Question: 1.)When comparing two mutually exclusive projects or more, the best project valuation method is: Select one: a. NPV b. Profitability index c. Payback d. IRR

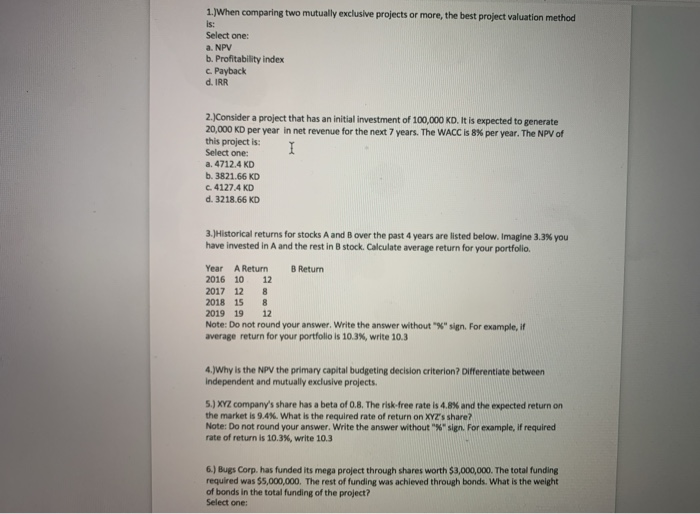

1.)When comparing two mutually exclusive projects or more, the best project valuation method is: Select one: a. NPV b. Profitability index c. Payback d. IRR 2.)Consider a project that has an initial investment of 100,000 KD. It is expected to generate 20,000 KD per year in net revenue for the next 7 years. The WACC is 8% per year. The NPV of this project is: Select one: a. 4712.4 KD b. 3821.66 KD c. 4127.4 KD d. 3218.66 KD I 3.)Historical returns for stocks A and B over the past 4 years are listed below. Imagine 3.3% you have invested in A and the rest in B stock. Calculate average return for your portfolio Year A Return B Return 2016 10 12 2017 12 8 2018 15 8 2019 19 12 Note: Do not round your answer. Write the answer without "%" sign. For example, if average return for your portfolio is 10.3%, write 10.3 4.)Why is the NPV the primary capital budgeting decision criterion? Differentiate between Independent and mutually exclusive projects 5.) XYZ company's share has a beta of 0.8. The risk-free rate is 4.8% and the expected return on the market is 9.4%. What is the required rate of return on XYZ's share? Note: Do not round your answer. Write the answer without sign. For example, if required rate of return is 10.3%, write 10.3 6.) Bugs Corp. has funded its mega project through shares worth $3,000,000. The total funding required was $5,000,000. The rest of funding was achieved through bonds. What is the weight of bonds in the total funding of the project? Select one

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts