Question: 1a) b) 203 2019 Fall Tutorial 05 (week 6) EveB1, Version 1 Student Name: 31.08.2019 04:43 PM Question 1 Green Company sells its product for

1a)

b)

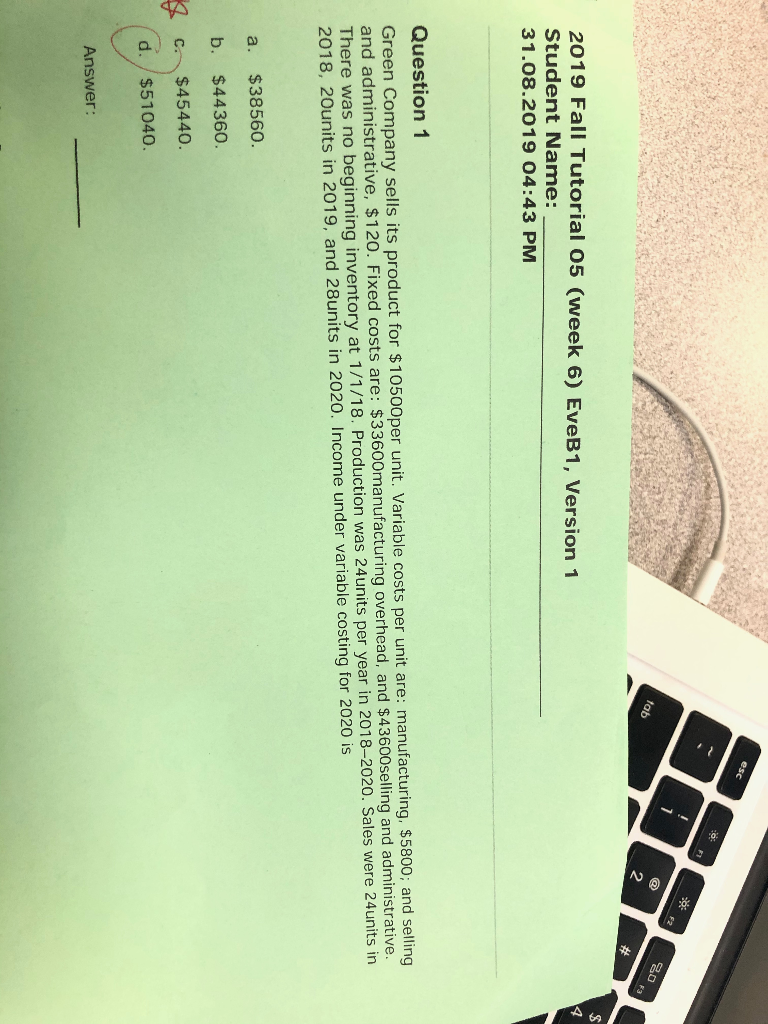

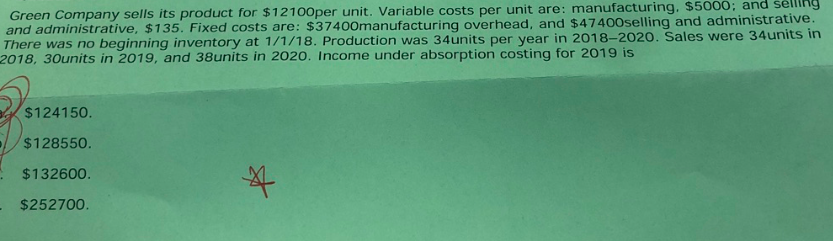

203 2019 Fall Tutorial 05 (week 6) EveB1, Version 1 Student Name: 31.08.2019 04:43 PM Question 1 Green Company sells its product for $10500per unit. Variable costs per unit are: manufacturing, $5800; and selling and administrative, $120. Fixed costs are: $33600manufacturing overhead, and $43600selling and administrative. There was no beginning inventory at 1/1/18. Production was 24units per year in 2018-2020. Sales were 24units in 2018, 20units in 2019, and 28units in 2020. Income under variable costing for 2020 is a. $38560 b. $44360 c. $45440. d. $51040. Answer: Green Company sells its product for $12100per unit. Variable costs per unit are: manufacturing, $5000; and selling and administrative, $135. Fixed costs are: $37400manufacturing overhead, and $47400 selling and administrative. There was no beginning inventory at 1/1/18. Production was 34units per year in 2018-2020. Sales were 34units in 2018, 30units in 2019, and 38 units in 2020. Income under absorption costing for 2019 is $124150. $128550. $132600. $252700. 203 2019 Fall Tutorial 05 (week 6) EveB1, Version 1 Student Name: 31.08.2019 04:43 PM Question 1 Green Company sells its product for $10500per unit. Variable costs per unit are: manufacturing, $5800; and selling and administrative, $120. Fixed costs are: $33600manufacturing overhead, and $43600selling and administrative. There was no beginning inventory at 1/1/18. Production was 24units per year in 2018-2020. Sales were 24units in 2018, 20units in 2019, and 28units in 2020. Income under variable costing for 2020 is a. $38560 b. $44360 c. $45440. d. $51040. Answer: Green Company sells its product for $12100per unit. Variable costs per unit are: manufacturing, $5000; and selling and administrative, $135. Fixed costs are: $37400manufacturing overhead, and $47400 selling and administrative. There was no beginning inventory at 1/1/18. Production was 34units per year in 2018-2020. Sales were 34units in 2018, 30units in 2019, and 38 units in 2020. Income under absorption costing for 2019 is $124150. $128550. $132600. $252700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts