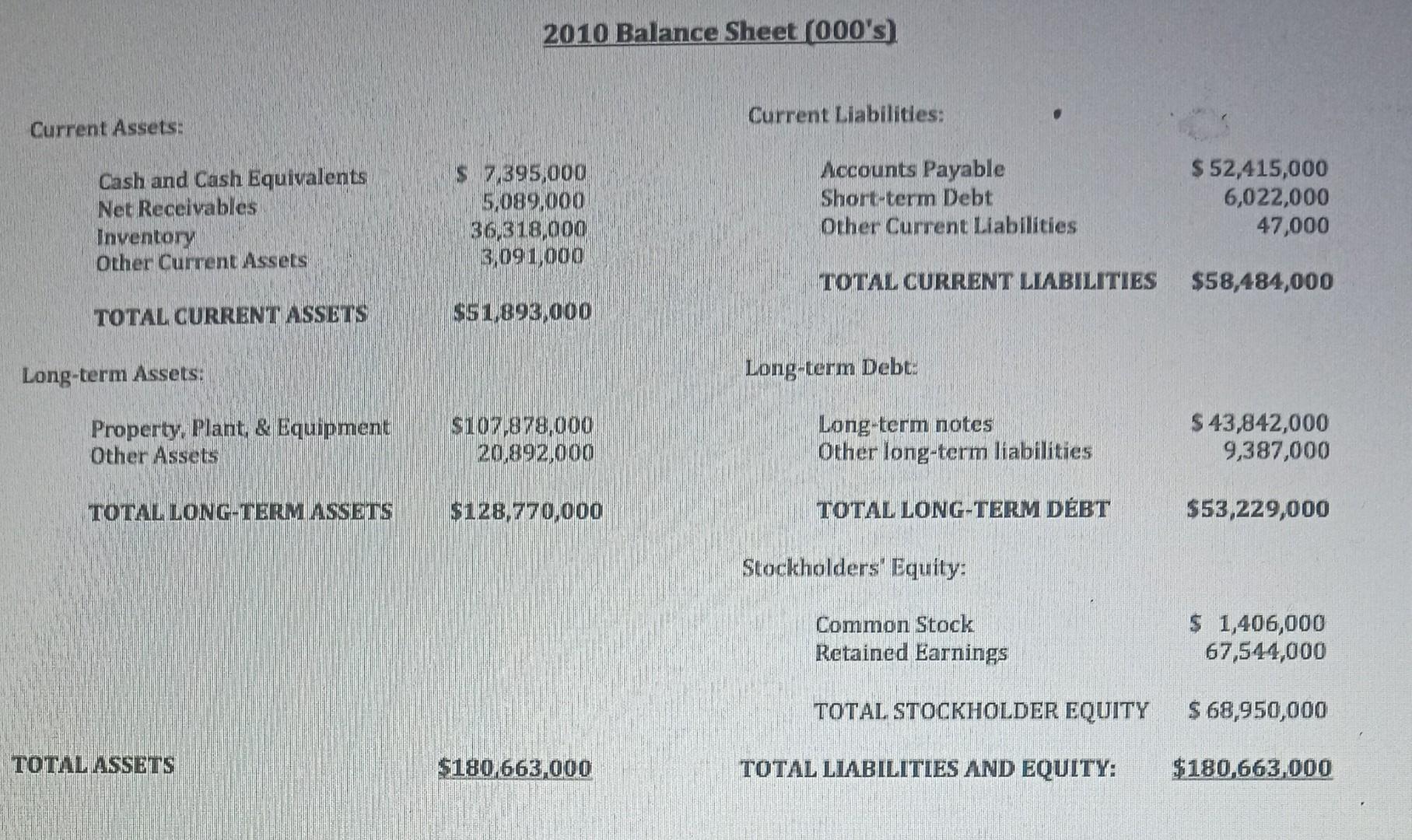

Question: 1a. b. c. d. e. f. g. h. I. j. 2010 Balance Sheet (000's) Based on Walmart's 2010 Balance Sheet, what is the Current Ratio?

1a.

b.

c.

d.

e.

f.

g.

h.

I.

j.

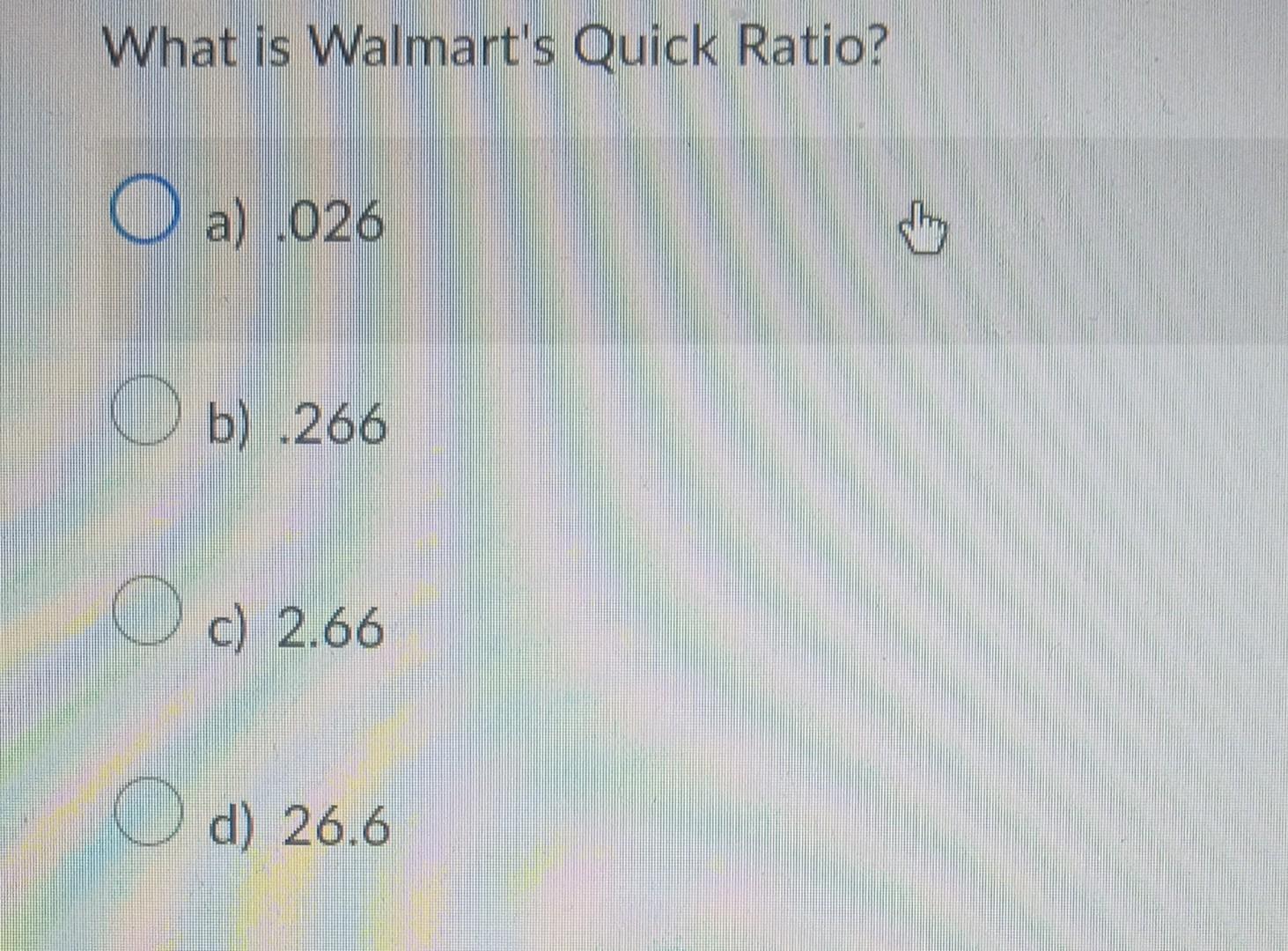

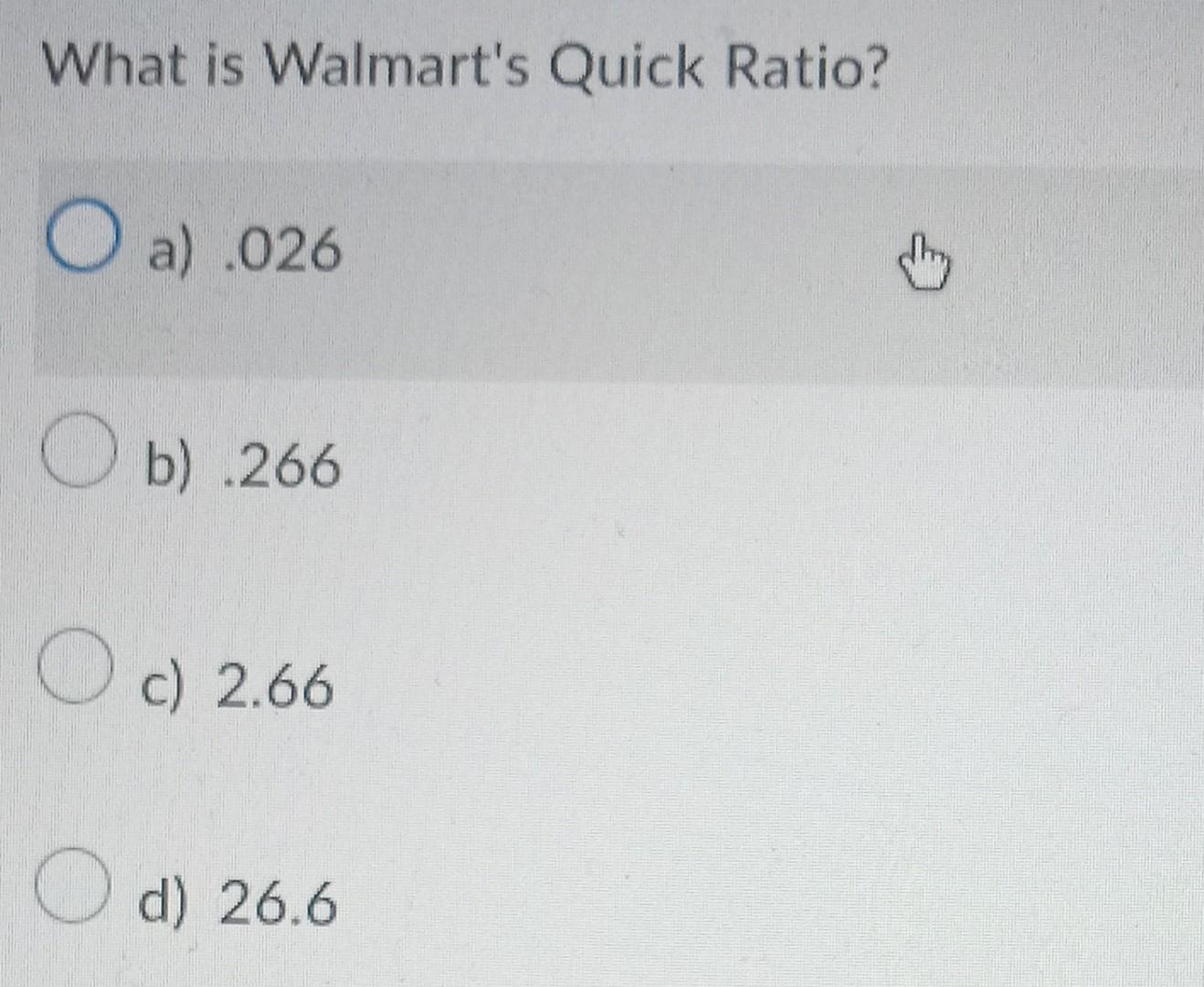

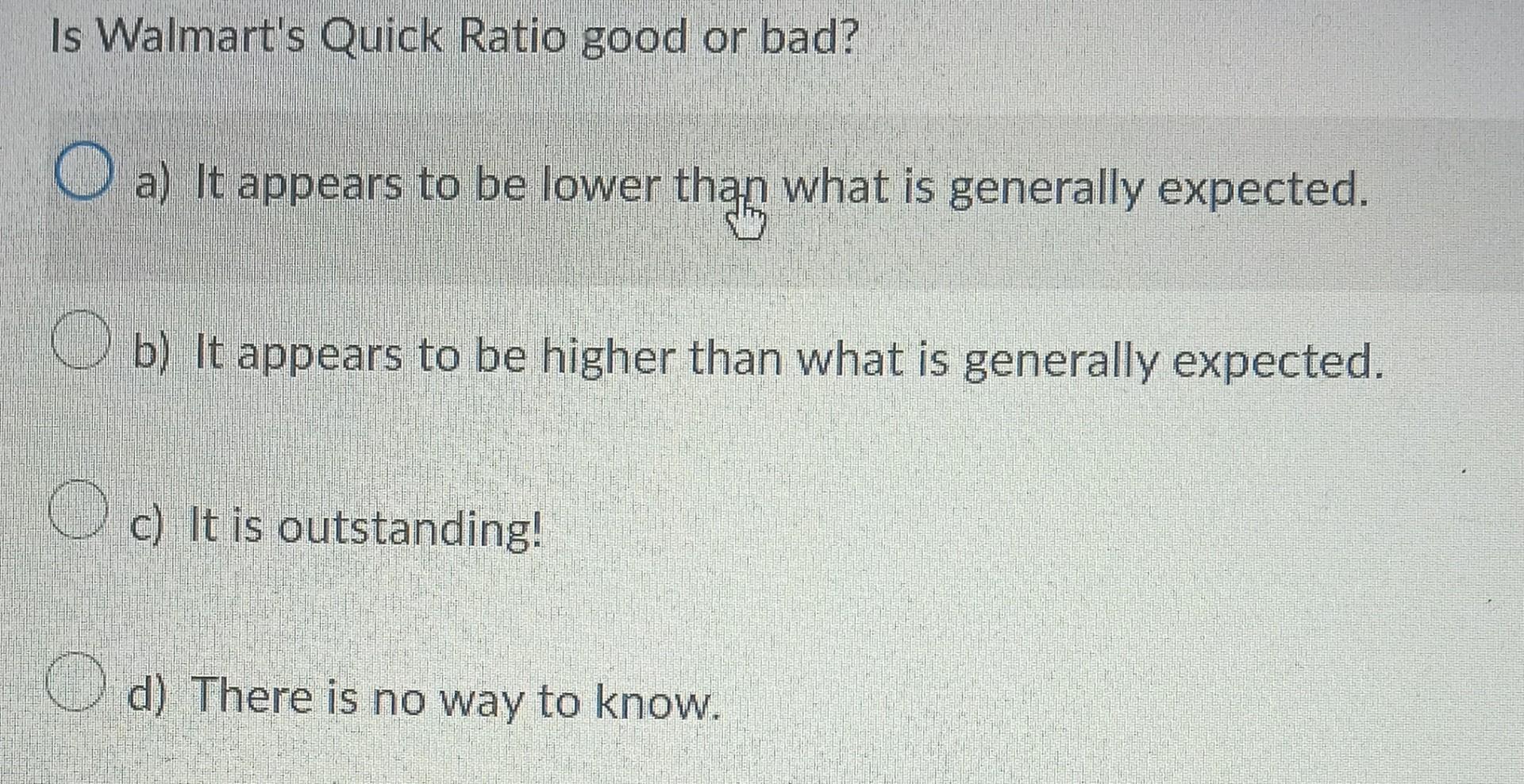

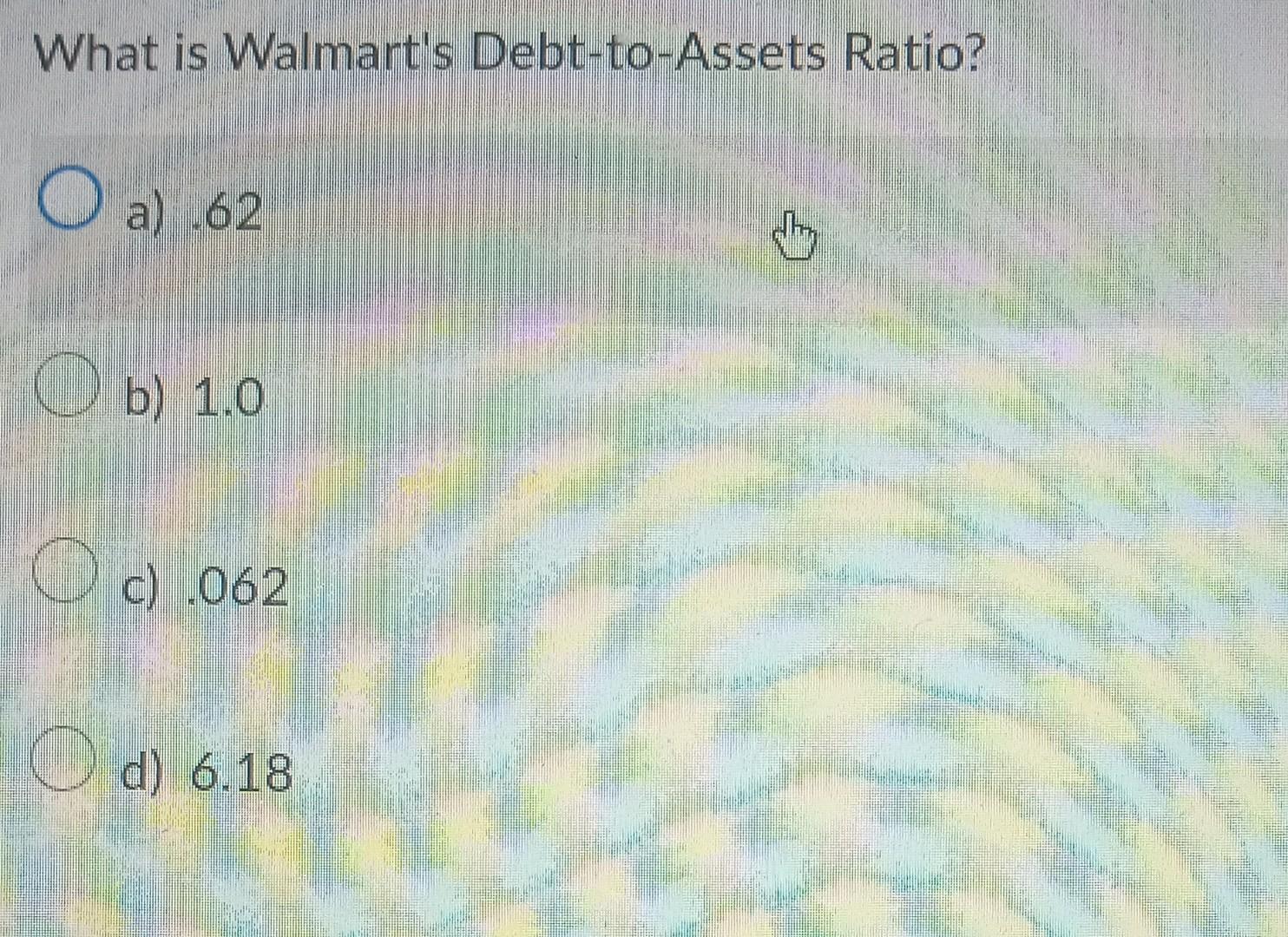

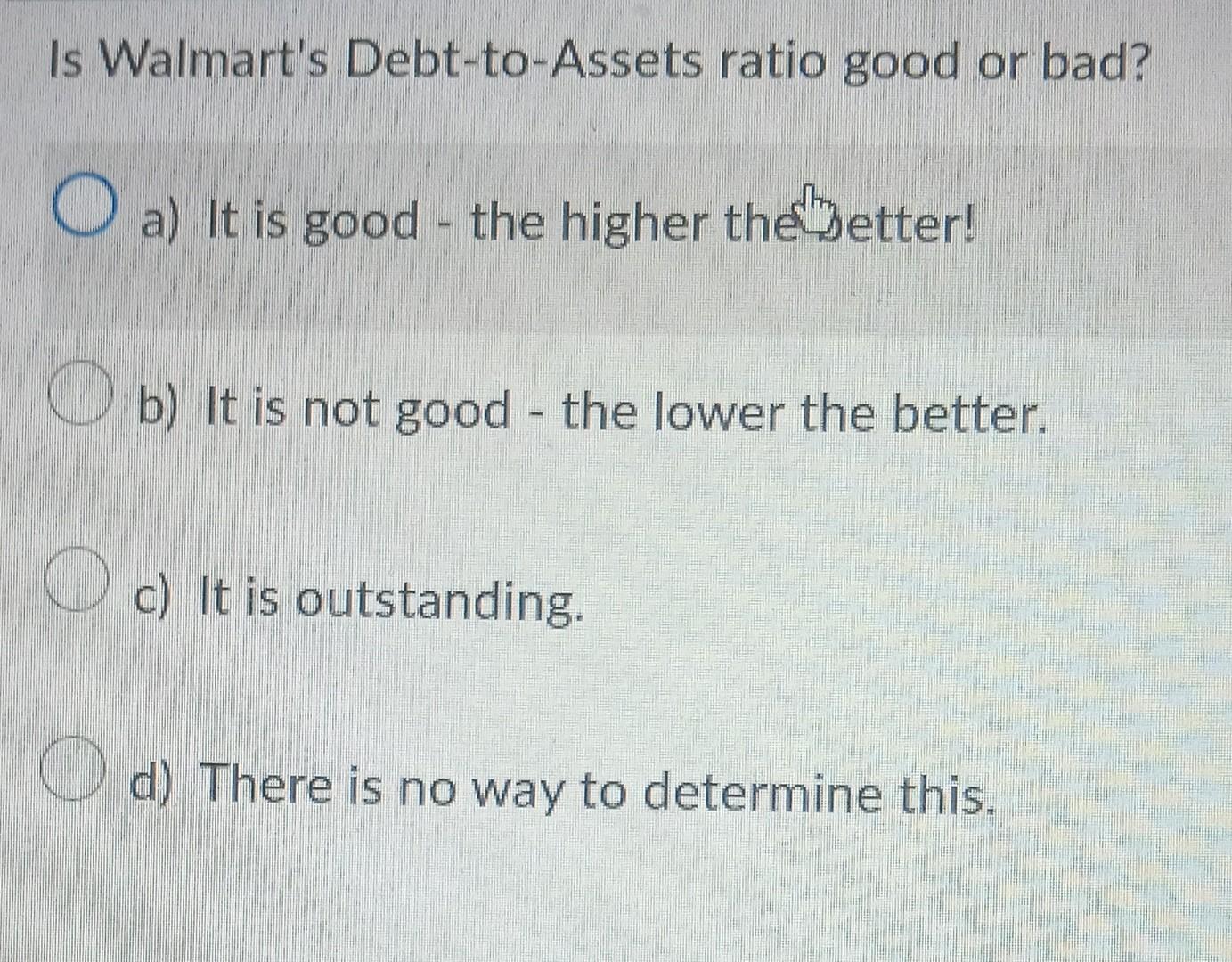

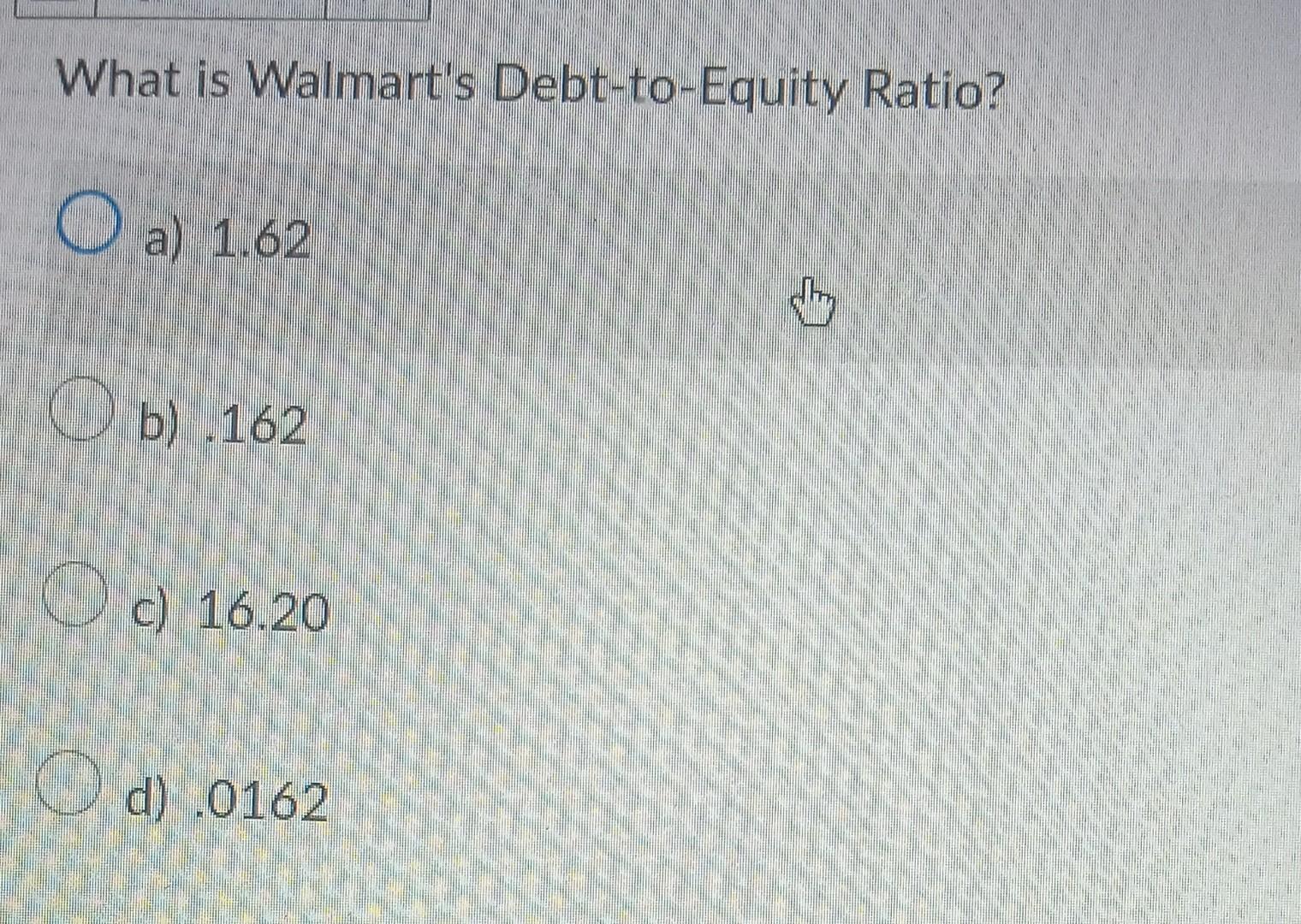

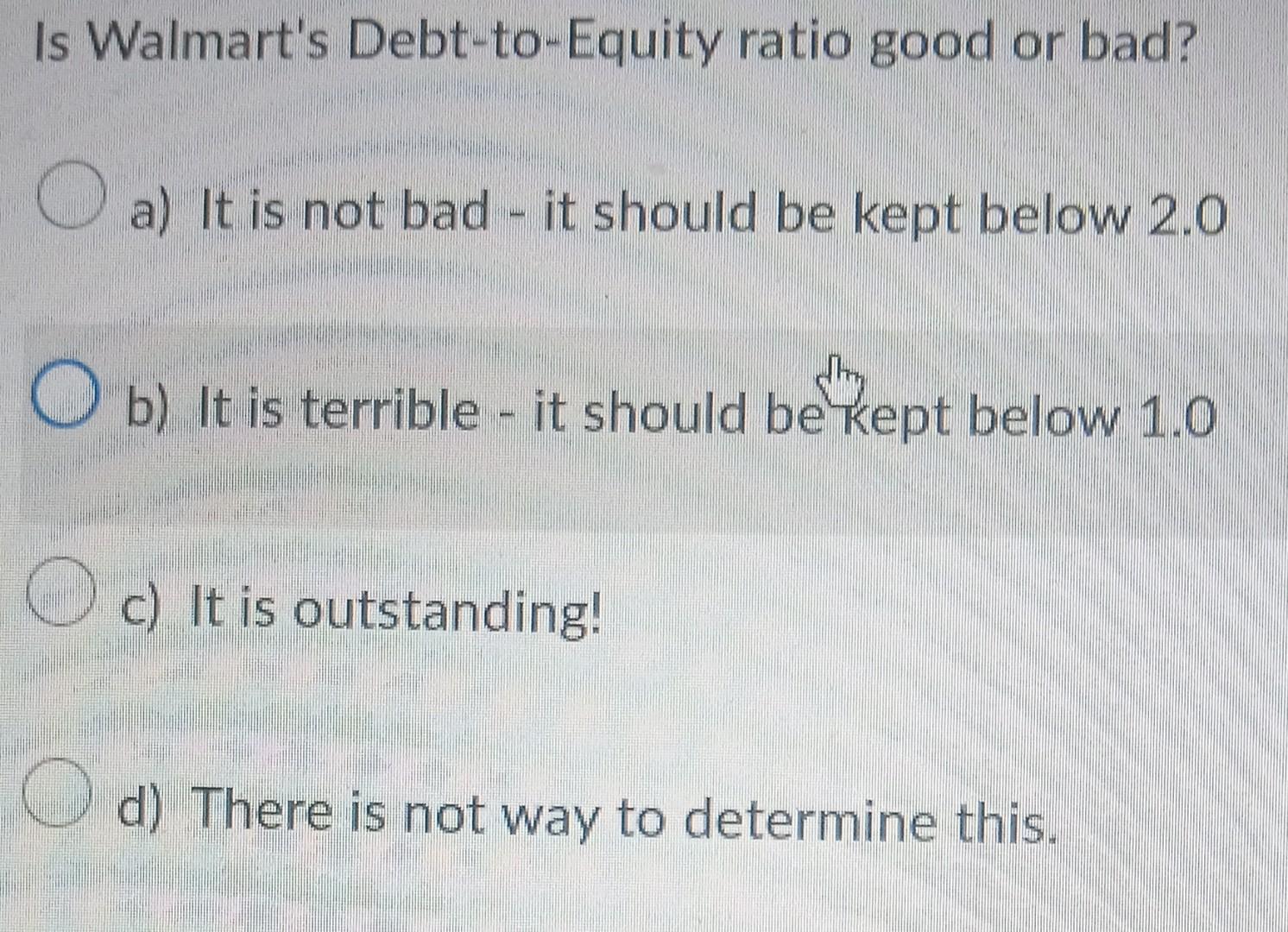

2010 Balance Sheet (000's) Based on Walmart's 2010 Balance Sheet, what is the Current Ratio? a) .89 b) 8.9 c) 1.887 d) 88.7 Would you say that Walmart's Current Ratio is good or bad? a) It is lower than what is generally recommended. ch b) It is better than what is generally recommended. c) It is outstanding! d) There is no way of knowing. Would you say that Walmart's Current Ratio is good or bad? a) It is lower than what is generally recommended. b) It is better than what is generally recommended. c) It is outstanding! d) There is no way of knowing. What is Walmart's Quick Ratio? a) .026 b) .266 c) 2.66 d) 26.6 What is Walmart's Quick Ratio? a) .026 b) .266 c) 2.66 d) 26.6 Is Walmart's Quick Ratio good or bad? a) It appears to be lower than what is generally expected. b) It appears to be higher than what is generally expected. c) It is outstanding! d) There is no way to know. What is Walmart's Debt-to-Assets Ratio? a) .62 b) 1.0 c) .062 d) 6.18 Is Walmart's Debt-to-Assets ratio good or bad? a) It is good - the higher the 3 ther! b) It is not good - the lower the better. c) It is outstanding. d) There is no way to determine this. What is Walmart's Debt-to-Equity Ratio? a) 1.62 b) .162 c) 16.20 d) .0162 Is Walmart's Debt-to-Equity ratio good or bad? a) It is not bad - it should be kept below 2.0 b) It is terrible - it should be kept below 1.0 c) It is outstanding! d) There is not way to determine this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts