Question: 1b. Consider a binomial model with two securities, a corporate bond B and a credit default swap CDS. B pays off one in state u

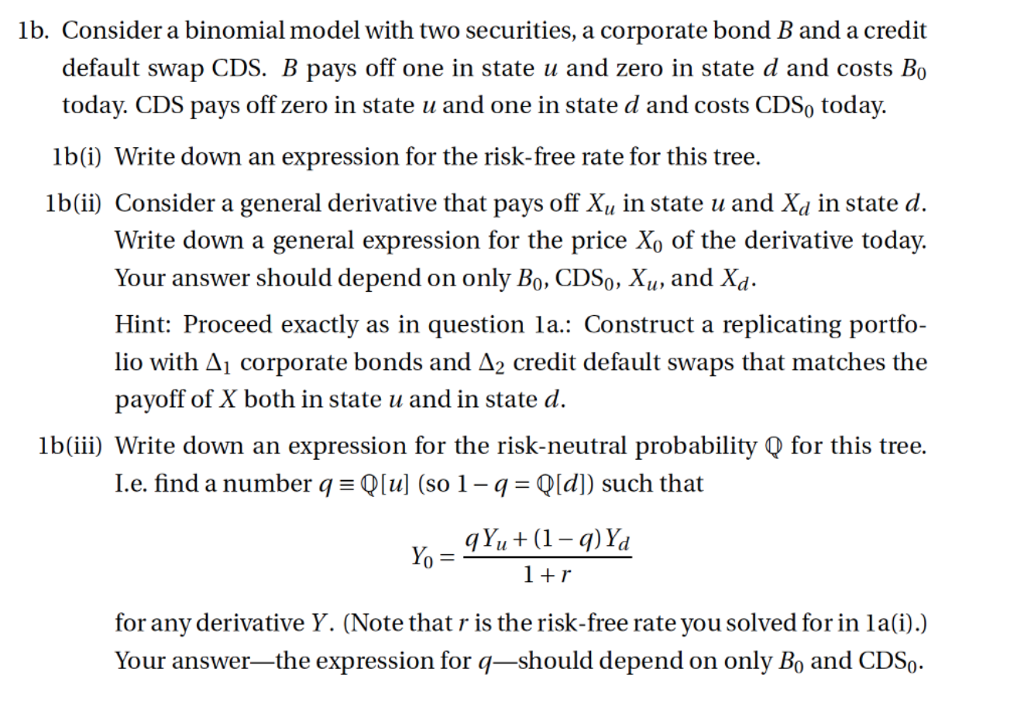

1b. Consider a binomial model with two securities, a corporate bond B and a credit default swap CDS. B pays off one in state u and zero in state d and costs Bo today. CDS pays off zero in state u and one in state d and costs CDSo today. lb(i) Write down an expression for the risk-free rate for this tree. lb(ii) Consider a general derivative that pays off Xu in state u and Xd in state d. Write down a general expression for the price Xo of the derivative today. Your answer should depend on only Bo, CDSo, Xu, and Xd. Hint: Proceed exactly as in question la.: Construct a replicating portfo- lio with 1 corporate bonds and 2 credit default swaps that matches the payoff of X both in state u and in state d. lb(iii) Write down an expression for the risk-neutral probability Q for this tree. 1.e. find a number q QI11] (so 1-q-Qld]) such that 0 for any derivative Y. (Note that r is the risk-free rate you solved for in la(i).) Your answer-the expression for q-should depend on only Bo and CDS0 1b. Consider a binomial model with two securities, a corporate bond B and a credit default swap CDS. B pays off one in state u and zero in state d and costs Bo today. CDS pays off zero in state u and one in state d and costs CDSo today. lb(i) Write down an expression for the risk-free rate for this tree. lb(ii) Consider a general derivative that pays off Xu in state u and Xd in state d. Write down a general expression for the price Xo of the derivative today. Your answer should depend on only Bo, CDSo, Xu, and Xd. Hint: Proceed exactly as in question la.: Construct a replicating portfo- lio with 1 corporate bonds and 2 credit default swaps that matches the payoff of X both in state u and in state d. lb(iii) Write down an expression for the risk-neutral probability Q for this tree. 1.e. find a number q QI11] (so 1-q-Qld]) such that 0 for any derivative Y. (Note that r is the risk-free rate you solved for in la(i).) Your answer-the expression for q-should depend on only Bo and CDS0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts