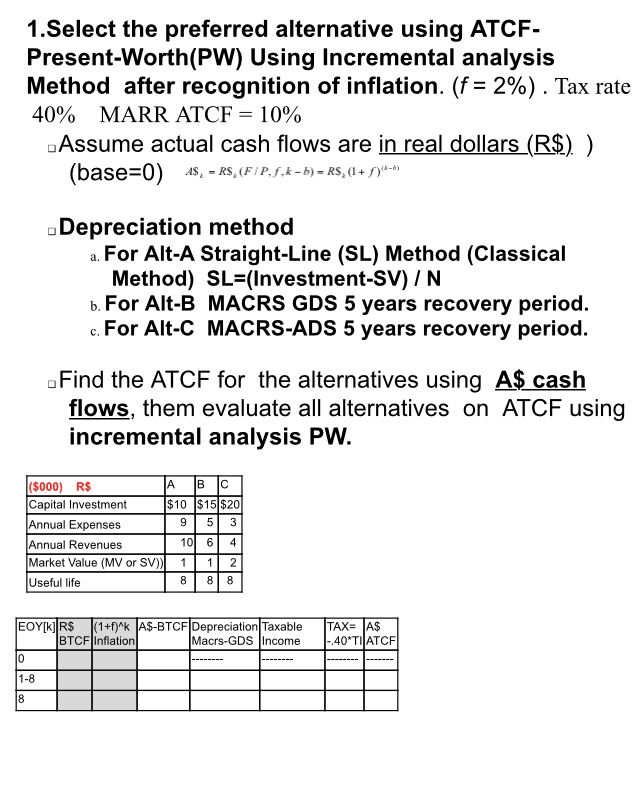

Question: 1.Select the preferred alternative using ATCF- Present-Worth(PW) Using Incremental analysis Method after recognition of inflation. (f= 2%) . Tax rate 40% MARR ATCF-10% Assume actual

1.Select the preferred alternative using ATCF- Present-Worth(PW) Using Incremental analysis Method after recognition of inflation. (f= 2%) . Tax rate 40% MARR ATCF-10% Assume actual cash flows are in real dollars (RS) ) Depreciation method a. For Alt-A Straight-Line (SL) Method (Classical Method) SL-(Investment-SV) / N b. For Alt-B MACRS GDS 5 years recovery period. c. For Alt-C MACRS-ADS 5 years recovery period. Find the ATCF for the alternatives using A$ cash flows, them evaluate all alternatives on ATCF using incremental analysis PW A BIC ($000) R$ Capital Investment Annual Expenses Annual Revenues Market Value (MV or SV)) 112 Useful life $10 $15$20 953 10 6 4 BTCF Inflation Macrs-GDS Income 40 TIATCF 1-8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts