Question: 1a. please show work 1b. please show work 1. Sallie's Sandwiches Sallie's Sandwiches is financed using 20% debt at a cost of 8%. Sallie projects

1a. please show work

1b. please show work

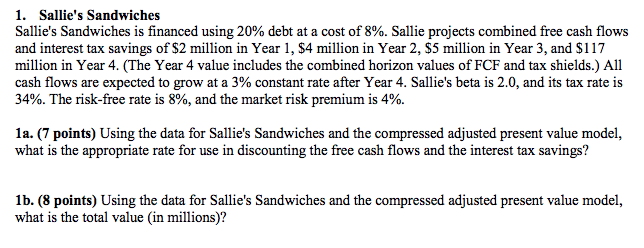

1. Sallie's Sandwiches Sallie's Sandwiches is financed using 20% debt at a cost of 8%. Sallie projects combined free cash flows and interest tax savings of $2 million in Year 1, $4 million in Year 2, $5 million in Year 3, and S117 million in Year 4. (The Year 4 value includes the combined horizon values of FCF and tax shields.) All cash flows are expected to grow at a 3% constant rate after Year 4. Sallie's beta is 2.0, and its tax rate is 34%. The risk-free rate is 8%, and the market risk premium is 4%. la. (7 points) Using the data for Sallie's Sandwiches and the compressed adjusted present value model, what is the appropriate rate for use in discounting the free cash flows and the interest tax savings? 1b. (8 points) Using the data for Sallie's Sandwiches and the compressed adjusted present value model, what is the total value (in millions)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts