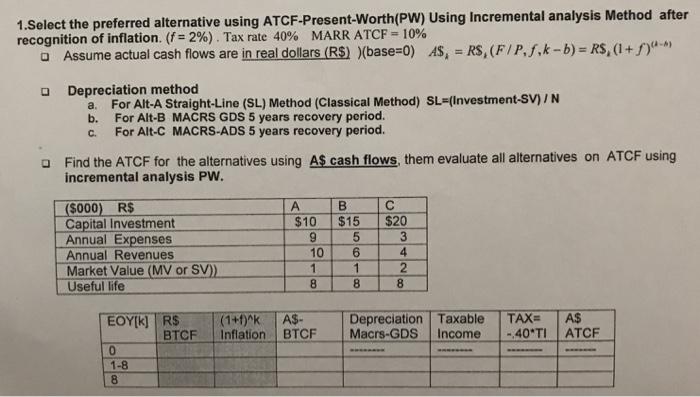

Question: 1.Select the preferred alternative using ATCF-Present-Worth(PW) Using Incremental analysis Method after recognition of inflation. (f = 2%). Tax rate 40% MARR ATCF = 10%

1.Select the preferred alternative using ATCF-Present-Worth(PW) Using Incremental analysis Method after recognition of inflation. (f = 2%). Tax rate 40% MARR ATCF = 10% O Assume actual cash flows are in real dollars (R$) (base%=D0) AS, = RS, (F/P,f.k-b) = R$, (1+f)- !3! Depreciation method For Alt-A Straight-Line (SL) Method (Classical Method) SL=(Investment-SV) / N a. b. For Alt-B MARS GDS 5 years recovery period. C. For Alt-C MACRS-ADS 5 years recovery period. O Find the ATCF for the alternatives using A$ cash flows, them evaluate all alternatives on ATCF using incremental analysis PW. (S000) R$ Capital Investment Annual Expenses Annual Revenues Market Value (MV or SV) Useful life A $10 6. 10 1. $15 $20 3 9. 4 8. 8. EOY[K] RS BTCF AS- Depreciation Taxable TAX= -40*TI (1+f)^k A$ ATCF Inflation BTCF Macrs-GDS Income 1-8 8 55610

Step by Step Solution

3.52 Rating (162 Votes )

There are 3 Steps involved in it

EVALUATION OF ALTERNATIVE A Actual Salvage value 1171659 11028 Annual Depreciation 110 101178 Annual R BTCF 1 109 BTCFBefore Tax cashflow k A B CAB D ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

60915c5d9f136_208290.pdf

180 KBs PDF File

60915c5d9f136_208290.docx

120 KBs Word File