Question: 1st problem) 2nd problem) 3rd problem) 2 CAPITAL GAINS TAX The J. Harris Corporation is considering selling one of its old assembly machines. The machine,

1st problem)

2nd problem)

3rd problem)

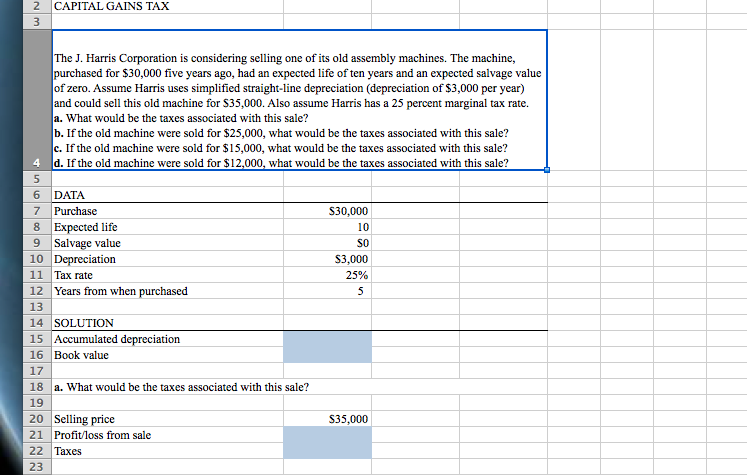

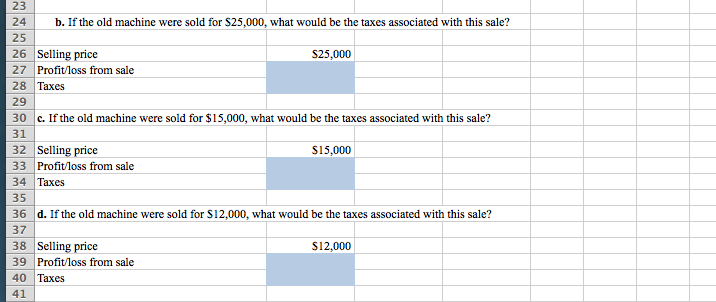

2 CAPITAL GAINS TAX The J. Harris Corporation is considering selling one of its old assembly machines. The machine, purchased for $30,000 five years ago, had an expected life of ten years and an expected salvage value of zero. Assume Harris uses simplified straight-line depreciation (depreciation of $3,000 per year) and could sell this old machine for S35,000. Also assume Harris has a 25 percent marginal tax rate. a. What would be the taxes associated with this sale? b. If the old machine were sold for $25,000, what would be the taxes associated with this sale? c. If the old machine were sold for $15,000, what would be the taxes associated with this sale? d. If the old machine were sold for $12,000, what would be the taxes associated with this sale? 4 6 DATA 7 Purchase 8Expected life 9 Salvage value 10 Depreciation 11 Tax rate 12 Years from when purchased 13 14 SOLUTION S30,000 10 S0 S3,000 25% - 15 Accumulated depreciation 16 Book value 17 18 a. What would be the taxes associated with this sale? 19 20 Selling price 21 Profit/loss from sale 22 Taxes 23 S35,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts