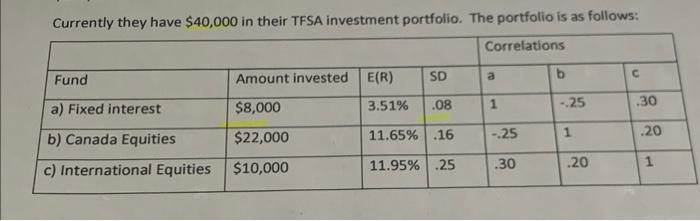

Question: 1.what is the real expected return on the portfolio using the information below? 2. what is the portfolio standard devisation ? *current inflation is 4%p.a

Currently they have $40,000 in their TFSA investment portfolio. The portfolio is as follows: Correlations Fund SD b Amount invested E(R) a C 3.51% a) Fixed interest .08 - 25 1 .30 $8,000 $22,000 11.65%.16 1 b) Canada Equities - 25 .20 .30 .20 11.95%.25 $10,000 1 c) International Equities Currently they have $40,000 in their TFSA investment portfolio. The portfolio is as follows: Correlations Fund SD b Amount invested E(R) a C 3.51% a) Fixed interest .08 - 25 1 .30 $8,000 $22,000 11.65%.16 1 b) Canada Equities - 25 .20 .30 .20 11.95%.25 $10,000 1 c) International Equities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts