Question: 1.Calculate & Explain Question: Below you will find various metrics and parameters to value two stocks A and B. These are actual securities, and the

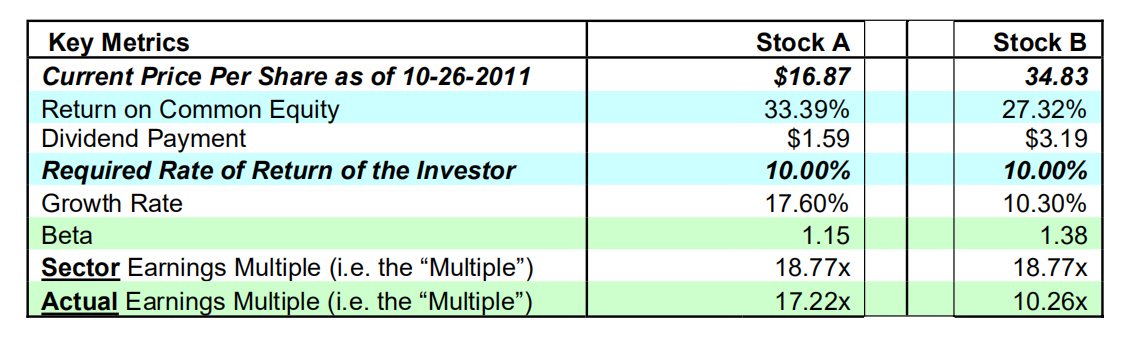

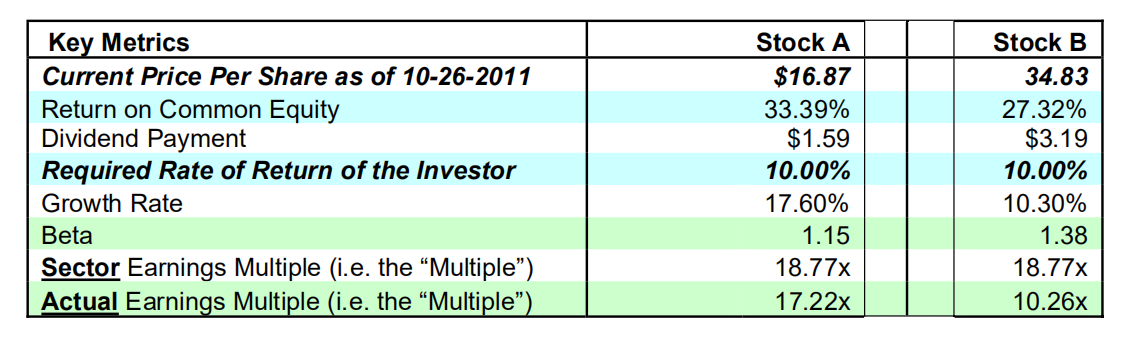

1.Calculate & Explain Question: Below you will find various metrics and parameters to value two stocks "A" and "B." These are actual securities, and the current price is as of the close of business day October 26th, 2011. Given these metrics below, please render your opinion of value for each security, whether overvalued, undervalued or fair value, and why? Please use the CAPM , assume Rm = 12% and Rf = 1.5%.

2.Calculate & Explain Question: Recalculate your answers similar to question #1 (i.e. arrive at a value for stocks A and B) but this time use the Sector Multipleto derive Stock A and B's values. If your values differ from question 3, why?

Key Metrics Stock A Stock B Current Price Per Share as of 10-26-2011 $16.87 34.83 Return on Common Equity 33.39% 27.32% Dividend Payment $1.59 $3. 19 Required Rate of Return of the Investor 10.00% 10.00% Growth Rate 17.60% 10.30% Beta 1.15 1.38 Sector Earnings Multiple (i.e. the "Multiple") 18.77x 18.77x Actual Earnings Multiple (i.e. the "Multiple") 17.22x 10.26x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts