Question: 1.A. DRAW BY HAND a Context DFD for the system described below as the photo 1.B DRAW BY HAND Level-0 DFD for this system. Prepare

1.A. DRAW BY HAND a Context DFD for the system described below as the photo

1.B DRAW BY HAND Level-0 DFD for this system. Prepare DFD such that it has six processes corresponding to the major sub processes described above. When preparing your level-0 DFD, be sure to label all aspects of your diagrams clearly.

NO NEED EXPLAINATION

Business Processes: Following is a transcript of the system analysts notes that are based on an interview with Ms. Baughman. The notes describe the processes performed by the application processing department of the insurance company.

Process 1: The process begins when an applicant for auto insurance submits a written insurance application request form to a clerk in the application processing department of Fidalgo Insurance. After the application processing department of Fidalgo Insurance receives the form, the data on the form is entered into a computer and stored in the Applicant database. The application request form includes a variety of information (e.g., background on the applicant, type of car to be insured, desired coverage, etc.).

Process 2: At various times throughout each business day, a clerk in Fidalgo Insurances application processing department does a query to extract the new applicant files from the Applicant database. For each new file, the clerk gathers the appropriate information needed to get information about the applicants vehicle registration. To get this information, Fidalgo Insurance sends a vehicle registration request to the Department of Motor Vehicles, which supplies a vehicle registration report. The purpose of this report is to verify the auto registration for the car that the applicant wishes to insure. In addition to the vehicle registration information, Fidalgo Insurance also needs to request a drivers record report for the applicant from the Washington State Police Department. After getting the report request, the Police Department scans the applicants driving history and sends back a drivers record report. The purpose of this report is to verify the applicants driving record. Information regarding the findings from these verification checks is then stored in the Applicant database.

Process 3: As an independent insurance agency, Fidalgo Insurance can work with more than one insurance firm to try to find the best type of insurance policy for an applicant. Fidalgo Insurance has relationships with a variety of large insurance firms. At the end of each day, information related to each verified application is sent out to various insurance firms (the information is sent via e-mail) to request customized auto insurance policy contracts for each applicant.

Process 4: After an insurance firm gets the information about an applicant, the firm typically prepares a proposed policy contract for the applicant and then sends a copy of the policy contract for the applicant to Fidalgo Insurance via e-mail. (Usually, the insurance firms do this rather quickly. However, there are some cases where an insurance firm will not prepare a contract promptly.) The policy contracts are received by a clerk at Fidalgo Insurance and the information in the submitted contracts is stored in a Policy Contracts database.

Process 5: Once all the policy contracts for an applicant are received (or after three working days, whichever comes first), a Fidalgo Insurance application agent extracts the different potential policy contracts for an applicant from the Policy Contracts database. Then the agent sorts through the details of these policy contracts and determines the best policy for the type and level of coverage desired by the applicant. To help with this decision, the agent accesses specific information about an applicants desired coverage that is stored in the Applicant database. The selected insurance policy along with a policy acceptance slip is prepared and then sent to the applicant. Also, for archival purposes, information about the selected policy (and the date that the policy acceptance slip was sent to the applicant) is stored in the Policy Contracts database.

Process 6: If the applicant wishes to accept the policy then he/she needs to send a signed copy of the policy acceptance slip to the Fidalgo Insurance application processing department within five working days. If the signed policy acceptance slip is received, then a) the applicants record in the Applicant database is updated to include information concerning the applicants insurance policy (e.g., name of insuring company, start date, etc.), and b) a notice about the applicant and the policy (including price) is prepared and sent to Fidalgo Insurances Billing Department. The Billing Department will then handle the process of billing the policy applicant (now a customer).

THOSE TWO DFD ANSWERS MUST BE SIMILAR LIKE THESE PHOTO BELOW

LEVEL-0

CONTEXT DFD

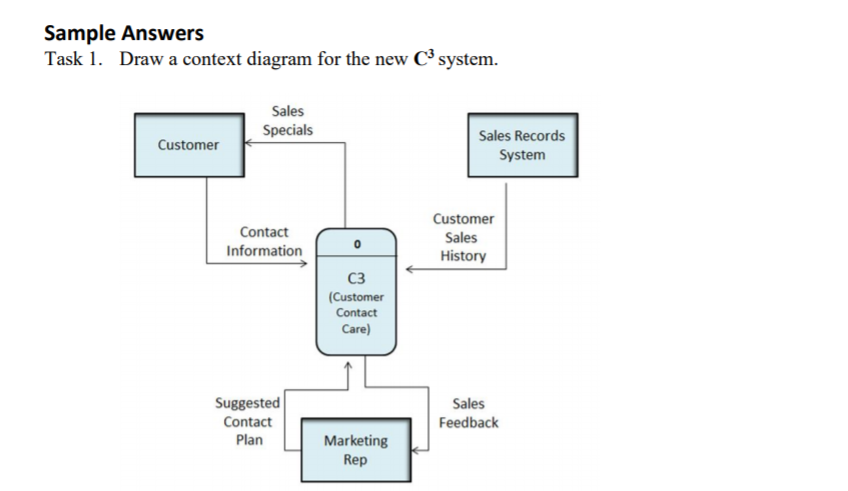

Sample Answers Task 1. Draw a context diagram for the new C3 system

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts