Question: 1Record JEs date and ref. 2. post year 2 JE info to GL 3. complete 10-column worksheet 4. prepare FS and nites 5. prepare 12/31

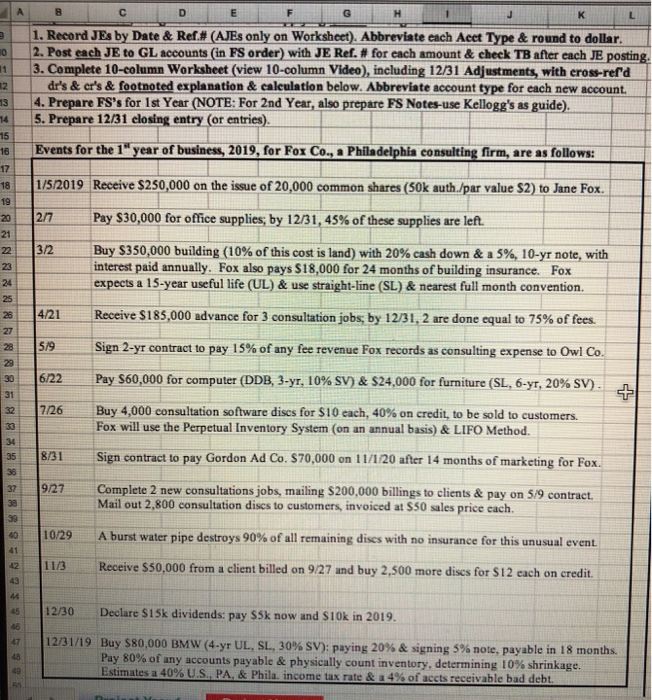

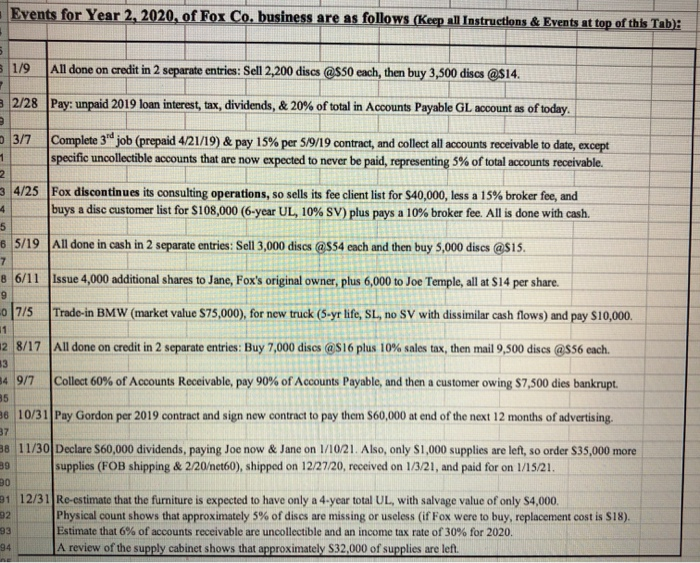

C D E F G H I J 1. Record JEs by Date & Ref# (AJEs only on Worksheet). Abbreviate each Aeet Type & round to dollar. 2. Post each JE to GL accounts (in FS order) with JE Ref. # for each amount & check TB after each JE posting 3. Complete 10-column Worksheet (view 10-column Video), including 12/31 Adjustments, with cross-ref'd dr's & cr's & footnoted explanation & calculation below. Abbreviate account type for each new account 4. Prepare FS's for 1st Year (NOTE: For 2nd Year, also prepare FS Notes-use Kellogg's as guide). 5. Prepare 12/31 closing entry (or entries) Events for the 15 year of business, 2019, for Fox Co., a Philadelphia consulting firm, are as follows: 1/5/2019 Receive $250,000 on the issue of 20,000 common shares (50k auth./par value $2) to Jane Fox. || 2/7 .. Pay $30,000 for office supplies; by 12/31, 45% of these supplies are left. 322 Buy $350,000 building (10% of this cost is land) with 20% cash down & a 5%, 10-yr note, with interest paid annually. Fox also pays $18,000 for 24 months of building insurance. Fox expects a 15-year useful life (UL) & use straight-line (SL) & nearest full month convention. 421 Receive $185,000 advance for 3 consultation jobs; by 12/31, 2 are done equal to 75% of fees. Sign 2-yr contract to pay 15% of any fee revenue Fox records as consulting expense to Owl Co. 6/22 Pay $60,000 for computer (DDB, 3-yr, 10% SV) & $24,000 for furniture (SL, 6-yr, 20% SV). 1126 F&NRRN & 858 8 8 8 8 8 0939393 Buy 4,000 consultation software discs for S10 cach, 40% on credit, to be sold to customers. Fox will use the Perpetual Inventory System (on an annual basis) & LIFO Method. 831 Sign contract to pay Gordon Ad Co. S70,000 on 11/1/20 after 14 months of marketing for Fox. 13 19127 Complete 2 new consultations jobs, mailing $200,000 billings to clients & pay on 5/9 contract. Mail out 2,800 consultation dises to customers, invoiced at $50 sales price cach. 10/29 A burst water pipe destroys 90% of all remaining dises with no insurance for this unusual event. 11/3 Receive $50,000 from a client billed on 9/27 and buy 2,500 more dises for S12 each on credit. 12/30 Declare S15k dividends: pay $5k now and S10k in 2019. 12/31/19 Buy $80,000 BMW (4-yr UL, SL, 30% SV): paying 20% & signing 5% note, payable in 18 months. Pay 80% of any accounts payable & physically count inventory, determining 10% shrinkage. Estimates a 40% U.S., PA, & Phila, income tax rate & #4% of acets receivable bad debt. Events for Year 2, 2020, of Fox Co, business are as follows (Keep all Instructions & Events at top of this Tab): 1/9 All done on credit in 2 separate entries: Sell 2,200 discs @S50 each, then buy 3,500 discs @$14. 2/28 Pay: unpaid 2019 loan interest, tax, dividends, & 20% of total in Accounts Payable GL account as of today. 3/7 Complete 3 job (prepaid 4/21/19) & pay 15% per 5/9/19 contract, and collect all accounts receivable to date, except specific uncollectible accounts that are now expected to never be paid, representing 5% of total accounts receivable. 4/25 m2 Fox discontinues its consulting operations, so sells its fee client list for $40,000, less a 15% broker fee, and buys a disc customer list for $108,000 (6-year UL, 10% SV) plus pays a 10% broker fee. All is done with cash. B 5/19 All done in cash in 2 separate entries: Sell 3,000 discs @$54 cach and then buy 5,000 discs @$15. 8 6/11 Issue 4,000 additional shares to Jane, Fox's original owner, plus 6,000 to Joe Temple, all at $14 per share. 775 Trade-in BMW (market value $75,000), for new truck (5-yr life, SL, no SV with dissimilar cash flows) and pay $10,000. 28/17 All done on credit in 2 separate entries: Buy 7,000 discs @S16 plus 10% sales tax, then mail 9,500 discs @556 cach. 4 9/7 Collect 60% of Accounts Receivable, pay 90% of Accounts Payable, and then a customer owing $7,500 dies bankrupt. 6 10/31 Pay Gordon per 2019 contract and sign new contract to pay them 560,000 at end of the next 12 months of advertising. 18 11/30 Declare 560,000 dividends, paying Joe now & Jane on 1/10/21. Also, only $1,000 supplies are left, so order $35,000 more supplies (FOB shipping & 2/20et60), shipped on 12/27/20, received on 1/3/21, and paid for on 1/15/21. 1 12/31 Ro-estimate that the furniture is expected to have only a 4-year total UL, with salvage value of only $4,000. Physical count shows that approximately 5% of discs are missing or useless (if Fox were to buy, replacement cost is $18). Estimate that 6% of accounts receivable are uncollectible and an income tax rate of 30% for 2020. A review of the supply cabinet shows that approximately $32,000 of supplies are left C D E F G H I J 1. Record JEs by Date & Ref# (AJEs only on Worksheet). Abbreviate each Aeet Type & round to dollar. 2. Post each JE to GL accounts (in FS order) with JE Ref. # for each amount & check TB after each JE posting 3. Complete 10-column Worksheet (view 10-column Video), including 12/31 Adjustments, with cross-ref'd dr's & cr's & footnoted explanation & calculation below. Abbreviate account type for each new account 4. Prepare FS's for 1st Year (NOTE: For 2nd Year, also prepare FS Notes-use Kellogg's as guide). 5. Prepare 12/31 closing entry (or entries) Events for the 15 year of business, 2019, for Fox Co., a Philadelphia consulting firm, are as follows: 1/5/2019 Receive $250,000 on the issue of 20,000 common shares (50k auth./par value $2) to Jane Fox. || 2/7 .. Pay $30,000 for office supplies; by 12/31, 45% of these supplies are left. 322 Buy $350,000 building (10% of this cost is land) with 20% cash down & a 5%, 10-yr note, with interest paid annually. Fox also pays $18,000 for 24 months of building insurance. Fox expects a 15-year useful life (UL) & use straight-line (SL) & nearest full month convention. 421 Receive $185,000 advance for 3 consultation jobs; by 12/31, 2 are done equal to 75% of fees. Sign 2-yr contract to pay 15% of any fee revenue Fox records as consulting expense to Owl Co. 6/22 Pay $60,000 for computer (DDB, 3-yr, 10% SV) & $24,000 for furniture (SL, 6-yr, 20% SV). 1126 F&NRRN & 858 8 8 8 8 8 0939393 Buy 4,000 consultation software discs for S10 cach, 40% on credit, to be sold to customers. Fox will use the Perpetual Inventory System (on an annual basis) & LIFO Method. 831 Sign contract to pay Gordon Ad Co. S70,000 on 11/1/20 after 14 months of marketing for Fox. 13 19127 Complete 2 new consultations jobs, mailing $200,000 billings to clients & pay on 5/9 contract. Mail out 2,800 consultation dises to customers, invoiced at $50 sales price cach. 10/29 A burst water pipe destroys 90% of all remaining dises with no insurance for this unusual event. 11/3 Receive $50,000 from a client billed on 9/27 and buy 2,500 more dises for S12 each on credit. 12/30 Declare S15k dividends: pay $5k now and S10k in 2019. 12/31/19 Buy $80,000 BMW (4-yr UL, SL, 30% SV): paying 20% & signing 5% note, payable in 18 months. Pay 80% of any accounts payable & physically count inventory, determining 10% shrinkage. Estimates a 40% U.S., PA, & Phila, income tax rate & #4% of acets receivable bad debt. Events for Year 2, 2020, of Fox Co, business are as follows (Keep all Instructions & Events at top of this Tab): 1/9 All done on credit in 2 separate entries: Sell 2,200 discs @S50 each, then buy 3,500 discs @$14. 2/28 Pay: unpaid 2019 loan interest, tax, dividends, & 20% of total in Accounts Payable GL account as of today. 3/7 Complete 3 job (prepaid 4/21/19) & pay 15% per 5/9/19 contract, and collect all accounts receivable to date, except specific uncollectible accounts that are now expected to never be paid, representing 5% of total accounts receivable. 4/25 m2 Fox discontinues its consulting operations, so sells its fee client list for $40,000, less a 15% broker fee, and buys a disc customer list for $108,000 (6-year UL, 10% SV) plus pays a 10% broker fee. All is done with cash. B 5/19 All done in cash in 2 separate entries: Sell 3,000 discs @$54 cach and then buy 5,000 discs @$15. 8 6/11 Issue 4,000 additional shares to Jane, Fox's original owner, plus 6,000 to Joe Temple, all at $14 per share. 775 Trade-in BMW (market value $75,000), for new truck (5-yr life, SL, no SV with dissimilar cash flows) and pay $10,000. 28/17 All done on credit in 2 separate entries: Buy 7,000 discs @S16 plus 10% sales tax, then mail 9,500 discs @556 cach. 4 9/7 Collect 60% of Accounts Receivable, pay 90% of Accounts Payable, and then a customer owing $7,500 dies bankrupt. 6 10/31 Pay Gordon per 2019 contract and sign new contract to pay them 560,000 at end of the next 12 months of advertising. 18 11/30 Declare 560,000 dividends, paying Joe now & Jane on 1/10/21. Also, only $1,000 supplies are left, so order $35,000 more supplies (FOB shipping & 2/20et60), shipped on 12/27/20, received on 1/3/21, and paid for on 1/15/21. 1 12/31 Ro-estimate that the furniture is expected to have only a 4-year total UL, with salvage value of only $4,000. Physical count shows that approximately 5% of discs are missing or useless (if Fox were to buy, replacement cost is $18). Estimate that 6% of accounts receivable are uncollectible and an income tax rate of 30% for 2020. A review of the supply cabinet shows that approximately $32,000 of supplies are left

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts