Question: a Qui 18 This Test: 23 pts possible Submit Test (Capital gains tax) The J. Harris Corporation is considering selling one of its old assembly

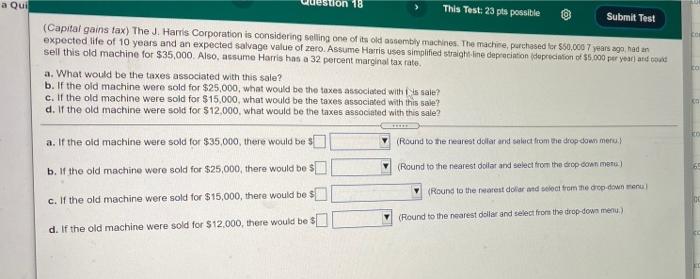

a Qui 18 This Test: 23 pts possible Submit Test (Capital gains tax) The J. Harris Corporation is considering selling one of its old assembly machines. The machine, purchased for 550,000 7 years ago, had an expected life of 10 years and an expected salvage value of zero. Assume Harris uses simplified straight line depreciation depreciation of 55.000 per year and could sell this old machine for $35,000. Also, assume Harris has a 32 percent marginal tax rate. a. What would be the taxes associated with this sale? b. If the old machine were sold for $25,000, what would be the taxes associated with is sale? c. If the old machine were sold for $15,000, what would be the taxes associated with this sale? d. If the old machine were sold for $12,000, what would be the taxes associated with this sale? co a. If the old machine were sold for $35,000, there would be s (Round to the rest dollar and select from the drop down menu. b. If the old machine were sold for $25,000, there would be $ (Round to the nearest dollar and select from the drop con metu) (Round to the nearest dolor and set from the drop-down menu c. If the old machine were sold for $15,000, there would be $ d. If the old machine were sold for $12,000, there would be $ (Round to the nearest dollar and select from the drop down menu.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts