Question: please show how to get to each answer Consider a 30 -year 6% callable, corporate bond issued in March of 2013. The bond has 10

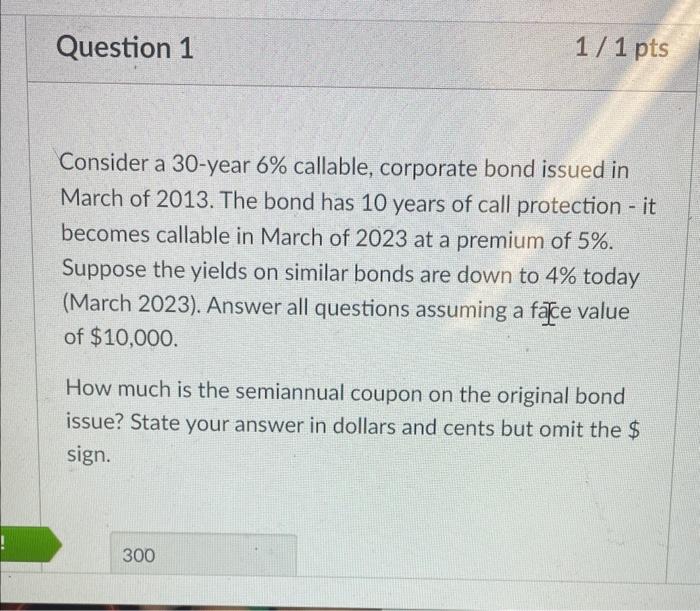

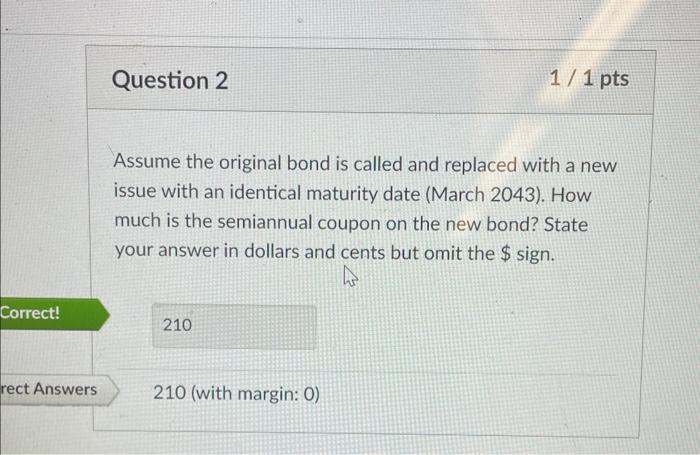

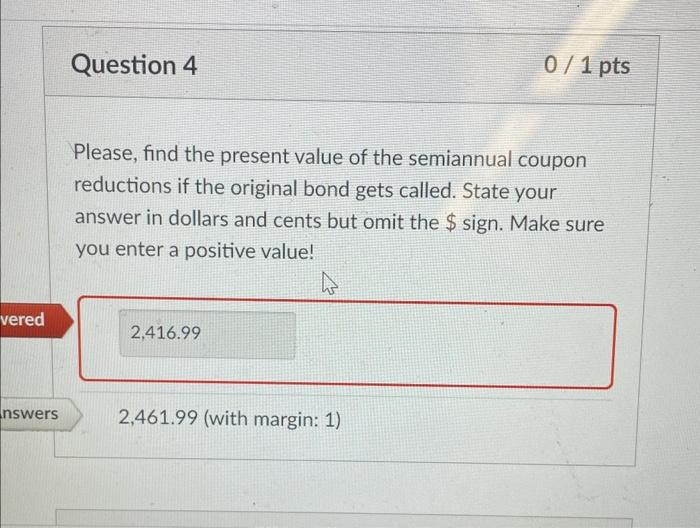

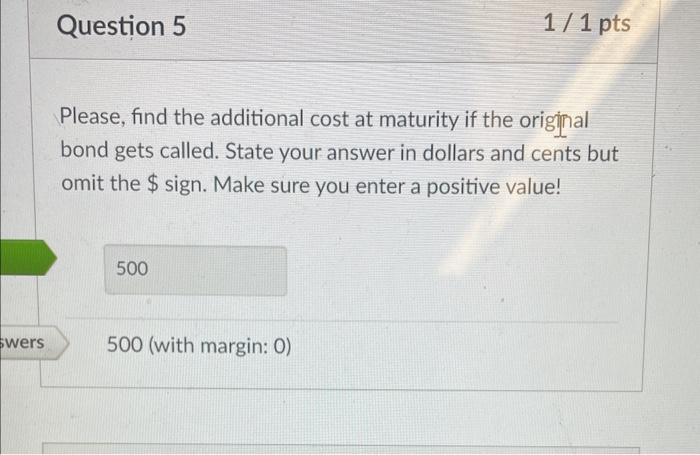

Consider a 30 -year 6% callable, corporate bond issued in March of 2013. The bond has 10 years of call protection - it becomes callable in March of 2023 at a premium of 5\%. Suppose the yields on similar bonds are down to 4% today (March 2023). Answer all questions assuming a facce value of $10,000. How much is the semiannual coupon on the original bond issue? State your answer in dollars and cents but omit the $ sign. Assume the original bond is called and replaced with a new issue with an identical maturity date (March 2043). How much is the semiannual coupon on the new bond? State your answer in dollars and cents but omit the $ sign. Please, find the present value of the semiannual coupon reductions if the original bond gets called. State your answer in dollars and cents but omit the $ sign. Make sure you enter a positive value! Please, find the additional cost at maturity if the originnal bond gets called. State your answer in dollars and cents but omit the $ sign. Make sure you enter a positive value! 500 (with margin: 0) What is the present value of that cost? State your anstver in dollars and cents but omit the $ sign. Make sure you enter a positive value! 226.45 (with margin: 1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts