Question: Help me do this assignment by guiding me step by step to complete everything, provide me guide question that I have to complete. So basically

Help me do this assignment by guiding me step by step to complete everything, provide me guide question that I have to complete. So basically I need a step by step guide (as detailed as possible) to help me do the assignments. Please help me, thanks alot

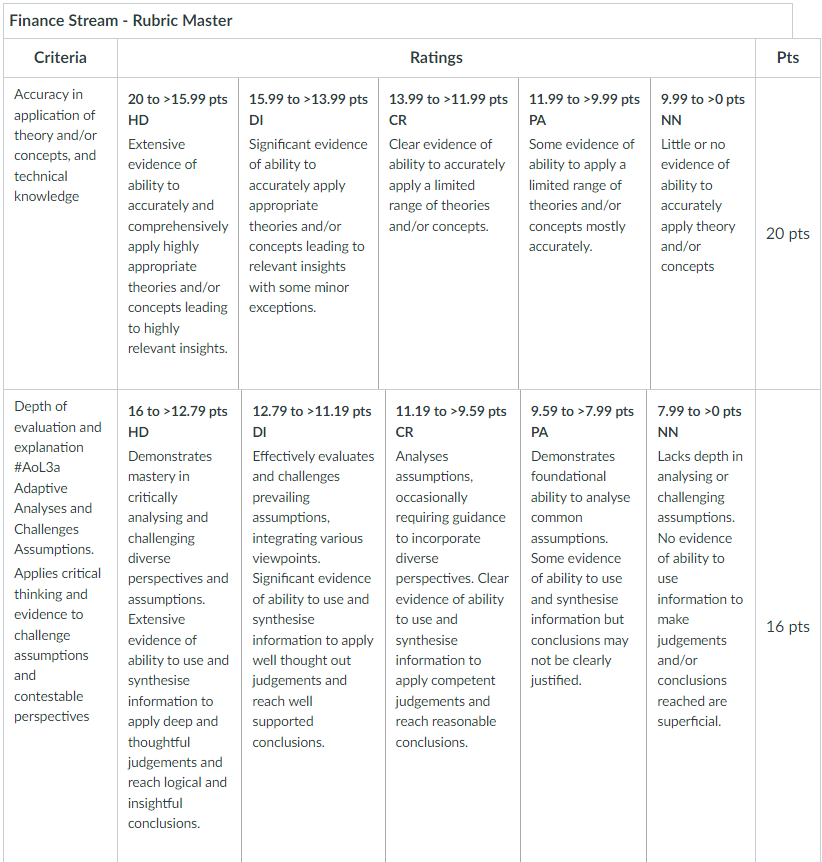

This is the question: Assessment 3- Semester 2, 2024 Individual Investment Trading Report (maximum around 3000 words) (50 marks) The goal of this individual assessment is to gain a better understanding of the equity portfolio investment (in the US stock market) and risk management processes. Below are the tasks to be completed in this assessment: 1) Make an account (with your student ID, e.g., sXXXXXXX) on marketwatch.com and join the following trading game: BAFI3192 Derivatives and Risk Management - Trading Simulation - Sem2, 2024 Password for the game is: BAFI3192S22024 2) Your goal is: a. to set up and manage an equity portfolio. b. to make profit by trading from the beginning of Week 8, Monday, 19th August 20241 until Wednesday 4th September 2024. c. to identify and manage the portfolio risk and d. to communicate your investment and risk management process using a professional report. 3) There should be two elements to your portfolio: i) an initial portfolio that must remain fixed for the trading period, and ii) an additional portfolio that you can use to actively trade over the trading period. - The initial equity portfolio should consist of at least 5 different stocks and should be created on the first trading day (19th August 2024). The stocks for the initial 1 The earliest time that you can start trading is 8:30pm on Monday, 19th August 2024 (Vietnam, GMT+7)

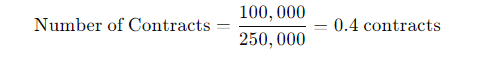

portfolio should belong to a single American index, for example, the S&P 500, Dow Jones, NASDAQ. - The additional portfolio can be created once you have chosen your 5 stocks and have decided on how much to spend. Any leftover funds after the purchase of the initial portfolio can then be used to actively trade with the objective of maximizing profit. The stocks in the active element of your portfolio can be traded across American indexes. - Note that you will be trading American equities and as such, the market timing is 9.30am - 4pm EDT (or 8.30pm - 3am the next day in Vietnam time). You can place your trades after hours during the day, Vietnamese time, and they will be executed once the market opens in America. 4) Calculate the one day 99%-Value at Risk of your initial portfolio (portfolio created on the first trading day) using the historical approach. Use daily stock prices since 1st January 2019 for the calculation of the VaR 5) Additionally, undertake the following on the initial portfolio: a) Calculate the Beta of your initial equity portfolio. b) Hedge your initial portfolio against share price declines with Futures contracts. The futures index value should be recorded on the first and last day of trading, i.e., 19th August 2024 and 4th September 2024 respectively. It is recommended that you record the index price when you purchased and sold the final share in your initial portfolio. c) Select one stock from the initial portfolio and hedge its position against potential losses with an Options contract. The option premium should be recorded on the first day of trading, i.e., 19th August 2024. 6) For the active portfolio, you can engage in additional transactions (either buying or selling) of stocks during the trading period in order to maximize your portfolio's return.

You can purchase additional shares of the companies in your initial portfolio to actively trade in your active portfolio but note that you cannot trade the shares in your initial portfolio, e.g., if you have 1000 Tesla shares in your initial portfolio, and then decide to trade an additional 500 Tesla shares, only the additional 500 can be actively manage. The initial 1000 shares cannot be touched. A copy of your initial and additional portfolio including the list of stocks and balances is required in the report as part of your analysis. Whether you engage in additional trades, please keep in mind that you must maintain the 5 initial stocks in your portfolio for whole the trading period so you can perform the required hedging activities at the end of the trading period. You are allowed to use AI Generative tools (e.g., the free trial version of Toggle AI, TICKERON, SCANZ or others) to help you in the process of finding an asset (stock) to support your decision in your active portfolio. Please provide evidence (e.g., a screenshot or the transcript of the conversation with the AI Generative tools) and you need to present your counterargument and evaluate the advice (pros and cons) from the AI tools. (Note: Hedging of the initial portfolio should be done on the day it is created. Make sure to use the relevant derivative prices on that day. A screen capture of the listed price of the relevant derivative contracts used for hedging (with the specified date where possible) should be attached to your report).

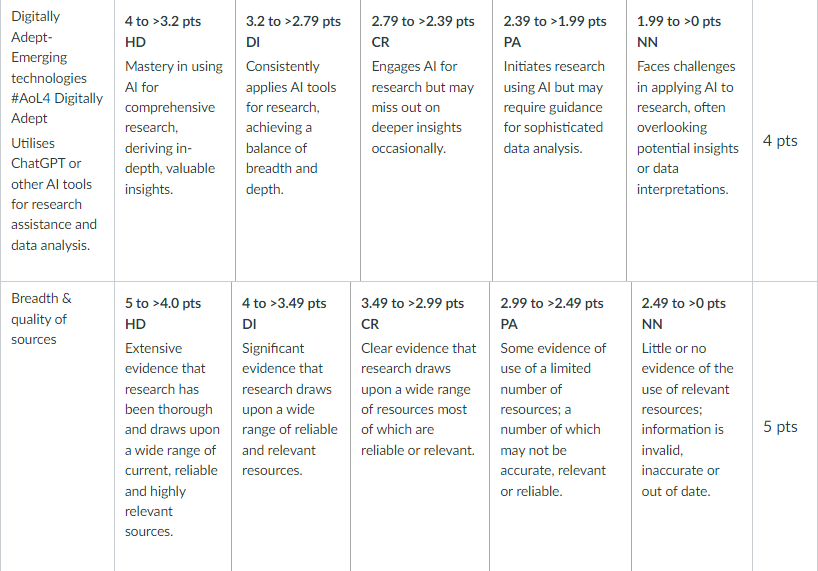

Additional guidelines for trading Portfolio investment strategy Since the trading game is only for a few weeks, the investment strategy is to generate high short- term growth in the value of the portfolio over the trading period. You may use both fundamental (EPS / PE ratio / ROE) and technical analysis to construct your equity portfolio. AI Generative Tools Companies have started to explore building generative AI research assistants that can augment and automate the functions of traders/financial analysts in banks and hedge funds. One of the examples includes Toggle, which is a generative AI research assistant that functions as a text bot. Another example includes TICKERON, which is a platform that helps you to view bought and sold trades with potential profit and stop loss in real-time. Assessment Guide Your report should include the following sections (*note: this marking guide gives you an indication of the weight awarded to each report element, but the final scores will be based on the marking rubric): 1. Accuracy in application of theory, practical concepts, and technical knowledge (20 marks) o Trading philosophy: Provide an overview of your trading philosophy, i.e., how stocks were selected, and strategy to outperform the market. You should identify yourself as a value or growth investor or a mixture of both and provide justifications. (5 marks) o Portfolio construction: Present your initial portfolio including information on why you have invested in the stocks in your initial portfolio. (5 marks) o Recommended (but not mandatory) research information of this part could include: a. the fundamentals of each stock b. the technical analysis of each stock c. news and the overall market and macroeconomic condition d. the initial weightings of the portfolio and the rationale for that composition

o Additionally, you should also provide a calculation of expected return of your portfolio using the CAPM (Beta, risk free rate, expected market return) o Risk identification (5 marks) - In this section you could discuss the risk profile of your portfolio. The discussion should include the following points: a. The systematic risk of your initial portfolio b. The unsystematic risk of your initial portfolio c. Calculation and discussion of the one day 99%-Value at Risk of your portfolio using historical approach. o Hedging (5 marks) - This section should include an explanation of how the portfolio was hedged. This comprises of: a. How you used the Futures contract to hedge your initial equity portfolio position against a possible market decline. Provide calculations as necessary. b. How you used the Options contract to hedge your individual stock position. Provide calculations as necessary. 2. Depth of evaluation and explanation (20 marks) o Reflection on the trading process - An important goal of this assessment is to provide students with a (costless) insight into trading behavior, risk appetite, and risk management process. As such you should provide a robust and comprehensive critical reflection of the trading and hedging process. Your reflection should include: a) Your risk appetite. Hint: are you risk-seeking or risk-averse? How did this influence your selection of stocks in your trading and hedging activities? Has your appetite remained the same or has it changed over the course of the trading period? Explain. (4 marks)

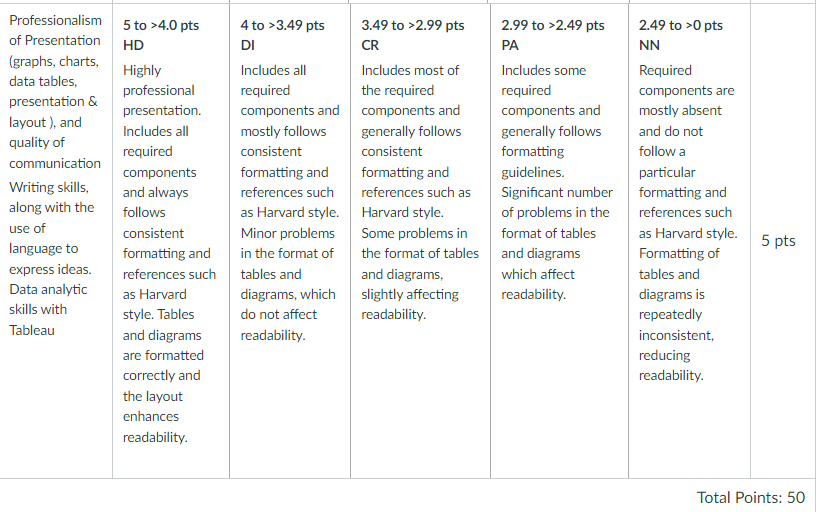

b) A comparison of the expected return on the portfolio (i.e., using the CAPM model) and the actual returns achieved (based on stock price movement). Discuss the difference and implication this has in relation to the potential risk in stock portfolio investment. This discussion may require a demonstration of a good understanding of the CAPM model, how it is used, and what it often shows. (4 marks) c) A calculation of the net portfolio return taking into account the hedging transactions, and a calculation of net return of the particular stock that you have hedged using option contracts. (4 marks) d) A comparison of the hedging transactions from which you should make a conclusion on i) the effect of hedging on your investment portfolio e.g., how it helped you manage the risks that you have identified above, and ii) the preferable derivative contracts (among the two) that you would prefer to use in hedging an investment portfolio. (4 marks) e) Digitally Adept-Emerging technologies #AoL4 Digitally Adept: Using appropriate AI Generative tools (e.g., Toggle AI, TICKERON, SCANZ), provide analysis/opinion/recommendation (buy/sell) of one aspect of a stock that you select to be added to your active portfolio. In addition, you need to present your counterargument and evaluate the advice (pros and cons) from the AI tool using one of the relevant frameworks we learned in the course (You need to state which frameworks you are referring to in your report, e.g., foreign exchange risk, interest rate risk, business risk, etc.). (4 marks) 3. Professionalism of presentation (5 marks) o Writing skills, along with the use of language to express ideas. o Data analytic skills with Tableau: You will need to provide at least 1 output in the form of data visualization using Tableau and your input data from your portfolio (Volume, Histogram, detailed tables, dashboard, etc.)

4. Referencing (5 marks)

Notes: - The report requires VAR calculations that should be undertaken in Excel. Therefore, you should submit a separate Excel file on Canvas detailing your calculations. - The report requires Tableau data visualization output that should be undertaken in Tableau. Therefore, you should submit a separate Tableau output file on Canvas. - Remember that one of the focuses of this report is risk management. As such please be balanced in how you approach your discussions. In other words, it is easy to get carried away with the technical and fundamental analysis so please be mindful of this. You are encouraged to be selective for the portfolio construction discussions and only include relevant information. Please refrain from including excessive information (e.g., economic factors) without clear evidence of how it helps in selecting the stocks. - The listed items in the guidelines above are only recommendations and are not exhaustive. You can be very brief about one or more of these elements if it does not pertain to you. - Bonus marks will be awarded to the top 3 traders. ? highest portfolio return will be awarded 3 extra marks, ? 2nd highest portfolio return will be awarded 2 extra marks, ? 3rd highest return will be awarded 1 extra mark.

Additional resources Resources to help with portfolio construction - Marketwatch provides information on the ratios and calculates the moving average for you. https://www.marketwatch.com/investing/stock/fb - Watch this video on how to evaluate stocks using fundamentals: https://www.youtube.com/watch?v=hrs6WhHV12c - Watch this video on how to use moving averages to identify buy and sell signals: https://www.youtube.com/watch?v=4R2CDbw4g88 - Information on value investing can be found here: https://www.investopedia.com/university/stockpicking/stockpicking3.asp - Information on growth investing can be found here: https://www.investopedia.com/university/stockpicking/stockpicking4.asp Futures and Options Data - Futures contract on the S&P500 can be found here https://www.marketwatch.com/investing/future/sp%20500%20futures - Options contract for, for example, Facebook can be found here https://www.marketwatch.com/investing/stock/fb/options Other data: - Historical stock prices and market returns can be downloaded from numerous open access websites such as: a. Yahoo Finance b. Digital Look c. Investing.com - You find a proxy for risk free rate here 3-month treasury bill https://fred.stlouisfed.org/series/TB3MS CAPM, Beta and ROE helpful videos (For access to these links, log in using RMIT email and account): - Capital Asset Pricing Model (CAPM) https://www.linkedin.com/learning/finance-and-accounting- tips/capital-asset-pricing-model-capm?u=2104756&auth=true - What is Beta https://www.linkedin.com/learning/finance-and-accounting-tips/what-is- beta?u=2104756&auth=true - ROE Dupont https://www.linkedin.com/learning/finance-and-accounting-tips/the-dupont- framework-and-return-on-equity?u=2104756&auth=true - Earnings per share: https://www.linkedin.com/learning/finance-and-accounting-tips/earnings- per-share-4?u=2104756&auth=true

This is the rubric:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts