240 680 250 350 4,100 1,700 870 470 840 2019 $4,800 1,400 430 295 490 240 700 295 425 4,740 2,150 530 470 380 * Taxes are paid in their entirety in the year that the tax obligation is incurred. Net fixed assets are fixed assets net of accumulated depreciation since the asset was installed. Suppose that Fincorp has 598,000 shares outstanding. What were earnings per share? (Round your answers to 2 decimal places.) Answer is complete but not entirely correct. 2018 Earnings per share 2019 $ 760.00 $ 850.00 Here is a simplified balance sheet for Locust Farming: Current assets Long-term assets Locust Parming Balance Sheet ($ in millions) $ 42,535 Current liabilities 46,854 Long-term debt Other liabilities Equity $ 89,389 Total $ 29,744 27,763 14,339 17,543 $ 89,389 Total Locust has 656 million shares outstanding with a market price of $94 a share. a. Calculate the company's market value added. (Enter your answers in millions.) million Market value Market value added million b. Calculate the market-to-book ratio. (Round your answer to 2 decimal places.) Market-to-book ratio c. How much value as the company created for its shareholders as a percent of shareholders' equity, that is, the net capital contributed to the firm by its shareholders? (Enter your answer as a percentage rounded to the nearest whole number.) Increase in value of equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts