Question: 1please help 2i need answer of final question C thank you for your help Product Decisions Under Bottlenecked Operations Youngstown Glass Company manufactures three types

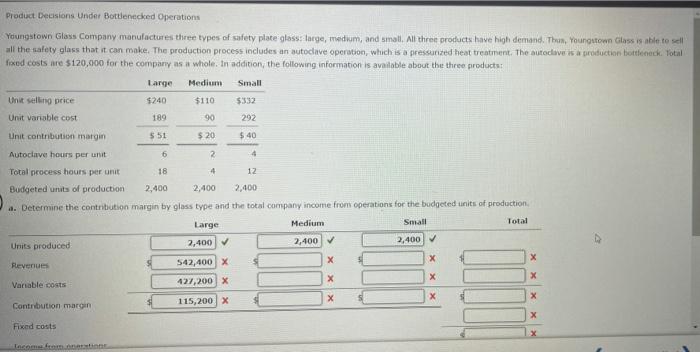

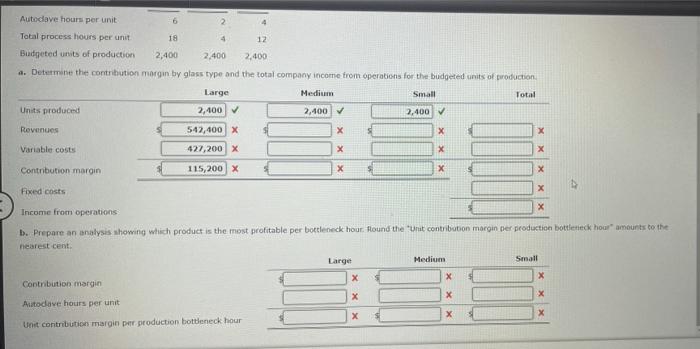

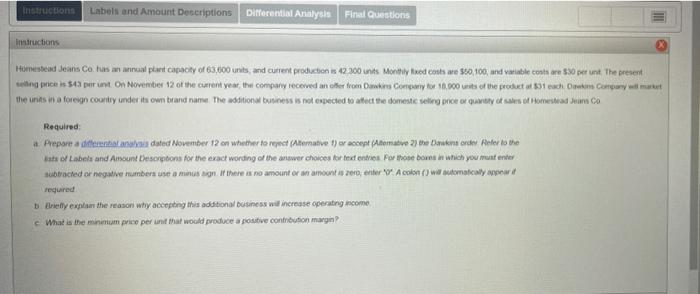

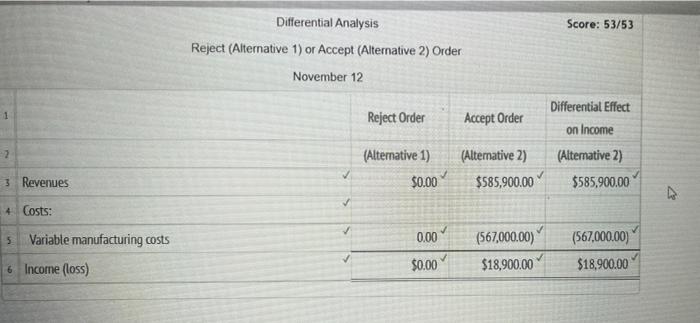

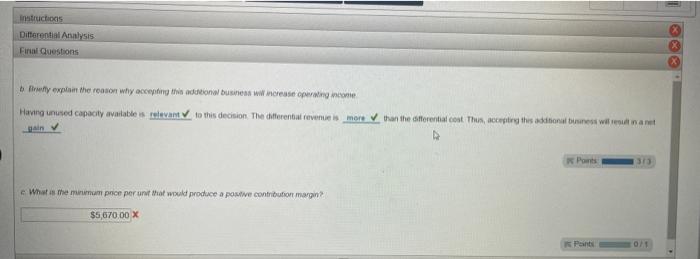

Product Decisions Under Bottlenecked Operations Youngstown Glass Company manufactures three types of safety plate glass: large, medium, and small. All three products have high demand. Thus, Youngstown Glass is able to sell all the safety glass that it can make. The production process includes an autoclave operation, which is a pressurized heat treatment. The autoclave is a production bottleneck. Total fixed costs are $120,000 for the company as a whole. In addition, the following information is available about the three products: Large Medium Small Unit selling price $240 $110. $332 Unit variable cost 189 90 292 Unit contribution margin $51 $.20 $40 Autoclave hours per unit 6 2 4 Total process hours per unit 18 4 12 Budgeted units of production 2,400 2,400 2,400 a. Determine the contribution margin by glass type and the total company income from operations for the budgeted units of production. Medium Small Large Total 2,400 Units produced 2,400 2,400 X X Revenues 542,400 X x Variable costs 427,200 X X X Contribution margin 115,200 X Fixed costs Income from onerations X X X X Autoclave hours per unit - Total process hours per unit Budgeted units of production 18 12 2,400 2,400 2,400 a. Determine the contribution margin by glass type and the total company income from operations for the budgeted units of production. Medium Small Total Large 2,400 Units produced 2,400 2,400 Revenues 542,400 X X x X Variable costs 427,200 X X X X Contribution margin 115,200 x X X X Fixed costs X X Income from operations product is the most profitable per bottleneck hour. Round the "Unit contribution margin per production bottleneck hour" amounts to the b. Prepare an analysis showing nearest cent. Large Medium Small Contribution margin Autodave hours per unit Unit contribution margin per production bottleneck hour 6 X X X $ X X X X X X Instructions Labels and Amount Descriptions Differential Analysis Final Questions Instructions Homestead Jeans Co. has an annual plant capacity of 63,600 units, and current production is 42,300 units Monthly fixed costs are $50, 100, and variable costs are $30 per unt. The present selling price is $43 per unit. On November 12 of the current year, the company received an offer from Dawkins Company for 10,000 units of the product at 831 each. Dawkins Company will make the units in a foreign country under its own brand name. The additional business is not expected to affect the domestic selling price or quantity of sales of Homestead Jeans Co Required: a Prepare a differential analais dated November 12 on whether to reject (Alternative t) or accept (Alterative 2) the Dawkins order Refer to the ists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign. If there is no amount or an amount is zero, enter 0 A colon () will automatically appear i required b Briefly explain the reason why accepting this additional business will increase operating income What is the minimum price per unit that would produce a positive contribution margin? 1 2 3 4 Costs: 5 Variable manufacturing costs 6 Income (loss) Revenues Differential Analysis Reject (Alternative 1) or Accept (Alternative 2) Order November 12 Reject Order (Alternative 1) $0.00 0.00 $0.00 Accept Order (Alternative 2) $585,900.00 (567,000.00) $18,900.00 Score: 53/53 Differential Effect on Income (Alternative 2) $585,900.00 (567,000.00) $18,900.00 instructions Differential Analysis Final Questions b Briefly explain the reason why accepting this additional business will increase operating income Having unused capacity available is relevant to this decision. The differential revenue is more than the differential cost Thus, accepting this additional business will result in a net Points 313 e What is the minimum price per unit that would produce a positive contribution margin? $5,670,00 X Points 10/1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts