1)Essay In June, 2013, Chinas banking sector experienced a serious money crunch. Please compare and contrast the...

Question:

1)Essay

In June, 2013, China’s banking sector experienced a serious money crunch. Please compare and contrast the case of China’s money Crunch and the case of Orange County’s yield curve play.

2)Short Answer Questions

What are the four moments of return of risky assets? How are they calculated?

Please describe Bootstrap Method in your own words. Why is it so important in determining term structure?

Why don’t people like fat-tailed distribution of return of financial assets?

3)Calculation Questions

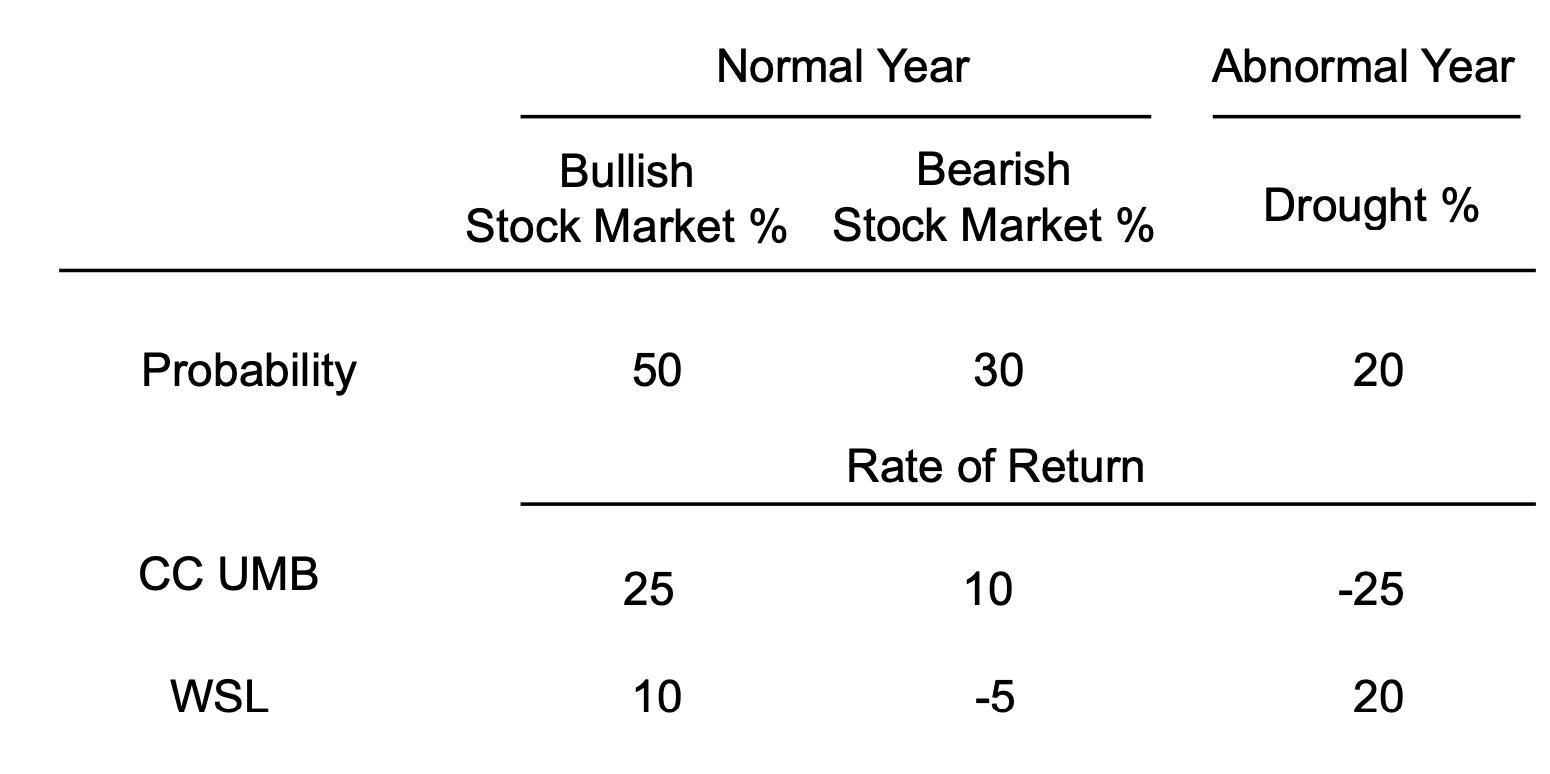

CC UMB is an umbrella manufacturer, while WSL is a suntan lotion producer. Their stock market performances are demonstrated in the following table: (10%)

1) If one’s portfolio is half CC UMB and half WSL, what are its expected return and standard deviation? Calculate the standard deviation from the portfolio returns in each scenario. (Hint: first calculate the portfolio return in bullish market, then the return in bearish market, then drought.)

2) What is the covariance between CC UMB and WSL

3) Calculate the portfolio standard deviation by using rule 5.

Financial Accounting Tools for business decision making

ISBN: 978-0470534779

6th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso