Question: 1-Classify the ratio as below groups Leverage Ratios: to measure the extent to which the company's assets are financed with debt; Liquidity Ratios: to measure

1-Classify the ratio as below groups |

| Leverage Ratios: to measure the extent to which the company's assets are financed with debt; |

| Liquidity Ratios: to measure the company's ability to pay its bills; |

| Profitability Ratios: to measure the company's ability to generate earnings; |

| Efficie ncy Ratios: to measure the company's ability to utilize its assets; |

| Market Value Ratios: to measure the market perception about the company's future prospects. |

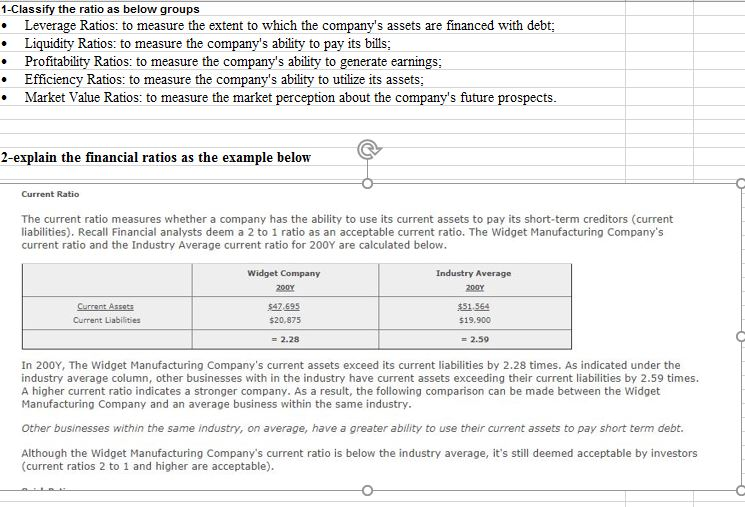

| 2-explain the financial ratios as the example below

|

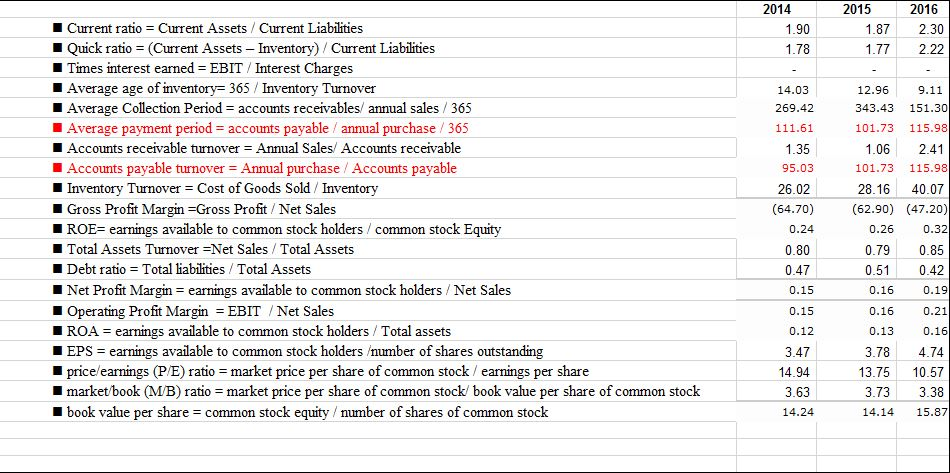

2014 2015 2016 1.87 2.30 1.77 2.22 Current ratio Current Assets Current Liabilities Quick ratio (Current Assets Inventory) / Current Liabilities Times interest earned EBIT / Interest Charges Average age of inventory 365 Inventory Turnover Average Collection Period accounts receivables/ annual sales 365 Average payment period accounts payable /annual purchase 365 Accounts receivable turnover-Annual Sales/ Accounts receivable Accounts payable turnoverAnnual purchase/ Accounts payable Inventory Turnover Cost of Goods Sold Inventory Gross Profit Margin Gross Profit Net Sales ROE earnings available to common stock holders common stock Total Assets Turnover =Net Sales / Total Assets Debt ratio Total liabilities Total Assets Net Profit Marginearnings available to common stock holders Net Sales Operating Profit MarginEBIT Net Sales ROA earnings available to common stock holders Total assets 1.90 1.78 14.03 269.42 111.61 1.35 95.03 26.02 (64.70) 0.24 0.80 0.47 0.15 0.15 0.12 3.47 14.94 3.63 14.24 12.96 9.11 343.43 151.30 101.73 115.98 1.06 2.41 101.73 115.98 28.16 40.07 (62.90) (47.20) 0.26 0.32 0.79 0.85 0.51 0.42 0.16 0.19 0.16 0.21 0.13 0.16 3.78 4.74 13.75 10.57 3.73 3.38 14.14 15.87 EPS earnings available to common stock holders umber of shares outstanding price/earnings s (P/E) ratiomarket price per share of common stock / earnings per share market/book (M/B) ratio market price per share of common stock/ book value per share of common stock book value per share common stock equity umber of shares of common stock e-common

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts