Question: 1A) B) C) The last part (C) does not contain anymore information along with the problem, that is all that I am given. Sorry! The

1A)

B)

C)

The last part (C) does not contain anymore information along with the problem, that is all that I am given. Sorry!

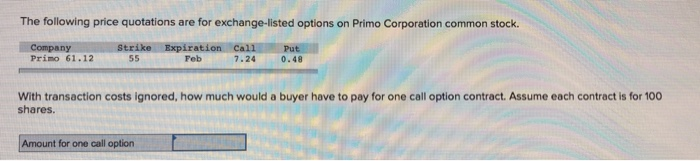

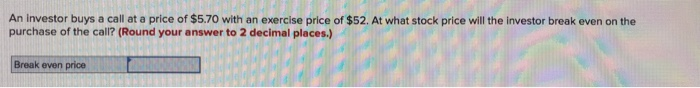

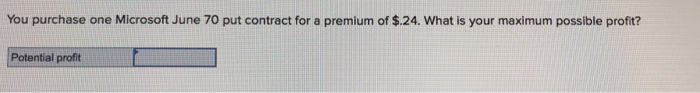

The following price quotations are for exchange-listed options on Primo Corporation common stock. Company Primo 61.12 Strike 55 Expiration Call Feb 7.24 Put 0.48 With transaction costs ignored, how much would a buyer have to pay for one call option contract. Assume each contract is for 100 shares. Amount for one call option An investor buys a call at a price of $5.70 with an exercise price of $52. At what stock price will the investor break even on the purchase of the call? (Round your answer to 2 decimal places.) Break even price You purchase one Microsoft June 70 put contract for a premium of $.24. What is your maximum possible profit? Potential profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts